Binance Begins $1 Billion SAFU Shift as Bitcoin Replaces Stablecoins

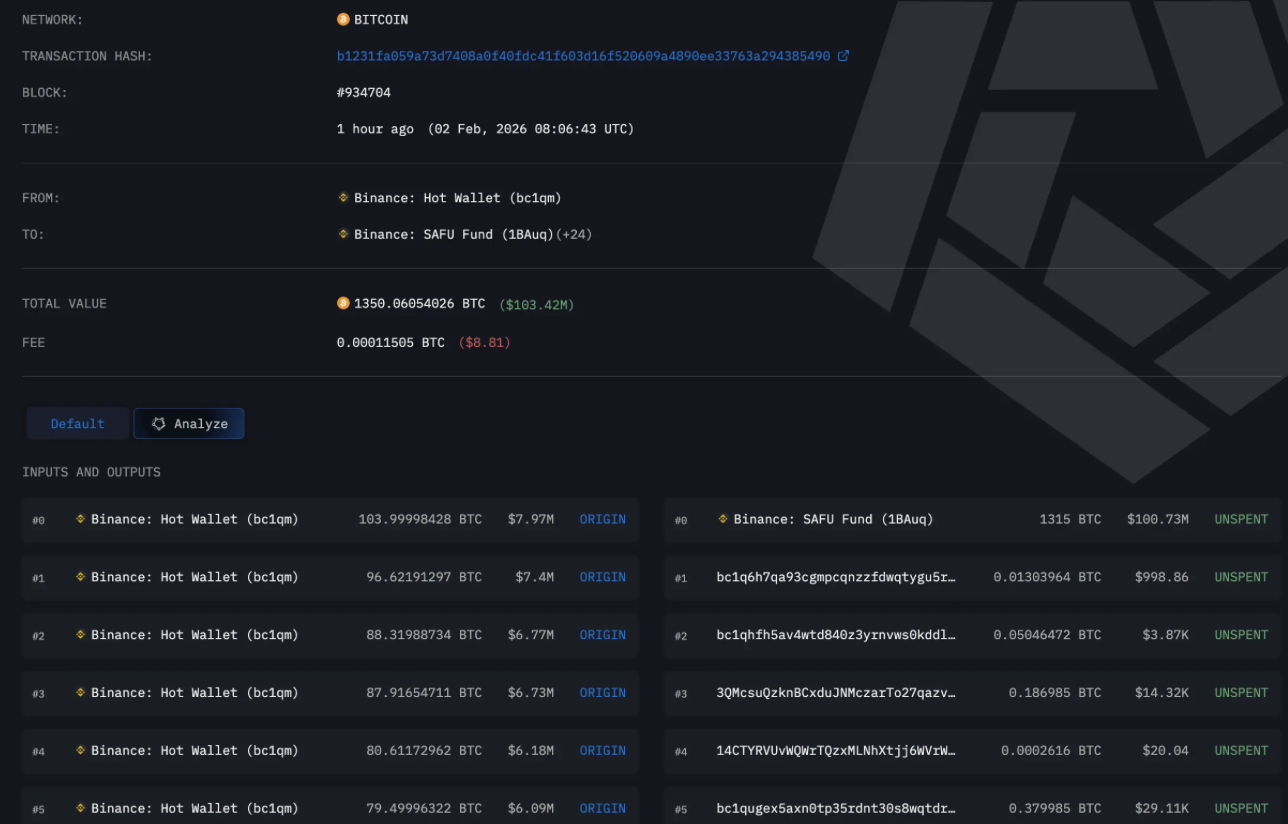

Binance has taken the first concrete step in its plan to restructure the Secure Asset Fund for Users (SAFU), transferring 1,315 Bitcoin tokens (BTC), worth approximately $100.7 million, into the fund on February 2, 2026, according to on-chain data.

The transaction originated from a Binance hot wallet and represents an internal reclassification of existing reserves rather than new market purchases. It marks the initial phase of a broader strategy to convert the SAFU fund entirely from stablecoins into Bitcoin.

SAFU Rebalance Plan: From Stablecoins to Bitcoin

Binance previously disclosed that it intends to transition $1 billion in SAFU reserves, currently held primarily in stablecoins such as USDC, into Bitcoin. The conversion is expected to take place over a 30-day period following the company’s announcement on January 30.

Source: https://intel.arkm.com/explorer/address/0xEe7aE85f2Fe2239E27D9c1E23fFFe168D63b4055

Source: https://intel.arkm.com/explorer/address/0xEe7aE85f2Fe2239E27D9c1E23fFFe168D63b4055

To address Bitcoin’s price volatility, Binance outlined a rebalancing framework tied to the fund’s dollar value. The exchange has committed to maintaining SAFU at $1 billion, with a defined lower threshold. If the market value of the fund falls below $800 million, Binance plans to inject additional capital to restore it to target levels.

According to the exchange, the decision reflects a strategic preference for Bitcoin as what it described as the “core asset” of the crypto ecosystem and a long-term store of value.

Operational Safeguards Added to SAFU Wallet

In parallel with the BTC transfer, on-chain records show that the SAFU fund address implemented Allowed Recipient Whitelisting on February 2. This security feature restricts outgoing transactions to pre-approved addresses, a measure commonly used to reduce operational risk and prevent unauthorized fund movements.

The update suggests Binance is reinforcing internal controls as it restructures the fund’s asset composition.

SAFU’s Role in Binance’s Risk Framework

The SAFU fund was established in 2018 as an emergency insurance pool designed to compensate users in the event of security breaches or platform failures. It has since remained a central component of Binance’s risk management framework.

By the end of 2025, Binance reported holding approximately $162.8 billion in total user assets, underscoring the scale at which SAFU operates as a backstop within the broader platform. While the fund’s structure is evolving, its core purpose, user protection, remains unchanged.

The post Binance Begins $1 Billion SAFU Shift as Bitcoin Replaces Stablecoins appeared first on ETHNews.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Breaking: CME Group Unveils Solana and XRP Options