Litecoin is speeding up towards the next ETF, and the application of altcoin ETF may be accelerated due to the Trump administration

Author: Weilin, PANews

On January 17, Nasdaq submitted Form 19b-4 for Canary Funds' Litecoin spot ETF, which means that the application has officially entered the 240-day review period. During this process, the Securities and Exchange Commission (SEC) will have the right to approve, reject or request more information. At the same time, Bloomberg analyst James Seyffart revealed that Canary Funds ' application for Litecoin ETF has submitted a revised S-1 document, suggesting that the SEC may have begun to participate in the review. In the two-step approval process required for ETFs, Litecoin ETF has ushered in new developments.

With the Trump administration about to take office, the market is full of expectations for the future regulatory direction of altcoin ETFs, especially on the approval of altcoin ETFs such as Litecoin, Solana and XRP.

Nasdaq Files Form 19b-4 for Canary’s Litecoin ETF

On January 17, Nasdaq submitted Form 19b-4 for Canary Funds’ Litecoin ETF application. The document shows that US Bancorp Fund Services, LLC will serve as the administrator and US Bank NA will be responsible for custodial cash for the ETF. According to the document, Coinbase Custody Trust Company LLC will custodian Litecoin for the ETF.

According to SEC regulations, once this form is submitted, a 240-day approval cycle will be initiated. During this period, the SEC will decide whether to approve the application or request further information. "This 19b-4 filing from Nasdaq advances the process within the SEC, but the SEC still needs to confirm the filing, which usually happens within a few weeks," said James Seyffart, an ETF analyst at Bloomberg. "If or when the SEC confirms the filing, we will have a clearer understanding of the timeline for potential rejection or approval."

"Bitcoin is gold, Litecoin is silver" is a slogan in the old cryptocurrency circle. Litecoin is a fork of Bitcoin, which means that its protocol follows the same basic rules as Bitcoin; for example, it uses the Proof-of-Work consensus mechanism. Originally, Litecoin was created by Charlie Lee in 2011 and is mainly aimed at small transactions. Although its core developers are involved, they have relatively little direct intervention, which makes its "decentralized" feature more prominent. It is worth noting that the SEC has never regarded Litecoin as a security, which is different from the fact that cryptocurrencies with larger market capitalizations such as SOL and XRP are called "securities" by the SEC, which means that LTC has a certain convenience in approval.

As of 2:00 pm on January 17, Litecoin's market value was $10.48 billion. According to CMC data, it is currently ranked 19th in the cryptocurrency market value, and its price has risen by 16% in the past 24 hours. This growth trend makes the approval of Litecoin ETF more attractive, especially when the SEC has not recognized Litecoin as a security.

The 19b-4 form is the second part of the two-step ETF approval process and follows Canary Capital's revised S-1 form filed on Wednesday. On January 16, Canary Funds filed a revised S-1 document for the Litecoin ETF application. Analyst James Seyffart said that although there is no guarantee, this may indicate that the SEC is involved in this document, and this development is a positive signal for predicting that the Litecoin ETF is more likely to be approved.

Bloomberg analyst Eric Balchunas also said that he had heard some rumors that Litecoin's S-1 filing had received feedback from the SEC, and the revised filing was a good sign for our prediction that Litecoin is most likely to become the next approved cryptocurrency (ETF).

3 Altcoin ETFs Could Attract $14.6 Billion in Inflows

On January 17, Bloomberg ETF analyst James Seyffart tweeted that the SEC has not yet accepted the recent Solana ETF application, but believes that approval of the Solana or XRP ETF is only a matter of time.

As early as December 18, Bloomberg analyst Eric Balchunas said, " We expect a wave of cryptocurrency ETFs in 2025, although not all at once. The first may be a Bitcoin + Ethereum combination ETF, followed by Litecoin (because it is a fork of Bitcoin = commodity), then HBAR (because it is not classified as a security), and finally XRP/Solana (both of which have been classified as securities in pending litigation)."

Last year, the SEC received multiple applications for ETFs that track cryptocurrencies other than Bitcoin, from XRP to Solana and Litecoin, but ultimately approved only an ETF related to Ethereum. With the pro-crypto Trump administration set to take office next week, Litecoin (LTC) could be the first cryptocurrency to be approved, according to analysis by Bloomberg's two ETF analysts, Eric Balchunas and James Seyffart.

JPMorgan analysts predict that if multiple altcoin ETFs are approved by the SEC, they could attract up to $14 billion in inflows. According to JPMorgan's analysis, the Solana ETF is expected to attract $3 billion to $6 billion in funds within 6 to 12 months, while the XRP ETF could attract $4 billion to $8 billion. This prediction is based on the "adoption rate" data of existing cryptocurrency ETFs. For example, the Bitcoin ETF has attracted about $108 billion in assets one year after its launch, with a penetration rate of 6% of Bitcoin's market value. Similarly, the Ethereum ETF attracted $12 billion in assets in six months, with a penetration rate of 3% of Ethereum's market value.

