Bitcoin Price Crashes 6% to $84,000 As Market Braces for Next Catalyst

Bitcoin Magazine

Bitcoin Price Crashes 6% to $84,000 As Market Braces for Next Catalyst

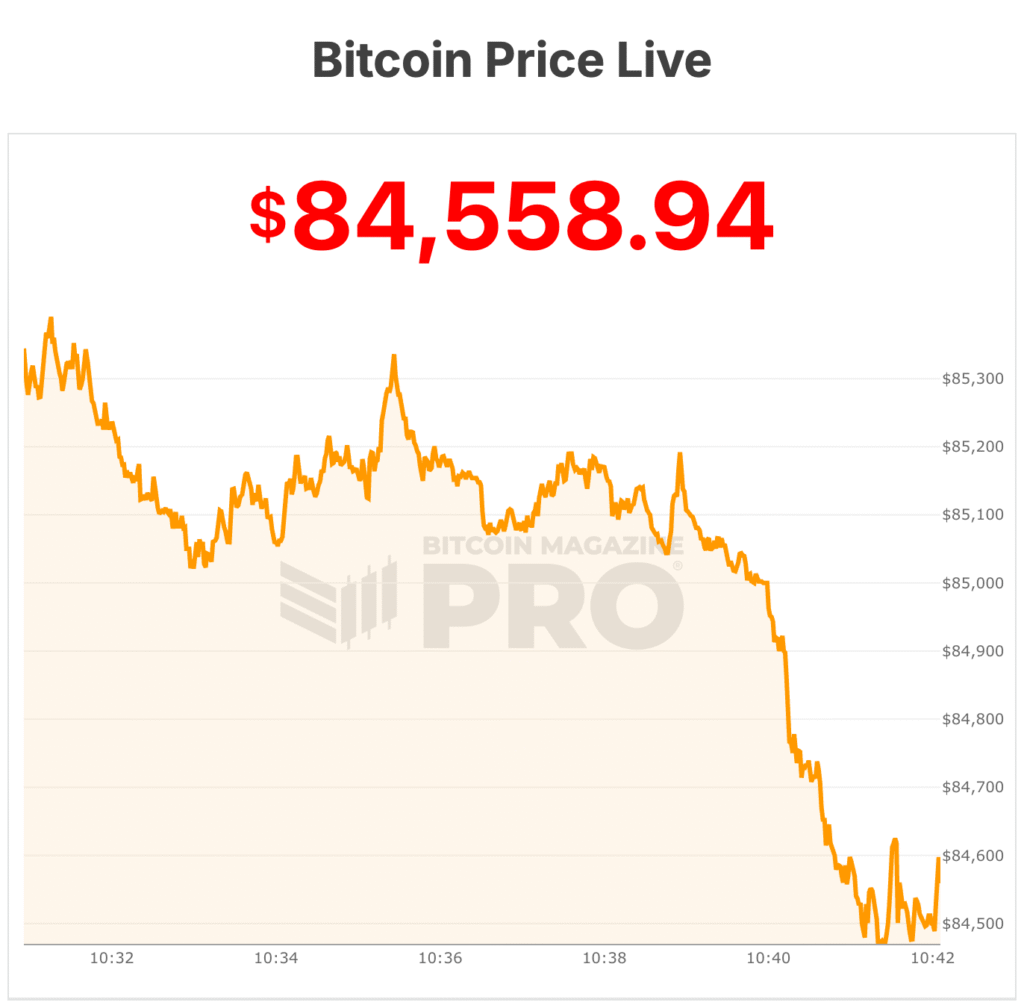

Bitcoin price fell sharply this morning, sliding to lows in the $84,000 range and extending a swift reversal from recent 24-hour highs above $90,000, as macro uncertainty and fragile market structure reasserted control.

The bitcoin price dropped to as low as $84,416, down roughly 6% over the past 24 hours if accounting for daily highs, according to Bitcoin Magazine Pro data.

The move came less than a day after bitcoin traded as high as $90,400, marking a rapid round-trip that underscored heightened volatility around this week’s Federal Reserve meeting.

Daily trading volume climbed to roughly $48 billion as the selloff accelerated, suggesting forced liquidations and short-term positioning unwind. Bitcoin’s total market capitalization fell to about $1.72 trillion, down approximately 4% on the day.

With unemployment at 4.4%, Powell emphasized labor market resilience and refrained from signaling urgency around easing policy — an outcome that proved unfriendly for speculative assets.

For crypto markets that had rallied into the decision, the meeting quickly turned into a “sell the news” event.

Bitcoin price needs to hold $84,000

The reversal also came as bitcoin struggled to reclaim key technical levels. After briefly clearing $90,000, the bitcoin price failed to hold above resistance near $91,000, triggering renewed selling pressure.

Analysts have flagged the $88,000 level as an important pivot for near-term stabilization, with $84,000 now emerging as critical downside support.

A sustained break below that level could expose deeper retracements toward the $72,000–$68,000 zone, according to Bitcoin Magazine analysts.

Bulls are expected to defend the $84,000 area aggressively to avoid a broader technical breakdown.

Meanwhile, Gold surged to new all-time highs above $5,550 per ounce this week, highlighting continued demand for hard assets amid currency uncertainty. Bitcoin initially appeared to benefit from similar tailwinds but failed to sustain momentum.

Next week, the White House will host banking and crypto executives on February 2 to discuss reviving stalled U.S. crypto legislation.

The meeting, organized by the administration’s crypto council, will focus on contentious issues — especially how proposed rules would treat interest and rewards paid on dollar-pegged stablecoins — as the Trump administration seeks to broker a compromise after talks broke down.

At the time of writing, Bitcoin price is trading at $84,437, with a 24-hour trading volume of $48 billion.

The cryptocurrency is down 4% over the past 24 hours and is trading 6% below its seven-day high of $90,316. Bitcoin price is sitting at its seven-day low, down roughly 0% from the $85,417 level.

This post Bitcoin Price Crashes 6% to $84,000 As Market Braces for Next Catalyst first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

‘One Battle After Another’ Becomes One Of This Decade’s Best-Reviewed Movies

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council