Dalio: U.S. Nears Crisis Point as Bitcoin Trapped by American Selling Pressure

Ray Dalio warned the U.S. stands “on the brink” of transitioning from Stage 5 pre-breakdown to Stage 6 systemic collapse as Bitcoin is trading defensively at $88,000, trapped in a 60-day range by record institutional selling pressure from American counterparties.

The billionaire investor’s latest analysis of the “Big Cycle” coincides with Bitcoin’s failure to live up to its “digital gold” narrative, while traditional safe havens surge to all-time highs.

Dalio’s framework identifies bankrupt government finances and wealth gaps as the “single most reliable leading indicator of civil war or revolution,” conditions he argues now characterize American reality.

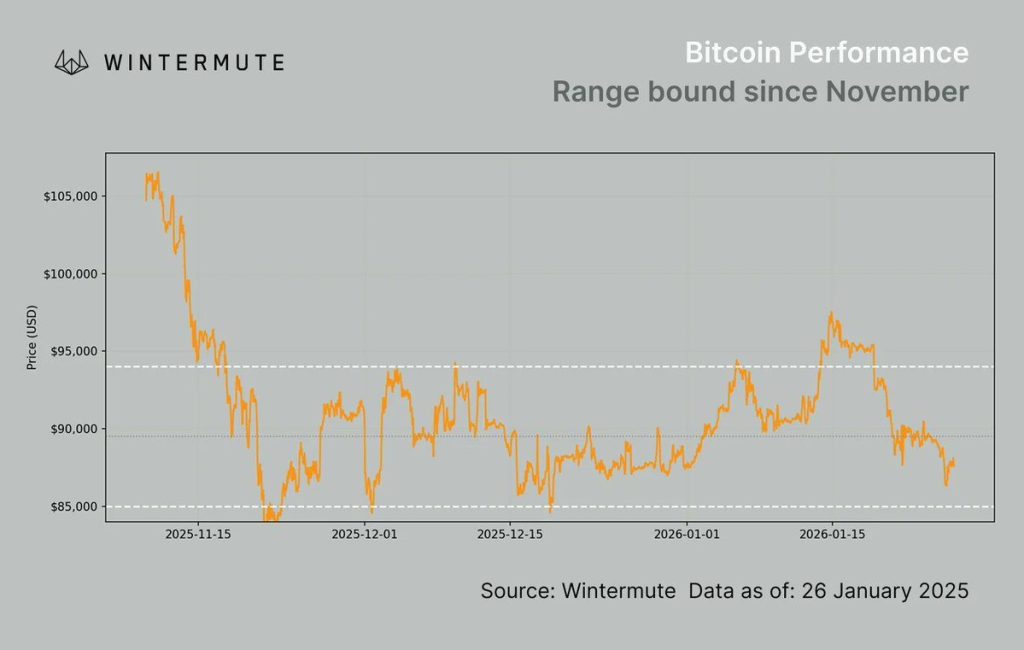

Meanwhile, Wintermute’s desk reports that Bitcoin remains stuck between $85,000 and $94,000 as U.S. spot ETF products hemorrhage capital and the Coinbase premium trades at a persistent discount, indicating that domestic institutions are driving bearish momentum.

Dalio’s Crisis Warning Meets Bitcoin’s Range-Bound Reality

Dalio’s long essay positions current American conditions within Stage 5 of his Big Cycle framework, where “bad financial conditions and intense conflict” precede systemic breakdown.

“We are now clearly on the brink of crossing from Stage 5 (pre-breakdown) to Stage 6 (breakdown),” he wrote, pointing to unsustainable debt loads that force governments to either “print a lot of money, which depreciates its value” or implement painful austerity.

The analysis comes as Bitcoin trades range-bound for 60 consecutive days, an unusual pattern for an asset class often marketed as protection against exactly the monetary debasement Dalio describes.

Source: Wintermute

Source: Wintermute

Gold climbed above $5,066 per ounce on Tuesday while silver surged 6.4% to $110.60, both setting fresh records as investors sought traditional inflation hedges.

Dalio warned that “later stages may involve capital controls, reserve freezes, and cross-border restrictions, turning funds into political tools,” conditions that typically favor “freely transferable assets” and investments “prioritizing resistance to freezing and blockades.“

Bitcoin proponents have long argued that crypto fits this profile, yet the asset has failed to attract safe-haven flows amid elevated macro uncertainty.

U.S. Institutions Drive Selling as ETF Flows Turn Negative

Wintermute’s OTC desk identified American selling pressure as the primary force keeping Bitcoin suppressed within its trading range.

“The Coinbase premium confirms it. US counterparties are net sellers, more so than Europe (marginal buyers) or Asia (neutral),” the firm’s market update stated, noting that “ETFs drive momentum in this market; when that bid disappears, you get choppy, directionless price action.“

U.S. spot Bitcoin ETF products recorded their largest weekly outflow since February 2025 last week, reversing the strong inflows that accompanied January’s brief breakout attempt toward $97,000.

The failure of that rally left Bitcoin back in the middle of its established range, with $85,000 serving as tested support.

CryptoQuant’s on-chain analysis suggests the selling pressure also comes from opportunistic profit-taking rather than forced capitulation.

The Miners’ Position Index printed near -1.5, indicating miners “are now selling less than their 1-year average” after aggressive inventory monetization at $110,000-$120,000 levels.

Similarly, exchange whale ratios remain elevated, but deposits fall “well below prior spike highs, implying tactical, price-sensitive distribution rather than all-in capitulation.“

Catalyst-Rich Week Could Break Two-Month Deadlock

Speaking with Cryptonews, Arthur Azizov, Founder at B2 Ventures, framed Bitcoin’s weakness within the context of competing safe-haven narratives.

“When uncertainty rises, capital first moves into classic defensive assets. We see this now from gold breaking above $5,000,” Azizov said, adding that “Bitcoin is often called ‘digital gold,’ but in reality, it’s still, first and foremost, a risk asset.“

Multiple macro catalysts converge this week that could finally break Bitcoin from its compressed range.

The Federal Reserve announces its policy decision on Wednesday alongside key earnings from Microsoft, Meta, Tesla, and Apple, while Trump’s fresh 25% tariff threat against South Korea adds geopolitical uncertainty.

Wintermute analysts expect continued consolidation absent a clear directional catalyst.

“Sixty days of compression meeting this much event risk, something gives,” the firm concluded, identifying $85,000 as the critical support level with ETF flow reversal required before Bitcoin can “break convincingly above mid-$90K levels.“

Market Performance Indicates Cautious Recovery

Bitcoin traded at $88,553 earlier today and rose 1.4% as Asian markets opened with tentative optimism despite fresh tariff threats.

However, at the time of writing, Bitcoin is back below the $88K support level, pushing the total crypto market cap to $3.06 trillion, down 0.18% on the day.

The uncertain trajectory came as broader risk assets found footing ahead of the Fed decision, though Azizov’s “base case is consolidation,” with expectations that Bitcoin will “hold the $85k–$88k zone,” which previously served as strong support through late 2025.

You May Also Like

Jerome Powell’s Press Conference: Crucial Insights Unveiled for the Market’s Future

Shiba Inu Price Forecast for Feb 9: Here’s Key Overhead Resistance for Any Move Upwards