XRP News, ZCash Price Prediction and Remittix ICO Passes 94% Completion

The cryptocurrency markets continue to garner worldwide attention, with their digital assets always on the radar of investors. While Bitcoin and Ethereum remain very relevant, investors are looking at altcoins and new projects. XRP, a token touted by some for cross-border payments, and ZCash, known for its privacy-enhancing transactions, bear close watching this week.

Among established tokens, Remittix (RTX) quietly builds momentum, as a project that bridges crypto and traditional finance. Investors are increasingly taking note of its real-world utility, especially in front of the launch of its PayFi platform.

XRP and ZCash Market Overview

The current price of XRP is $1.90. This is a mild decrease of 0.02%. Its market capitalization is $116.56 billion, while its 24-hour volume is currently down 52.92%. This is a mild dip as investors’ interest is steady, especially for those intending to adopt its payment solutions on a larger scale.

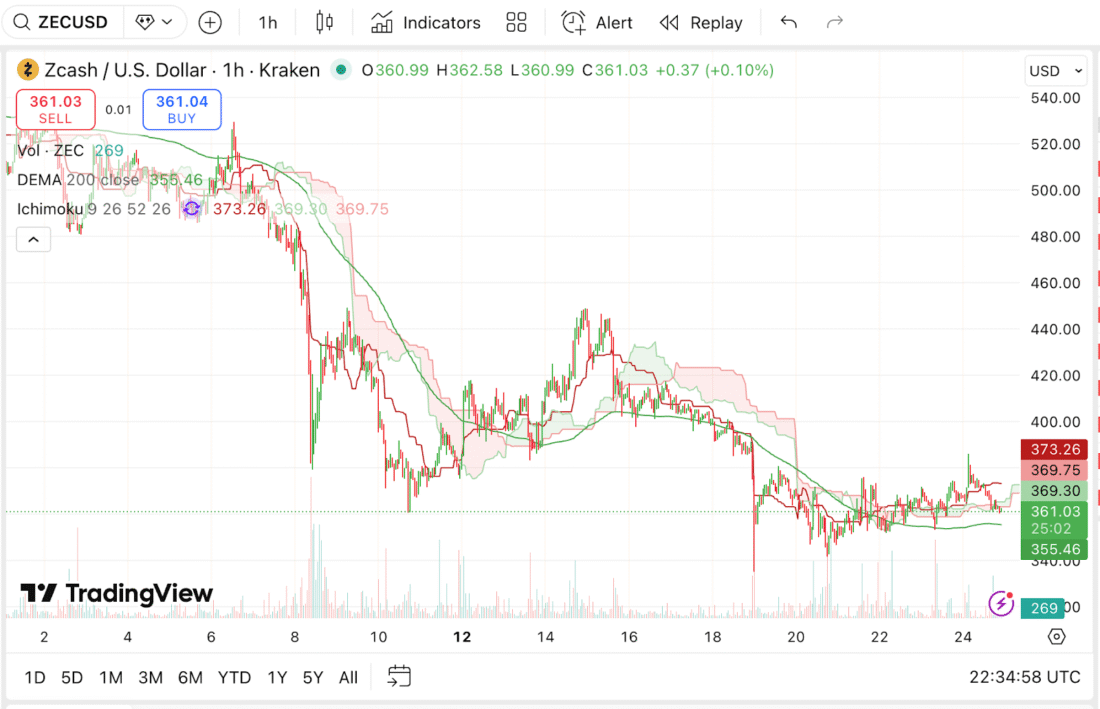

On the other hand, the price at which Zcash was last sold in the market is noted to be $361.88 and there has been a decline in the asset by 1.55%. Furthermore, the capitalization size has been noted to be at 5.96 billion dollars. On the other hand, the volume at which the asset was traded on the last day is noted to be 356.62 dollars.

There has been an 18.64% decrease in the volume. Nonetheless, the attractiveness of the assets to those interested in the private digital asset keeps the asset strong. Also, the interest in the digital asset by the broader blockchain space keeps the market activity high. Both XRP and ZCash show the dynamic nature of

Remittix (RTX): Real-World Utility Driving Growth

Remittix (RTX) is gaining recognition as one of the most promising crypto projects for investors seeking tokens with immediate real-world applications. At $0.123 per token, RTX has managed to sell over 701 million of its 750 million supply, equivalent to more than 93% of the token supply in circulation. This degree of active involvement within the community is evidence that there is high demand for the token itself.

Recently, the project raised $28.8 million in private funding. One of the major milestones for this project is the launch of the Wallet on the Apple App Store; support for Google Play will follow soon. This allows users to safely store, send, and handle various forms of digital money.

Furthermore, with PayFi set to go live on the 9th of February 2026, users will enjoy the ability to make transactions between cryptocurrencies as well as between cryptocurrencies and fiat in more than 30 countries.

Why Remittix Stands Out

- Global Reach: Transfer crypto directly to bank accounts in over 30 countries

- Real-World Utility: Designed for actual usage, not speculation

- Security First: Fully audited by CertiK and team verified

- Community Momentum: Over 701 million tokens sold, highlighting demand

- Referral Program: 15% rewards in USDT for introducing new users

These characteristics make Remittix an attractive option for crypto investors looking for investments that offer strong security and real-world applications for the invested funds. Additionally, the global payments space is valued at $19 trillion, and Remittix has a real solution for this space by providing borderless payments and using the power of real-time foreign exchange rates for the business API integrations that Remittix has to offer. There are plans for multiple future CEX listings on exchanges such as Bitmart and LBANK.

Final Thoughts: Why Investors Are Watching

XRP and ZCash are both still indicative of general trends affecting altcoins as they see moderate change in price and transaction volume, while Remittix is beginning to rise as an intermediary in the movement towards making digital currency more feasible as an option for day-to-day purchases.

Due to its high adoption rate, high security, and accessibility, RTX is considered one of the best cryptocurrencies to buy as an investment as it becomes available to users following the PayFi platform and wallet releases.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Frequently Asked Questions

What are the best crypto tokens to buy right now?

Projects with real utility and verified audits often stand out. Remittix is gaining attention due to its live wallet, upcoming PayFi platform, and CertiK verification.

Which new crypto projects could explode in 2026?

Tokens with functional platforms, clear adoption use cases, and strong investor backing are leading candidates. Remittix is among the most notable.

How do I find the best new crypto ICOs early?

Tracking official launchpad updates, community announcements, and verified beta programs, like Remittix’s wallet beta, is a practical way to identify early-stage opportunities.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release

The post XRP News, ZCash Price Prediction and Remittix ICO Passes 94% Completion appeared first on Live Bitcoin News.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%