Internet from your neighbors’ routers: It’s faster and cheaper than new cell towers | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

While telecom giants spend years permitting new towers, ordinary people are already building the internet faster and cheaper. The contrast is stark: installing a single small cell tower can cost up to $300,000, while a full macro tower runs into the millions. With decentralized physical infrastructure networks — otherwise known as DePINs for short — the cost to add a new connectivity point is effectively zero, as it uses software to activate the Wi-Fi routers people already own.

- DePIN flips telecom economics: instead of million-dollar towers, connectivity is added by activating existing routers, cutting CAPEX, and closing last-mile gaps at near-zero marginal cost.

- The model already works at scale: with 13M+ devices live and rapid daily growth, decentralized networks are proving faster, cheaper deployment across telecom, data, storage, and compute.

- It’s a win for users and operators: better local coverage for users, flexible OpEx for telcos, and economically viable service in regions traditional infrastructure ignores.

This technology is already in mass use, with over 13 million devices up and running in DePIN networks. DePIN does for connectivity what ride-sharing apps, such as Uber, did for transportation. It turns millions of individual, underused assets into a powerful, coordinated network. For the end user, the experience is completely seamless.

Good connectivity should be like electricity; you flip a switch, and it’s there. This invisibility is the real sign of mass adoption, and it’s finally solving the digital divide created by the old model’s high costs and slow pace.

