Bitcoin 2026 Unveils First Headline Speakers and Expanded Program

Editor’s note: Bitcoin 2026 has begun rolling out its first confirmed speakers for the April 27–29 event in Las Vegas, signaling the scale and direction of its upcoming program. The conference, which has already passed 30,000 registrations, is expanding its format with new stages, targeted content tracks, and curated experiences for a broad audience that spans builders, investors, executives, and policymakers. Early headline speakers include prominent figures from both the Bitcoin industry and US regulatory institutions, underscoring the event’s growing role as a forum where technology, markets, and policy increasingly intersect.

Key points

- Bitcoin 2026 will take place April 27–29 at The Venetian Convention and Expo Center in Las Vegas.

- More than 30,000 attendees are already registered, with organizers expecting over 40,000 participants.

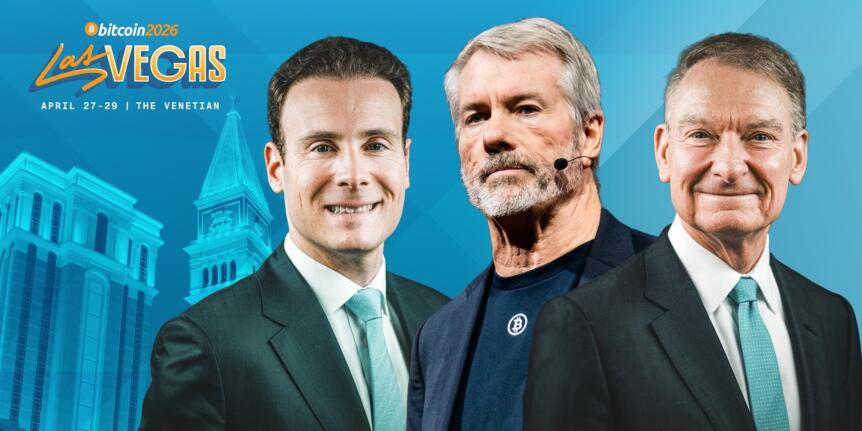

- Confirmed speakers include Michael Saylor, SEC Chair Paul S. Atkins, and CFTC Chair Mike Selig.

- The conference will feature six dedicated stages and over 100 hours of programming.

- For Crypto Breaking News readers, enjoy an exclusive 10% discount on tickets using the code: CryptoBreaking10.

Why this matters

Bitcoin conferences have evolved beyond community meetups into influential venues for shaping narratives around adoption, regulation, and infrastructure. The inclusion of sitting US regulators alongside corporate and technical leaders reflects Bitcoin’s deeper integration into global financial and policy discussions. For builders and investors, the expanded programming highlights where capital, innovation, and regulatory attention may converge in 2026, while the event’s scale points to sustained institutional and mainstream interest in the Bitcoin ecosystem.

What to watch next

- Additional speaker announcements as the multi-month rollout continues.

- Details on specific sessions and content tracks across the six stages.

- Further expansion of side events and curated community experiences.

Headline Speakers Set to Lead Dialogues Shaping Bitcoin’s Future

-

Michael Saylor — Founder & Executive Chairman, Strategy. One of Bitcoin’s most prominent evangelists and advocates, Saylor has shaped institutional adoption narratives worldwide.

-

Paul S. Atkins — Chairman, U.S. Securities and Exchange Commission, and the first serving SEC Chair to speak at a Bitcoin Conference, representing a historic moment at the intersection of regulation and digital asset policy.

-

Mike Selig — Chairman, Commodity Futures Trading Commission and longtime contributor to digital asset regulatory frameworks, bringing insight into futures, markets, and policy.

Fully Redesigned Programming — Tailored to Every Type of Bitcoiner

The 15 Types Of Bitcoiners You’ll Definitely See At Bitcoin 2026

As Bitcoin rolls into 2026, the ecosystem keeps growing – and so does the cast of characters. Here are the 15 personas you’ll absolutely encounter at Bitcoin 2026, whether you’re there to build, stack, meme, or argue about corporate balance sheets.

Six Stages, 100+ Hours of Programming

-

Nakamoto Stage

-

Genesis Stage

-

Energy Stage

-

Open Source Stage

-

Enterprise Stage

-

Deep Stage

Beyond Stages — Side Events, Culture, and Community Experiences

-

Compute Village — New to the Bitcoin Conference, this hub connects builders, miners, developers, and infrastructure leaders to collaborate on power-dense compute and energy.

-

Women of Bitcoin Bash — An evening celebration spotlighting women driving the Bitcoin movement.

-

Bitcoin for Corporations Symposium — A focused forum for enterprise, finance, and institutional dialogue.

-

Bitcoin Art Gallery — curated by BMAG — A showcase of artistic expression inspired by Bitcoin, hosted in partnership with Bitcoin Magazine’s museum initiative. Visit: https://museum.b.tc/

https://2026.b.tc/experience

About The Bitcoin Conference

The Bitcoin Conference, organised by BTC Media, the parent company of Bitcoin Magazine, is a global event series, featuring notable industry speakers, workshops, exhibitions, and entertainment. These events serve as vital platforms for Bitcoin industry leaders, developers, investors, and enthusiasts to gather, network, and exchange ideas. Bitcoin 2026 is being held in Las Vegas in April 2026. Its international events include Bitcoin Hong Kong (August 27-28, 2026), Bitcoin Amsterdam (November 5-6, 2026) and Bitcoin MENA (Abu Dhabi, December 2026).

This article was originally published as Bitcoin 2026 Unveils First Headline Speakers and Expanded Program on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Breaking: CME Group Unveils Solana and XRP Options