XRP Price: Token Falls to $1.50 as Network Metrics Drop 20% – What’s Next?

TLDR

- XRP price fell to $1.50, its lowest level since November 2024, down 57% from all-time high

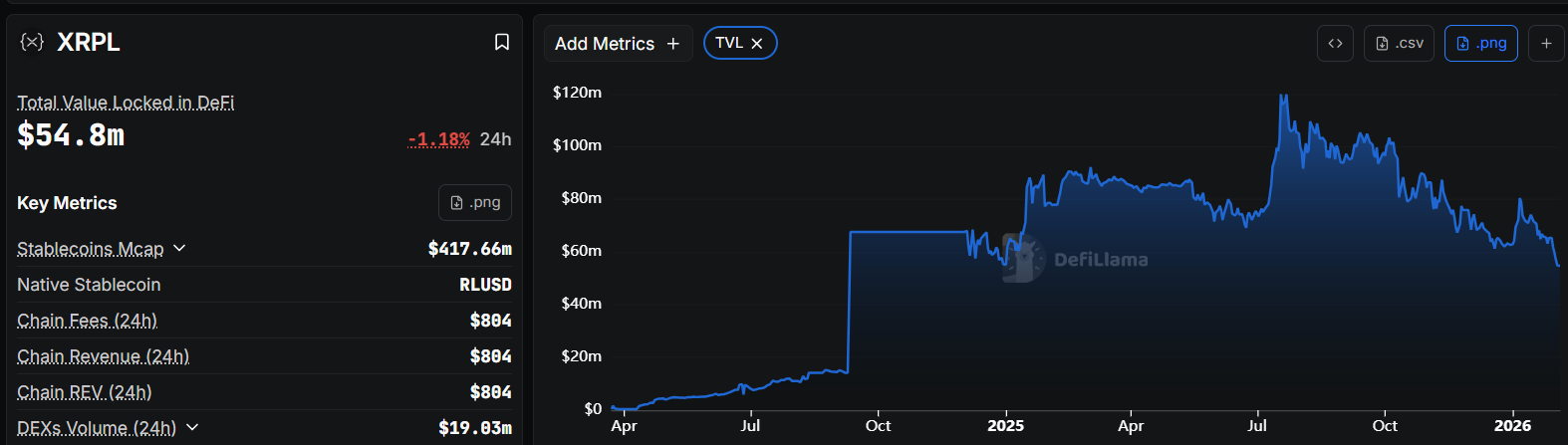

- Total value locked in XRP Ledger dropped 20% in 30 days to $55 million

- XRP burn rate has stagnated since August, with only 335 tokens burned on February 3

- XRP ETFs saw outflows of $404k on Monday after losing $92 million Thursday prior

- XRPL Permissioned Domains launched February 4 with 91% validator approval for institutional access

XRP price continued its downward trend this week. The token reached $1.50, marking its lowest point since November 2024.

XRP Price

XRP Price

The cryptocurrency has fallen 57% from its all-time high. This decline has pushed XRP into technical bear market territory.

Data from DeFi Llama shows the XRP Ledger is facing challenges in decentralized finance. The network currently hosts 21 protocols with a total value locked of $55 million.

Source: DefiLlama

Source: DefiLlama

This represents a drop of over 20% in the past 30 days. The DEX volume in the last 24 hours stood at $145,820.

These figures are small compared to other major networks. Ethereum maintains over $60 billion in total value locked and processed $3.1 million in volume.

The XRP burn rate has declined in recent months. Only 335 XRP tokens were burned on February 3.

This burn rate has remained flat since August of last year. The stagnant burn rate has not provided support for the price.

Stablecoin Growth Provides Bright Spot

XRPL has seen growth in the stablecoin sector. The network’s stablecoin supply increased to over $417 million.

Ripple USD (RLUSD) has become one of the top stablecoins in the industry. This growth represents a positive development for the network.

Real-world asset tokenization has also expanded on XRPL. Data from RWA shows the network has a represented value exceeding $1.47 billion.

This marks a 271% increase over the last 30 days. The growth accelerated on Tuesday when Ctrl Alt tokenized diamonds worth over $129 million.

Other major players in the network include Vert Capital, Guggenheim, and JMWH. These institutions are helping drive adoption in the tokenization space.

Ripple Labs received a Luxembourg license this week. The company previously obtained licenses in the UK and other countries.

It also secured a banking charter in the United States. The company received a money license in the EU as well.

XRP ETF Demand Weakens

Demand for XRP exchange-traded funds has decreased in recent weeks. These funds experienced outflows of over $404k on Monday.

This followed a loss of $92 million on Thursday of the previous week. The outflows reflect reduced investor interest in XRP exposure through traditional financial products.

Technical analysis suggests further downside potential. The token has fallen below all moving averages on the weekly chart.

XRP risks moving below the Major S/R pivot level of the Murrey Math Lines tool. The next key level sits at the psychological $1 mark.

A drop below $1 would point to further declines toward $0.7813. This level represents the Strong, Pivot, Reverse level of the Murrey Math Lines tool.

New Infrastructure Upgrade Goes Live

The XRP Ledger activated Permissioned Domains on February 4, 2026. More than 91% of validators backed the XLS-80 amendment.

Permissioned Domains are managed environments within XRPL. Access and user activity are controlled by credential-based rules.

These domains operate as credential-gated access layers on the public XRPL. The system enables controlled participation while using shared ledger infrastructure.

The XLS-80 proposal builds on the XLS-70 Credentials framework. Domain owners can define rules by specifying accepted credentials.

Accounts with accepted credentials become members automatically. No additional joining steps are required for membership.

The amendment introduces new technical components. These include the PermissionedDomain ledger object and management transactions such as PermissionedDomainSet and PermissionedDomainDelete.

The proposal documentation describes this amendment as foundational. It does not deliver end-user functionality on its own but enables future amendments and features.

The upgrade passed the required validator supermajority threshold of over 80% in late January. The amendment entered a standard two-week activation window before going live February 4.

The post XRP Price: Token Falls to $1.50 as Network Metrics Drop 20% – What’s Next? appeared first on CoinCentral.

You May Also Like

ETH Leverage ETF: Defiance Unlocks Revolutionary Opportunities for Retail Investors

Curve Finance votes on revenue-sharing model for CRV holders