Swift Surge: New XRP Whale Amasses $206 Million In Minutes

A fresh whale on the XRP ledger moved a large chunk of tokens in a very short time, and traders are split on what it means.

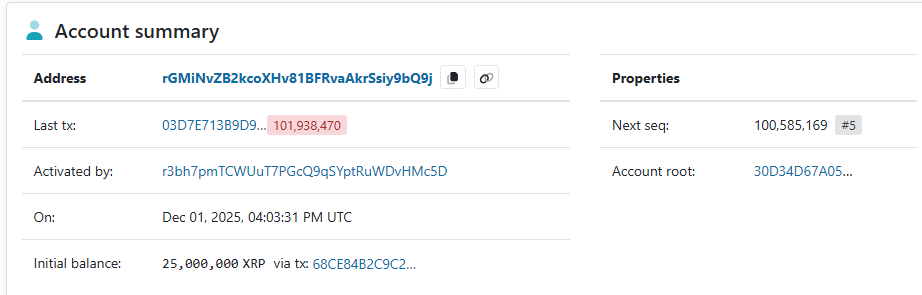

According to on-chain records, a newly activated address received two equal transfers that together totaled $120 million XRP.

The transfers came through an intermediary wallet that shuffled the coins across multiple quick moves.

Whale Activity And The Flow Of Funds

Reports say the incoming batches were two transfers of $60 million XRP each. The intermediary took each batch and pushed them onward to a holding address within the hour.

That receiving account now shows a balance of $185 million XRP after adding a leftover $35 million it already held. Exchange tags are absent. No known custodial label appears next to these addresses. That makes the trail harder to read.

Why The Moves Could Be Routine

Large holders move funds for many reasons. Custodians tidy up wallets. Exchanges consolidate holdings. Firms rotate funds locked in cold storage for operational reasons.

Those are common explanations. Active traders watched the price around the same time. Reports note XRP had slid to the low $1.70 range, breaking below the $1.80 support and slipping about 10% since Jan. 29.

If this were a quiet buy-the-dip, market signs would usually show up. Price stabilization or an uptick might follow. Spot volume could climb. Net outflows from exchange wallets might be visible.

None of those clear, matching clues appeared right away. Instead, the funds sat put. That raises the chance this was internal reshuffling rather than aggressive accumulation.

What The Intermediary Pattern SuggestsRouting through a central wallet is common. Some teams prefer to funnel receipts into a single address for accounting or security checks before dispersing them.

The pace of transfers can look dramatic on a block explorer. But drama does not equate to new money entering the market.

Without evidence that the source funds came from outside exchanges, or that they were purchased on the open market, the move should be treated as ambiguous.

Reports have disclosed similar on-chain activity in past months that later turned out to be either coordinated buying or routine housekeeping.

Featured image from Unsplash, chart from TradingView

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail