Digitap ($TAP) Outperforms $1.29 SUI Amid Brutal Market Crash: Best Crypto to Buy

SUI has just experienced another supply expansion, with VCs unlocking 44.25 million SUI tokens, which they can now sell on the open market. That explains why SUI is down 15% on the week, and this inflation problem also explains why SUI is down 75% from its ATH. But while SUI is languishing, Digitap ($TAP) continues climbing.

January 30th saw a historic day of trading for metals as the bubble popped. Gold and silver got smoked in a historic reversal, Bitcoin dipped well below $84,000, and crypto got hit with a $1.7 billion liquidation cascade. Yet despite all this, the Digitap crypto presale continues to see skyrocketing inflows, already raising more than $4.7 million.

The hunt for value is on, and all the leading altcoins to buy in this bearish environment are undervalued small caps. As the value rotation accelerates, banking looks to be the most promising trade of 2026, explaining why $TAP is outperforming $1.29 SUI and ranks as the best crypto to buy now.

Sui (SUI): 44.25 Million Token Unlock

Sui is one of the next-gen layer 1s built to deliver fast execution with its parallelized design. So why does this lightning-fast layer 1 have one of the worst charts in crypto? Bulls are nowhere to be seen, and SUI has made a succession of lower lows with each rally selling off faster.

In a risk-off market, the last thing an altcoin needs is fresh supply coming to market. SUI has a major unlock scheduled for February 1st, which will see insiders and VCs unlock approximately 0.44% of the total supply (44.25 million SUI tokens), after which they can dump these tokens on the open market.

After a big liquidation, lack of liquidity, and barely any demand for large-cap altcoins, unlocks like these can be a death sentence. Especially because the VCs bought SUI very, very cheaply, so even if the chart looks bad, they are still up many multiples on their investment. A bad time for an unlock and very unfortunate for the SUI bulls.

Digitap ($TAP): Crypto Presale Banking Play for 2026

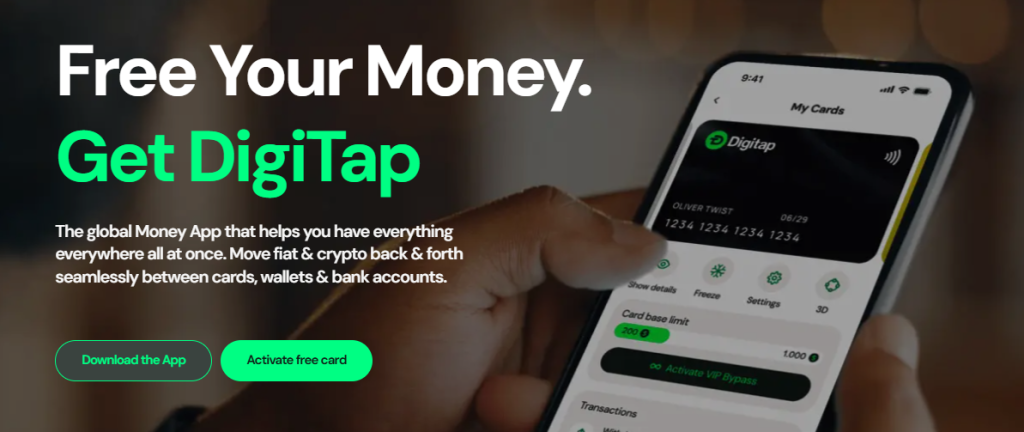

The world is already global, but money still behaves like it’s stuck in the 1990s. Digitap is built to fix that. Its omni-banking app, available for download today, means crypto and fiat now live together. In the 21st century, money has to move across borders as easily as information moves across the internet—because people work remotely, earn internationally, and spend in multiple currencies without thinking twice.

Digitap ranks among the most exciting altcoins to buy in 2026 because it is perfect for non-crypto natives to start using stablecoins. The smooth neobank UX gives users familiarity, while under the hood, crypto rails power transactions.

Pioneering a multi-rail settlement engine is what makes Digitap stand apart. Transactions can settle using traditional banking rails or blockchains. That means instant crypto-to-fiat transactions, sub 1% cross-border transactions, and no need to juggle multiple apps.

Digitap’s AI engine optimizes each transaction, and the same engine finds the best swap prices whenever people use their Digitap Visa card, allowing them to pay anywhere globally with crypto. Cheap cross-border transactions are an obvious pain point in global finance and a great onboarding vector for Digitap.

The recent Solana integration has unlocked native deposits on Solana and brought one of crypto’s fastest chains to this global money app. Digitap is outperforming because it has shipped its product while still operating its crypto presale. A rarity and with $TAP already up 263%, it is clear investors are onboard with this product-first approach.

Why Digitap Outperforming SUI Makes Sense in This Market

SUI is walking into a massive supply unlock. Digitap takes a completely inverse approach and has arguably one of the most deflationary token models on the market. 50% of platform profits go to the token flywheel. This flywheel buys tokens on the open market, burns half, and uses the other half to reward stakers.

Currently, crypto presale participants are earning 124% APY on their $TAP holdings paid from a fixed pool. The clever design behind $TAP’s tokenomics makes the token desirable and easily among the best cryptos to buy now. As Digitap scales and onboards more users, it will buy and burn more tokens. And when supply goes down, price almost always goes up.

At the current price of $0.0454, investors are clearly early to $TAP, and it will list later this year at $0.14. That means potential 3X upside for today’s buyers before open market price discovery even begins. While SUI looks heavy, Digitap is riding the banking and stablecoin narrative. With a massive target market, $TAP could become one of 2026’s most exciting trades.

Digitap is Live NOW. Learn more about their project here:

Presale | Website | Social | Win $250K

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Digitap ($TAP) Outperforms $1.29 SUI Amid Brutal Market Crash: Best Crypto to Buy appeared first on CaptainAltcoin.

You May Also Like

Top NYC Book Publishing Companies

Sensorion Announces its Participation in the Association for Research in Otolaryngology ARO 49th Annual Midwinter Meeting