XRP Price Could Consolidate Longer Before Liftoff to $10

XRP (XRP) remains in the spotlight as traders weigh the odds of a continued rally versus a protracted period of consolidation. Historical market cycles suggest that double-digit moves tend to follow extended accumulation phases, and current price action hints at a quiet buildup rather than a rapid breakout. The asset has held a tight range around $1.80–$2.00 since December 2024, a pattern that has preceded meaningful rebounds in past cycles. If the pattern repeats, XRP could spend more time grinding within a similar band before the next major move unfolds, potentially reshaping expectations for the broader altcoin market.

Key takeaways:

-

XRP macro setup targets $10, but an extended consolidation is likely before any major lift.

-

Strong support around $1.80–$2 since Dec 2024 has historically produced 35%-90% rebounds.

-

Onchain data suggest XRP is at levels that have previously preceded sideways price action.

-

If the pattern repeats from prior cycles, a longer accumulation could set the stage for a substantial breakout.

-

Some analysts see a path to multifold gains in later phases, with projections mentioning targets like $11 and even higher in successive waves.

Tickers mentioned: $XRP

Sentiment: Bullish

Price impact: Positive. The structure implies potential upside if the support holds and a breakout above recent resistance is achieved.

Trading idea (Not Financial Advice): Hold. Given the extended accumulation narrative, wait for a clear breakout above the $2.22 level or a sustained move beyond the current consolidation range before increasing exposure.

Market context: The XRP setup unfolds amid a broader crypto landscape characterized by uneven liquidity and evolving expectations around regulatory clarity and institutional participation, factors that shape altcoin cycles and the pace of demand for cross-border settlements and tokenized assets.

Why it matters

For investors who have weathered the pullbacks and consolidations of the past few years, the potential for a sustained move higher in XRP would recalibrate the risk-reward dynamics for altcoins more broadly. A shift from range-bound trading toward a new bull leg could unlock liquidity for related tokenized products and spur renewed interest in XRP-enabled use cases, including payments, remittances, and programmable finance. Yet the path remains conditioned on the delicate interplay between on-chain signals, futures market activity, and macro sentiment—factors that can extend consolidation as much as they can ignite a breakout.

From a technical perspective, the bullish thesis hinges on a pattern that has appeared in prior cycles: a robust defense of a key support zone, followed by a multi-quarter phase of accumulation that ultimately culminates in a powerful price surge. The current zone near $1.80–$2.00 has repeatedly served as a springboard for subsequent gains in the past, suggesting that bulls could gain momentum once the zone is decisively reclaimed. However, the timing of any breakout is highly contingent on the alignment of macro liquidity, trader positioning, and the speed at which new demand enters the market.

The story is not simply about a single price target. Some voices in the community have sketched a longer roadmap, noting that if the macro pattern repeats, the next impulse could carry XRP beyond the $10 mark, with even more ambitious projections in the outer waves. While such scenarios cannot be guaranteed, they reflect the evolving narrative of a token that has traded within historic price ranges and continues to attract interest from traders who study cycle dynamics and on-chain health metrics.

What to watch next

- New price action around the $2 level: a sustained move above $2.22 could reaffirm bullish momentum.

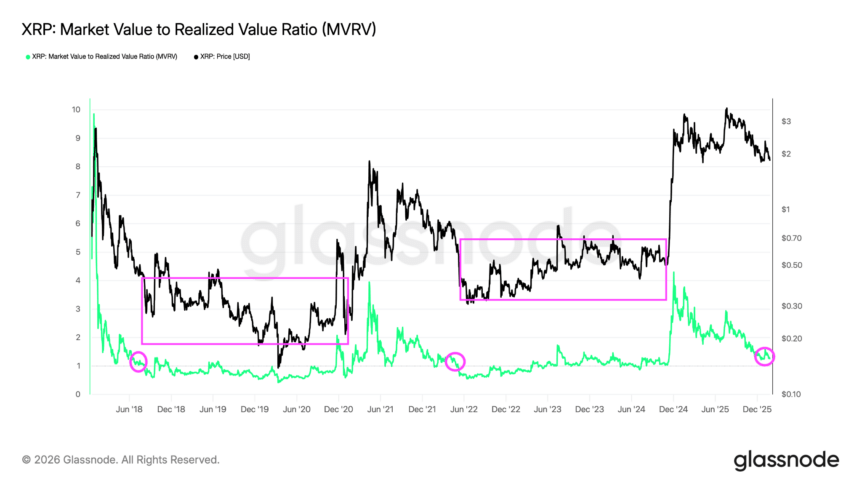

- On-chain signals: monitor the NUPL indicator’s position in relation to capitulation zones and the MVRV ratio’s movement away from historically low readings toward rekindled profits.

- Pattern replication: watch for similarities to 2022/2017 cycle behaviors, particularly the duration of accumulation before a breakout.

- Futures market dynamics: latent buying pressure in the futures market could precede a physical move in spot markets.

- Fundamental catalysts: any favorable regulatory developments or partnership announcements tied to XRP use cases could act as accelerants.

Sources & verification

- Price stability within the $1.78–$2.00 band since December 2024, as depicted in price action charts.