In the case of Solana and XRP, JPMorgan analysts expect that at a 3% penetration rate, Solana could attract $2.7 billion and XRP could attract $430 million, while at a 6% penetration rate, Solana could see inflows of $5.2 billion and XRP could see inflows of $8.4 billion.

For Litecoin, if it is accepted by Wall Street at the same rate as Bitcoin, investor demand for the product could soar to $580 million, based on a 6% penetration rate for a Bitcoin ETF, using this method of estimation.

Many crypto ETF applications are on the way, Grayscale Solana ETF received a preliminary response on January 23

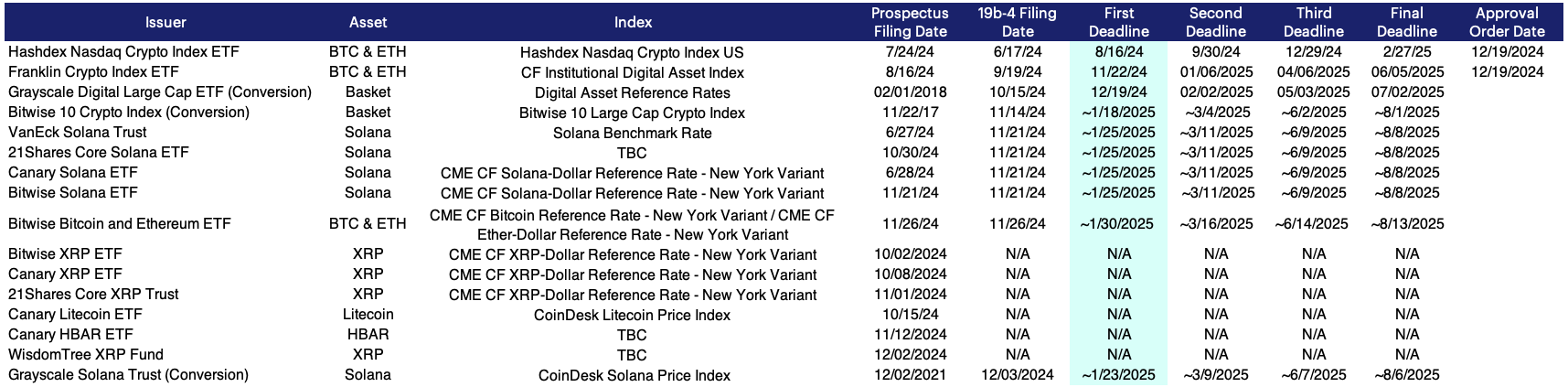

A list of crypto ETF applications as of mid-December 2024, including two recently approved applications. (“N/A” indicates that the proposed listing exchange has not filed a Form 19b-4.) Source: Bloomberg, CF Benchmarks

On December 19 last year, the SEC officially approved the first batch of "Bitcoin + Ethereum" hybrid exchange-traded funds (ETFs), namely Hashdex Nasdaq Crypto Index US ETF (Nasdaq Exchange) and Franklin Crypto Index ETF (Cboe BZX Exchange), which are expected to be officially listed and traded in January 2025. These measures have laid the foundation for the approval of new ETFs after the approval of Bitcoin and Ethereum spot ETFs.

As of mid-December 2024, several altcoin ETF applications are awaiting SEC approval. Among them, Grayscale's Solana ETF is expected to receive a preliminary response from the SEC by January 23, and other Solana ETF applications will expire on January 25. At the same time, Ripple's XRP ETF application is also under review, and multiple companies including WisdomTree, Bitwise, 21Shares, and Canary Capital have submitted applications.

Comparing the three altcoin ETFs horizontally, Katalin Tischhauser, head of investment research at crypto bank Sygnum, pointed out that Solana is unlikely to become the third crypto asset (after Bitcoin and Ethereum) to be approved for a U.S. spot ETF by the end of January. She said that the SEC has not yet begun to evaluate the market for Solana as an underlying asset, which means that Solana's ETF approval may take more time.

With the Trump administration taking office in four days, the market is full of expectations for the approval prospects of cryptocurrency ETFs. On January 17, according to foreign media reports, US President-elect Trump expressed his willingness to establish a US-first strategic reserve and give priority to cryptocurrencies such as Solana (SOL) and XRP. This good news also boosted the overall market.

At present, the ETF applications of altcoins such as LTC, Solana and XRP may have more opportunities in the new policy environment. With the appointment of the new SEC Chairman Paul Atkins, it is expected that the previous SEC supervision and approval model will be reversed. It is expected that in the next few months, the approval of altcoin ETFs will become an important topic in the crypto market, and the development of this process deserves close attention.

You May Also Like

Chorus One and MEV Zone Team Up to Boost Avalanche Staking Rewards

Strategy CEO: The company will issue more perpetual preferred stock to alleviate investor concerns about the share price.