Chainlink Price Nears a Critical Crossroad as Supply Builds Beneath the Surface

The post Chainlink Price Nears a Critical Crossroad as Supply Builds Beneath the Surface appeared first on Coinpedia Fintech News

Chainlink price is losing momentum as traders turn more defensive across the altcoin market. After failing to hold above $11, LINK extended its pullback today over 6%, pushing price toward the $9 mark, a zone where buyers are now expected to show intent.

The move lower has unfolded without panic. Instead, it reflects a gradual withdrawal of demand, with rebounds failing to attract sustained follow-through. This kind of price behavior often signals a market that is reassessing value rather than reacting emotionally.

As LINK price approaches key technical territory, on-chain data offers insight into why confidence has thinned.

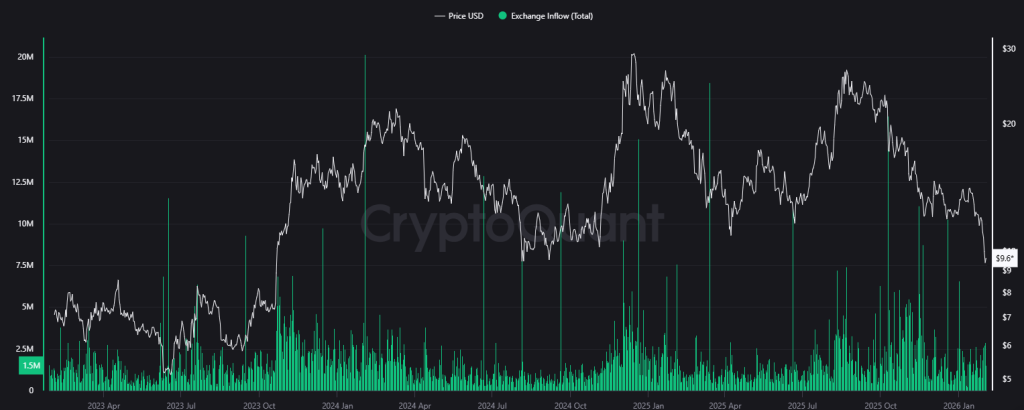

Spot Market Data Shows Steady Distribution Into Weak Rallies

Spot on-chain metrics point to persistent but controlled selling pressure rather than panic-driven exits. Over the past several sessions, LINK has recorded net exchange inflows averaging 2500,000–4000,000 LINK per day, even as price attempted minor recoveries. These inflows have coincided closely with short-term bounces, indicating that holders are using strength to distribute rather than accumulate. Exchange balances remain elevated relative to early-month levels, while spot volume on green candles has consistently lagged volume on red sessions.

This imbalance confirms that sell-side activity is absorbing demand faster than buyers are willing to step in. Crucially, there is no sign of aggressive accumulation clusters forming at current prices. Historically, LINK bottoms have aligned with sharp reductions in exchange inflows.

Leverage Exposure Resets as Risk Appetite Pulls Back

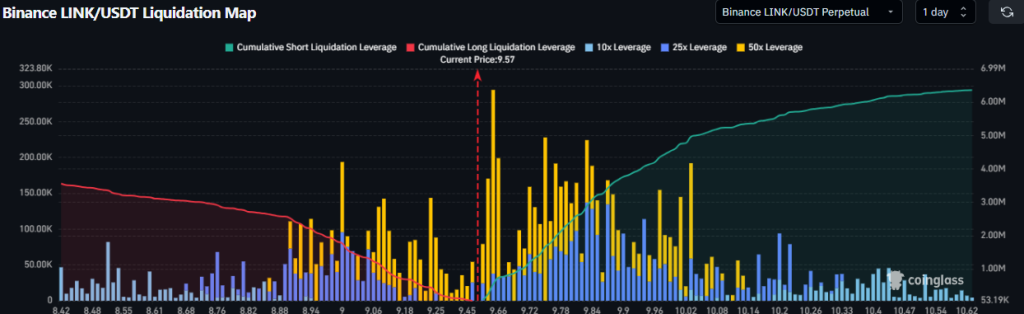

Derivatives data reinforces the idea that LINK’s move lower is driven by positioning reset, not aggressive bearish conviction. Open interest has declined near 2%, dropping from approximately $470 million to near $450 million, signaling that traders are reducing exposure rather than piling into shorts. This contraction reflects long-side unwinding, not fresh downside speculation.

However, funding rates across major perpetual markets have cooled from mildly positive territory to near neutral, removing a key bullish tailwind that supported LINK earlier in the cycle. The absence of strongly negative funding also suggests shorts are not pressing aggressively. While, liquidation data reveal a notable concentration of long liquidation liquidity between $9.00 and $9.50, with estimated exposure exceeding $60–$80 million. Above current price, short-side liquidity remains relatively thin, reinforcing downside gravity if spot demand fails to stabilize.

Chainlink Price Analysis: Is LINK Set to Retest $8?

Chainlink price has continued to paint the lower highs and lower lows swings, trapped inside a descending channel. Amidst the recovery in early 2026, LINK has failed to crack the $14 hurdle and faced decisive rejection, resulting in drop below the $10 crucial support zone. The $10 level has now flipped into resistance. The current price action suggests that Chainlink price may grab liquidity toward the $8 demand zone in the coming sessions.

As long as LINK price trades below the $9 zone, market structure favors continuation pressure toward the $7.50-$8.30 zone, where historical demand and accumulation zone intersect. A decisive defense of $9 could allow LINK to compress and stabilize ahead. However, the current phase is defined by distribution over accumulation and risk reduction over leverage expansion. The market awaits clear evidence of bottoming out and stronger volume response at support. Until then, LINK is not being chased, it is being tested.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Optimizely Named a Leader in the 2026 Gartner® Magic Quadrant™ for Personalization Engines