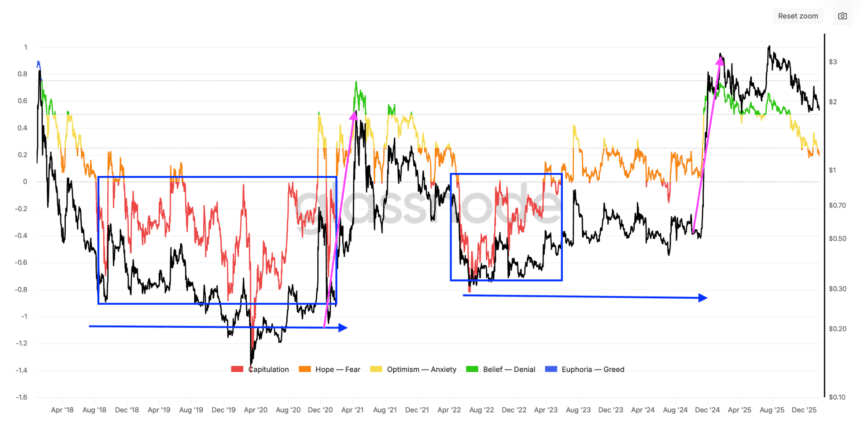

- On-chain indicators such as NUPL (Net Unrealized Profit/Loss) signaling capitulation zones in prior cycle bottoms.

- MVRV (Market Value to Realized Value) ratio levels hovering around 1.23, with historical peaks much higher in 2017 and 2021.

- Historical references to the pattern of accumulation followed by extended consolidation before major moves, including past cycles where XRP moved from sub-$1 to multi-dollar regimes.

- Related analyses and charts cited in the original discussion, including commentary from Mikybull Crypto and CryptoBull, as well as the referenced blockchain-tracking resources.

Long accumulation ahead: XRP’s path to a potential breakout

XRP (CRYPTO: XRP) has been trading within a measured range for months, a configuration that market observers describe as a prolonged period of accumulation rather than a leg-up in one impulsive move. After a phase of softness, buyers have repeatedly stepped in near the $1.80–$2.00 zone since late 2024, and this pattern mirrors the setups that preceded notable rallies in prior cycles. The reluctance to break decisively higher underscores the importance of patient positioning—trend-followers will want to see sustained demand, a steady reduction in selling pressure, and clear on-chain confirmations before taking on larger exposures.

On the price chart, the narrative centers on two critical regions. The first is the low-to-mid $2s, which traders will watch for a breakout that confirms a renewed uptrend. The second is the broader accumulation corridor around $2, which has historically functioned as a launchpad for the next phase of price discovery. In the current frame, analysts note that the pattern could allow XRP to drift higher toward multi-dollar levels if the cyclical dynamics align with macro liquidity and risk appetite. A number of voices have pointed to a potential upside into the low double digits, contingent on a sequencing of demand that harmonizes technical breakouts with fundamental drivers.

Source: Mikybull CryptoAnalysts also emphasize that the price pattern observed during the current cycle bears similarities to the run-ups seen in 2022 and 2017, where a protracted period of consolidation preceded a strong uptrend. The notion that time, rather than volatility, dictates the pace of the ascent resonates with the sentiment of veteran observers who stress the importance of longer accumulation before higher prices are unlocked. In this context, the forecast of a potential ascent toward $11 in the next impulse and a further leg to levels like $70 in subsequent waves reflects a plausible, though highly contingent, path for XRP as liquidity returns and buyers regain confidence.

On-chain perspectives reinforce the case for patience. The net unrealized profit/loss (NUPL) indicator has shown movements into what some analysts describe as the capitulation zone—an area historically associated with the bottoming phase of a price cycle. The interpretation is not a guaranteed bottom, but it does align with cycles where extended consolidation preceded a substantial revaluation. The market value to realized value (MVRV) ratio further supports the case for a period of subdued profit-taking, with the current reading around 1.23 significantly below peak levels from 2017 and 2021. Such readings often accompany a slow burn of price action before a decisive breakout, underscoring the need for a measured approach rather than a speculative sprint.

In the broader context, the story is not simply about a single price target. The article’s earlier analyses highlighted a connect-the-dots narrative: hold the line near $1.80–$2.00 and reassert above $2.22 to keep the bullish thesis intact, buoyed by latent demand in futures markets and a history of strong rebounds after repeated retests of the key support. The visuals and data sets referenced—ranging from Glassnode’s NUPL and MRVR charts to price-action overlays—paint a coherent picture of a market that could extend its consolidation before the next major leg higher once the conditions align.

As the market weighs these signals, traders keep a close eye on the cadence of each subsequent move. The possibility remains that XRP could spend more time near the $2 mark before a decisive breakout, a scenario that would align with the longer accumulation narrative observed in past cycles. That said, the combination of technical confluence around the support zone, on-chain confirmation signals, and evolving market dynamics keeps the door open for a substantial structural shift higher should demand regain momentum.

XRP: Net Unrealized Profit/Loss. Source: Glassnode

XRP: Net Unrealized Profit/Loss. Source: Glassnode

The current configuration also echoes the broader observation that price appreciation in XRP has historically been fed by a cycle of accumulation followed by a re-rating of risk, with on-chain metrics cycling through phases that reflect holder behavior and market sentiment. In practical terms, that means traders should anticipate a period of gradual upward drift rather than a sharp sprint higher, at least until new liquidity enters the picture and the market resumes a more aggressive pricing cadence.

XRP: MRVR extreme variation pricing bands. Source: Glassnode

XRP: MRVR extreme variation pricing bands. Source: Glassnode

In conclusion, the XRP narrative remains anchored in the idea that the next phase of a potential rally will be driven by a deliberate, longer accumulation period, a pattern that has historically preceded meaningful upside. The data and charts cited in this coverage emphasize that the market is watching for a clear signal—a sustained move above the key thresholds, supported by on-chain health and a favorable risk environment. Whether that signal arrives soon or after a more extended lull, XRP’s trajectory is intrinsically linked to the balance between demand and capital preservation across the broader crypto ecosystem. As ever, investors should remain cognizant of the risks that accompany any asset in an evolving regulatory and macro landscape.

https://platform.twitter.com/widgets.js

This article was originally published as XRP Price Could Consolidate Longer Before Liftoff to $10 on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%