Solana’s DeFi TVL hits $10B, highest level in six-month high

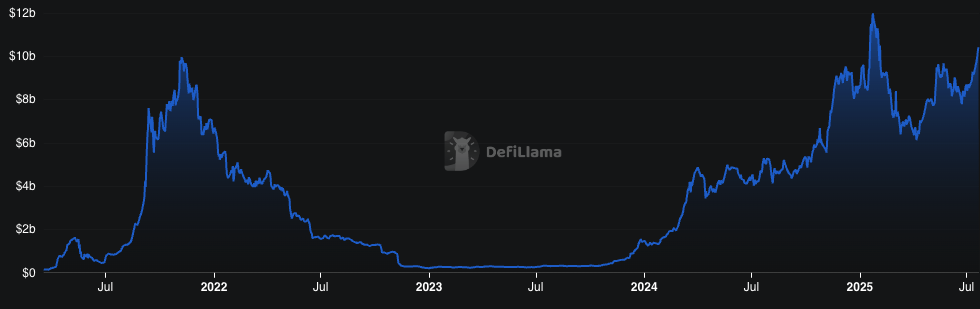

Solana’s recovery coincided with a similar increase in its DeFi TVL, which reached the highest level in six months.

The latest crypto bull run boosted both Solana’s (SOL) price and DeFi ecosystem. On Monday, July 21, Solana’s total market cap once again crossed $100 billion, with SOL trading at $194.62 per coin. With a market cap hovering below $105 billion, this is the highest level this metric has reached since Jan. 25 this year.

At the same time, the increase in Solana’s price also contributed to the rising value of its total ecosystem. Solana’s DeFi TVL has reached $10.453 billion, the highest this metric has been since January, when SOL hit an all-time high.

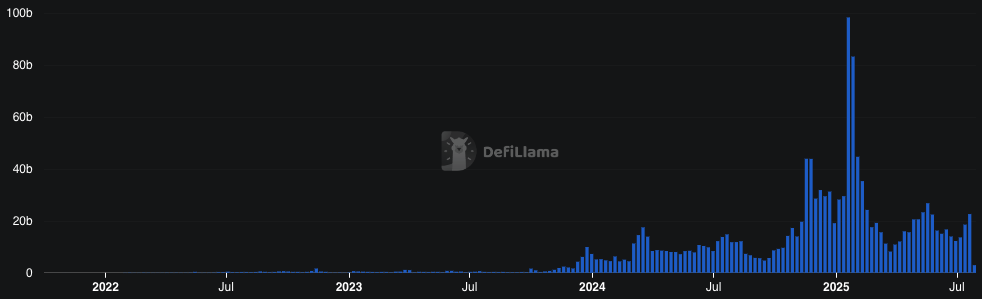

The growth was also reflected in the increase in DEX activity, although these figures did not approach the January highs. Between July 14 and July 20, Solana DEXs processed $22.58 billion in volume, up from $18.5 billion on the week prior.

Leading among decentralized exchanges are Raydium, Orca, and Meteora, with weekly volumes of $8.4 billion, $5.9 billion, and $5.3 billion, respectively. Still, weekly DEX volume remains far from its peak in mid-January, where it reached $98.28 billion.

Why Solana’s DeFi TVL rose

The most likely reason for Solana’s DeFi TVL reaching a six-month high is the boost from the Solana token price. This is because SOL tokens account for a significant percentage of assets held across the network’s DeFi protocols.

Solana’s DeFi TVL accounts for tokens, stablecoins, and memecoins deposited across various DeFi protocols within the Solana ecosystem. This includes tokens in smart contracts, lending pools, or vaults.

Still, the DeFi TVL does not include Solana tokens that are staked with validators for securing the network. Currently, this figure amounts to 355.4 million SOL, valued at $69.44 billion, or about 66% of all tokens in circulation. DeFi TVL also doesn’t include tokens held on centralized exchanges.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds