Solana (SOL) Price Prediction: Standard Chartered Predicts $2,000 by 2030 Despite Near-Term Challenges

TLDR

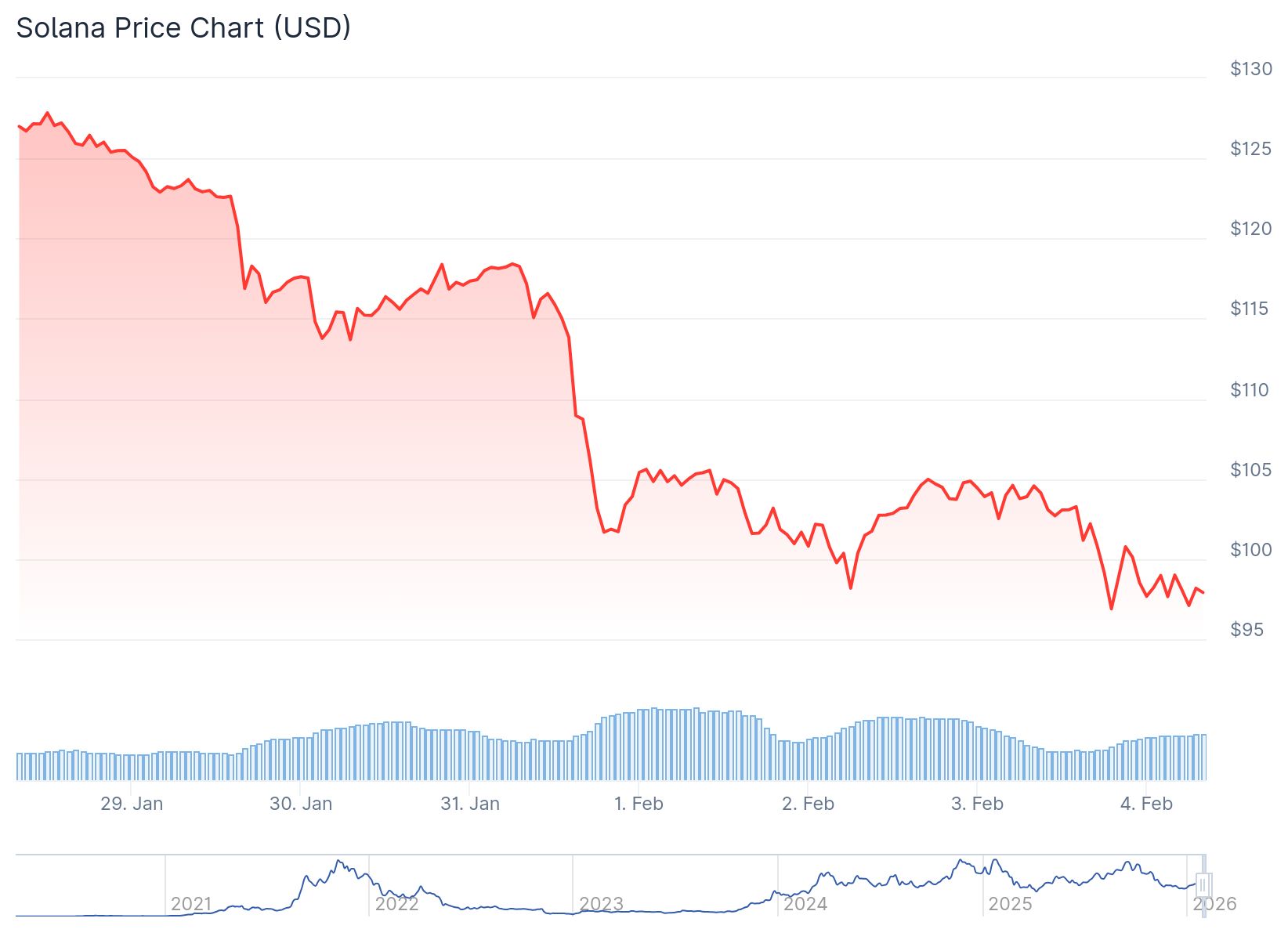

- Solana price found support at $100 after a 25% drop from $127, with technical indicators suggesting a potential recovery to $260

- Standard Chartered bank predicts SOL could reach $2,000 by 2030, representing a 1,900% increase from current prices around $100

- Solana’s total value locked hit an all-time high of 73.4 million SOL (worth $7.5 billion), marking an 18% increase over one week

- Daily transactions on Solana reached 109.5 million on Monday, a two-year high, while DEX volume hit eight-month peaks

- The bank reduced its 2026 price target to $250 from $310 but raised long-term forecasts based on Solana’s micropayment and stablecoin adoption

Solana price dropped 25% from $127 to find support around the $100 level. The cryptocurrency has bounced from this key support zone on multiple timeframes.

Solana (SOL) Price

Solana (SOL) Price

The four-hour chart shows a possible V-shaped recovery pattern forming. The relative strength index climbed to 36 from oversold conditions at 18.

On the daily chart, the RSI reached oversold levels at 29. This level has previously marked market bottoms for SOL and triggered price rebounds.

Solana now faces several resistance levels on its path higher. The first barrier sits at $113-$115, where key trendlines meet.

The second resistance zone is at $125-$130. This area contains the 50-day exponential and simple moving averages.

Network Activity Reaches New Highs

If SOL breaks above these levels, the price could climb toward $150. This would represent a 44% gain from current prices.

The weekly chart shows strong support for Solana at $95-$100. The last time SOL bounced from this level, it rallied 166% to $250 between April and September 2024.

The 50-week moving averages sit between $140-$160. This zone has historically acted as resistance and could slow any price rally.

Trader Tardigrade noted that SOL’s bounce from the lower boundary of a descending channel could push prices toward $215 at the upper boundary.

Solana’s total value locked reached an all-time high of 73.4 million SOL on Monday. At current rates, this equals about $7.5 billion.

This marks an 18% increase over the past week. The last time this metric hit peak levels was in June 2022 at 68.3 million SOL.

Daily transactions on Solana hit 109.5 million on Monday. This represents a two-year high for the network.

Bank Forecasts Long-Term Price Surge

Daily decentralized exchange volume reached an eight-month high of 51.3 million SOL on Monday. Weekly DEX trading volume hit a 12-month high of 264.8 million SOL.

Daily active addresses on Solana increased 115% during the second half of January.

Standard Chartered bank released new price predictions for Solana. The bank cut its end-2026 target to $250 from $310.

However, the bank raised its long-term forecasts. Standard Chartered now expects SOL to reach $400 by end-2027, $700 by end-2028, and $1,200 by end-2029.

The bank’s end-2030 target sits at $2,000. From current prices around $100, this represents a 1,900% increase.

Geoff Kendrick, Standard Chartered’s Global Head of Digital Assets Research, said the blockchain is evolving into a dominant platform for micropayments and stablecoin transactions.

Stablecoins on Solana turn over two to three times faster than those on Ethereum. Flows on Solana’s decentralized exchanges are shifting from memecoins toward SOL-stablecoin pairs.

Solana’s median gas fee of roughly $0.0007 compares with about $0.015 on Base. This allows the network to process high volumes that other blockchains cannot handle profitably.

The post Solana (SOL) Price Prediction: Standard Chartered Predicts $2,000 by 2030 Despite Near-Term Challenges appeared first on CoinCentral.

You May Also Like

ETH Leverage ETF: Defiance Unlocks Revolutionary Opportunities for Retail Investors

Curve Finance votes on revenue-sharing model for CRV holders