The problem with traditional infrastructure

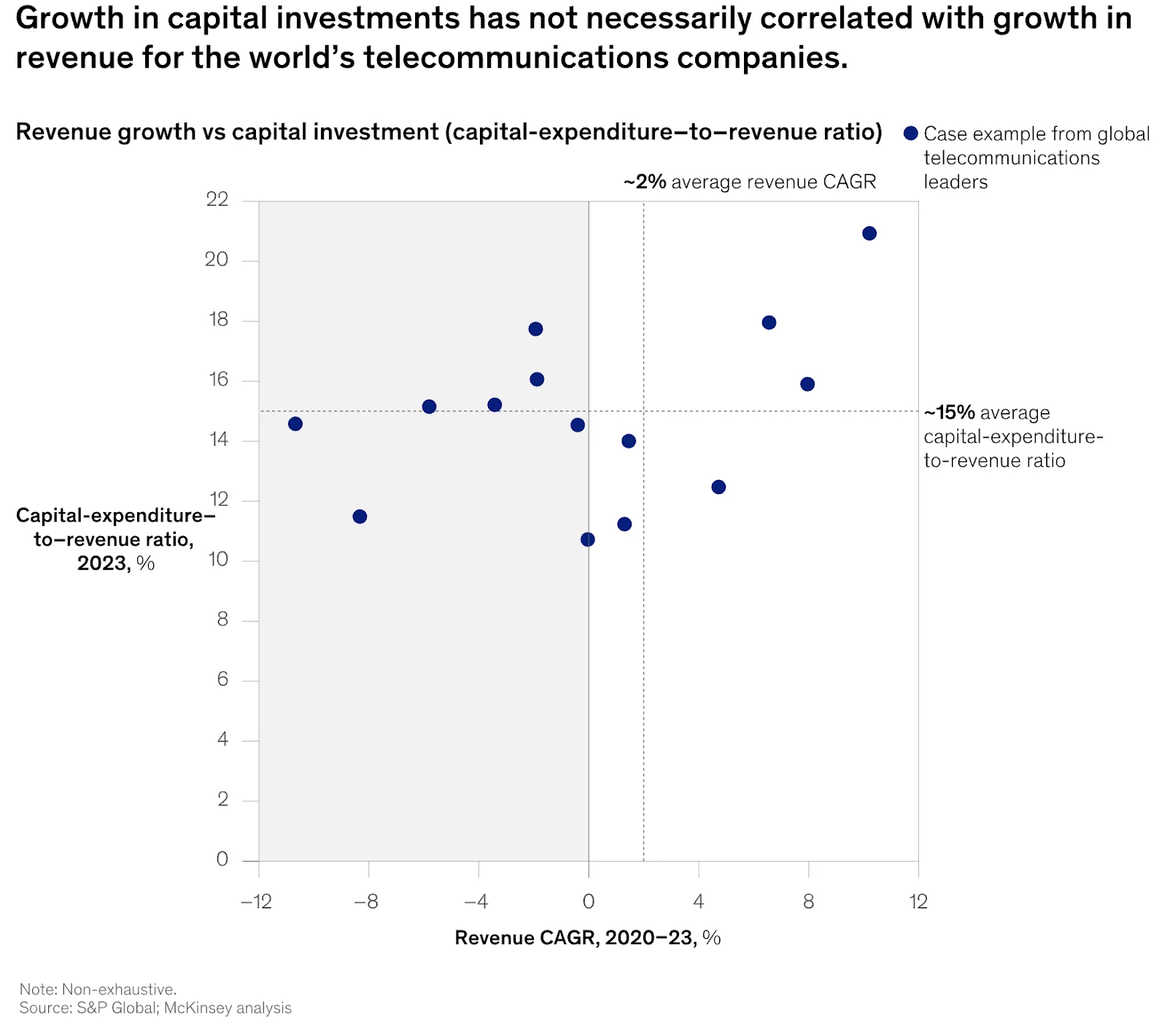

Source: McKinsey

Source: McKinsey

Telecom companies operate under immense financial pressure, with their capital expenditure-to-revenue ratios hovering between 17–20%. During the 5G investment peak, global mobile operators’ CAPEX was projected to hit $1.5 trillion. This has created a cycle of massive investment for incremental gains, leaving many operators among the most indebted companies in the world.

What I’ve learned is that this financial burden is compounded by logistical hurdles. Towers take years to deploy, bogged down by permits, site leases, and complex integrations. The world is moving at software speed, but physical infrastructure remains stuck at concrete speed. This creates a chronic gap between connectivity demand and supply.

Because of the high costs, operators logically focus on profitable areas, often ignoring sparsely populated or low-income regions where the return on investment is slow or nonexistent. The direct result is a widening digital divide, with an estimated 38% of the global population within mobile coverage areas remaining unconnected in a usage gap.

DePIN offers a collaborative, hybrid model to fix this: telecom operators provide the core backbone, and a distributed network of existing routers fills the last-mile gaps.

The decentralized model works: Faster, cheaper coverage

At its core, the decentralized model is a cooperative network. Your phone simply finds the shortest, fastest path to the internet, whether through a cell tower or a series of nearby routers.

The economics are just as simple. Every router owner can become a mini-provider, automatically earning rewards when their device helps route traffic for the network. The barrier to entry is near zero. Participation is often just a lightweight software or firmware update, not a demand to buy expensive new hardware.

Financially, the model is cheaper because it cuts out middlemen and shifts spending from rigid CAPEX to flexible OpEx. Telecom firms and enterprises pay for the actual connectivity provided, not the massive upfront cost of building. This structure also makes it economically viable for individuals to provide coverage in white spots that traditional operators deem unprofitable.

The proof is in the numbers

For DePIN, I see real scaling on the ground: once a wireless network passes 5 million registered routers and still adds 25,000+ a day, the question stops being “does this work?” The real discussion becomes “how do we integrate it well, and how do we keep service quality high?”

The model is also proving itself across industries beyond telecom. In transportation, DIMO has connected over 425,000 vehicles to its owner-permissioned data network, turning drivers into data suppliers. In the AI space, io.net aggregates underutilized GPUs from around the world into a global compute marketplace for developers. And in data storage, Filecoin has pioneered a decentralized marketplace that uses cryptographic proofs to verify that data is stored correctly over time.

This substantial growth is happening for a reason. These projects are tapping into a massive economic shift, with the DePIN market projected to become a $3.5 trillion industry by 2028.

A win for users, telecoms, and cities

In my experience, the beauty of this collaborative model is that it creates a win for everyone involved. Users get what they’ve always wanted: reliable connectivity in the places they actually live and work, like apartment buildings, offices, and underground areas.

Operators gain a strategic partner. DePIN allows for fast, low-cost gap-filling and a flexible way to handle peak-hour traffic without overbuilding their own networks. In one case study with a Fortune 500 company, this model led to a 23% increase in customers and an 82% rise in data transactions.

As I see it, DePIN has grown much beyond a simple experiment. The most effective way to understand the power of this model is to test it. To get started, identify a significant dead zone in coverage in your network. After that, launch a pilot program with a DePIN partner focused on that single area. As the last step, measure the cost, the deployment’s speed, and the service quality. The results will speak for themselves.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week