$1.8B Exits U.S. Crypto ETFs as Bitcoin, Ether Slide Despite Brief Rally

- Spot Bitcoin and Ether ETFs lost $1.82 billion over five trading days, with Bitcoin accounting for $1.49 billion of the total net withdrawals.

- Massive liquidations fueled the decline, as over $2.5 billion in leveraged positions were wiped out, the 10th largest daily event on record.

- Economic uncertainty triggered the exit, driven by a 43-day US government shutdown and a surge in gold and silver prices that drew capital away from risk assets.

US-listed spot Bitcoin and Ether ETFs recorded sustained outflows over the past week as crypto prices fell and leverage unwound across the market.

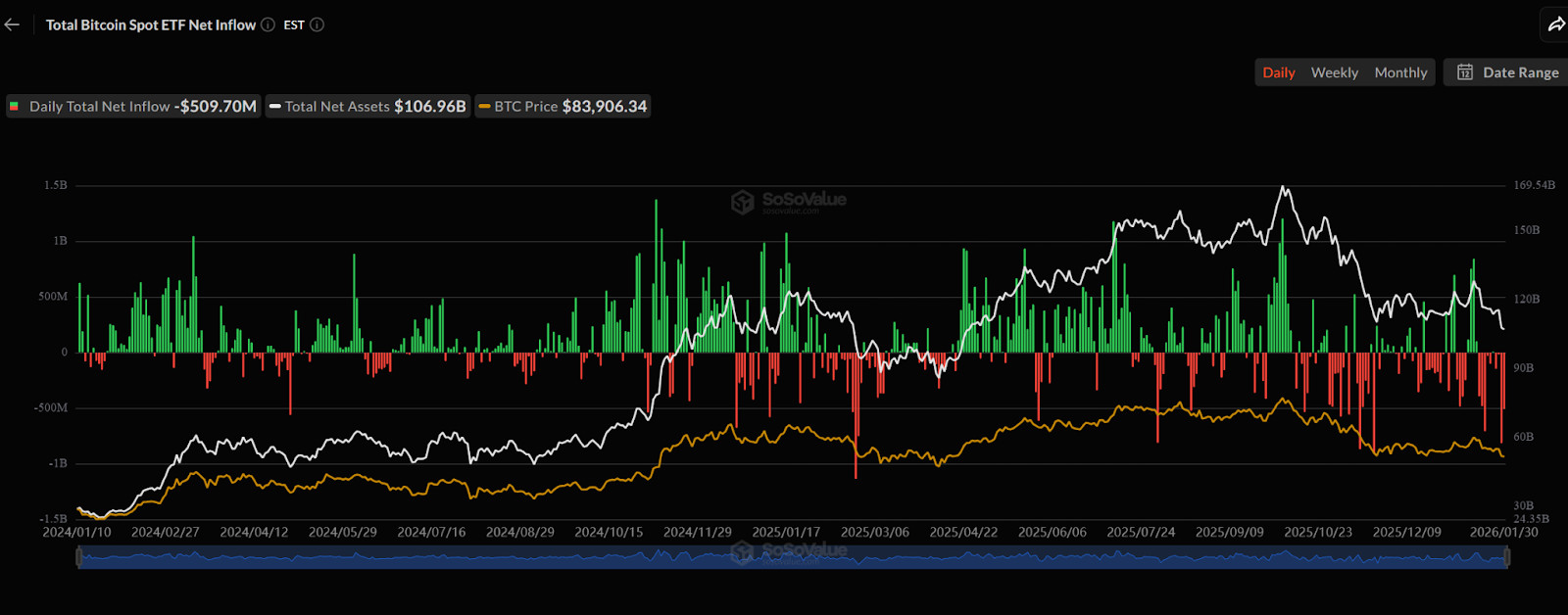

Data from SoSo Value shows that investors withdrew about US$1.82 billion (AU$2.78 billion) from spot crypto ETFs over five trading days. Spot Bitcoin ETFs accounted for roughly US$1.49 billion (AU$2.28 billion) of that total, while spot Ether ETFs saw about US$327 million (AU$500 million) in net outflows.

Source: SoSo Value.

Source: SoSo Value.

The withdrawals coincided with BTC and ETH falling 6.6% and 9.0%, respectively, trading near US$83,400 (AU$127K) for Bitcoin and US$2,685 (AU$4K) for ETH, according to CoinMarketCap.

Related: HYPE Explodes 57% in 72 Hours as Hyperliquid Trading Surge Fuels Breakout

Over US$1 Billion In Liquidations

The ETF outflows followed a brief rally earlier in January, when Bitcoin rose about 7% over two days amid speculation around progress in the US CLARITY Act. On Jan. 14, spot Bitcoin ETFs recorded their largest single-day inflow of 2026 at US$840.6 million (AU$1.29 billion).

That move coincided with the Crypto Fear & Greed Index reaching its highest reading of the year, signaling renewed risk appetite that quickly faded.

Market analysts attributed the subsequent selloff to liquidity conditions rather than macro or geopolitical catalysts.

Analysts at The Kobeissi Letter said the decline reflected a leverage-driven unwind, pointing to three rapid liquidation waves totaling about US$1.3 billion (AU$1.99 billion) within 12 hours. They described market liquidity as uneven, making prices more vulnerable to sharp moves when leverage builds.

Broader liquidation data from CoinGlass showed total liquidations briefly exceeding US$2.5 billion (AU$3.83 billion). Kobeissi said the episode ranked as the 10th-largest daily liquidation event on record, well below the October 10 selloff, when more than US$19 billion (AU$29.1 billion) was wiped out in 24 hours.

Read more: Why 75% of APAC Investors Still Avoid Crypto: New Data Upends Adoption Myths

The post $1.8B Exits U.S. Crypto ETFs as Bitcoin, Ether Slide Despite Brief Rally appeared first on Crypto News Australia.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

SBF's X account showed unusual activity, and FTT subsequently surged.