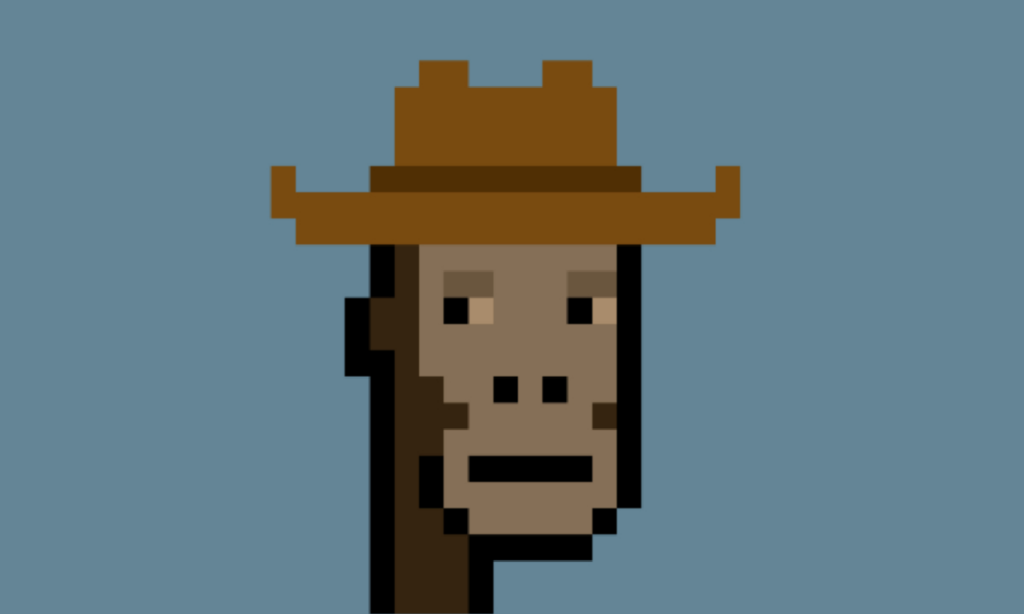

GameSquare acquired ‘cowboy ape’ CryptoPunk for $5.15m

GameSquare decided to promote its NFT pivot with a CryptoPunk deal featuring DeFi pioneer Robert Leshner.

- GameSquare bought ‘cowboy ape’ CryptoPunk

- The firm issued $5.15M in preferred stock for the deal

- DeFi pioneer Robert Leshner became GameSquare’s shareholder

Ethereum (ETH) treasury firm GameSquare is doubling down on NFTs. On Thursday, July 24, the company acquired the ‘cowboy ape’ NFT from Compound founder Robert Leshner in an all-equity deal. In a move to promote its NFT pivot, GameSquare issued $5.15 million of preferred stock to Robert Leshner, convertible into approximately 3.4 million stock.

With the sale, Robert Leshner, a DeFi pioneer and the CEO of Superstate, will become a shareholder in GameSquare. He will work with the company on its Ethereum-focused treasury strategy and support its recent pivot to NFTs.

GameSquare buys CryptoPunk to showcase NFT pivot

The rare ‘Cowboy ape,’ one of just 24 CryptoPunk NFTs with an ape-like appearance, will be added to GameSquare’s treasury. According to Justin Kenna, CEO of GameSquare, the company chose this NFT to showcase its belief in the potential for NFT tech.

Still, the NFT market is far from its highs in 2021, which applies even to popular collections such as CryptoPunks. The collection’s floor price is currently down 50% from its all-time high in October 2021. Smaller collections fared much worse, often losing 99% of their value.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail