Best Privacy Cryptos to Buy in January: Monero Hits $700 as Digitap ($TAP) Launches Non-KYC Visa Debit Card

The post Best Privacy Cryptos to Buy in January: Monero Hits $700 as Digitap ($TAP) Launches Non-KYC Visa Debit Card appeared first on Coinpedia Fintech News

Two very different forces are shaping January’s privacy narrative in crypto. On one side, Monero has surged past $700, driven by regulatory crackdowns that paradoxically increase demand for untraceable assets.

On the other side, Digitap ($TAP) is drawing attention with an already operational live crypto banking app and crypto presale built around payment access and user-controlled privacy.

XMR Holds $700 Support, What Levels Traders Are Watching

Monero is still one of the privacy coins traders keep a close eye on, even as price action cools. After pushing close to $800 earlier in the month, XMR has drifted into a holding pattern and is now hovering around the low $730s.

On the chart, RSI-14 has slipped back to roughly 57 after sitting in overbought territory, while the MACD histogram has edged just below zero. Price, however, continues to sit above the rising volatility index support, suggesting buyers have not stepped away.

While regulatory pressure and protocol upgrades like the upcoming FCMP++ remain long-term positives for XMR, liquidity constraints and derivatives-driven price discovery introduce near-term volatility risks.

This contrast highlights why some investors are also looking earlier in the privacy stack, toward platforms like Digitap, where exposure is tied less to mature price cycles and more to adoption-driven utility at the infrastructure level.

From Privacy Narrative To Use Case: Where Digitap Fits

While Monero reflects mature market dynamics, Digitap represents an early-stage approach to privacy and payments. Digitap is a live crypto banking application designed to unify fiat and crypto in one interface, supporting more than 20 fiat currencies and over 100 cryptocurrencies. Users can switch between assets, send funds globally via SEPA, SWIFT, or blockchain rails, and retain control over how much personal data they share.

This positioning aligns with growing demand for practical financial tools rather than purely speculative tokens. For investors scanning altcoins to buy with real-world use cases, Digitap’s focus on payments and privacy places it in a different risk and reward category than large-cap privacy coins.

USE THE LIMITED CODE “NEWTAP” FOR BONUS TAP TOKENS

Digitap’s Tiered Privacy Model: What No-KYC Really Means

Digitap approaches privacy through optionality rather than absolutes. The Wallet Plan requires no KYC and allows instant setup for users prioritizing anonymity.

Virtual card plans introduce light verification, while Pro accounts with physical cards use discreet offshore banking partners and require identity verification handled within regulated frameworks.

This tiered approach positions Digitap as a bridge between pure crypto privacy and real-world usability. Rather than promising unrestricted anonymity, the platform gives users control over how they interact with financial systems. That flexibility is increasingly relevant as regulatory pressure intensifies globally.

Presale Math Explained: How $TAP’s Stages Shape Entry Risk

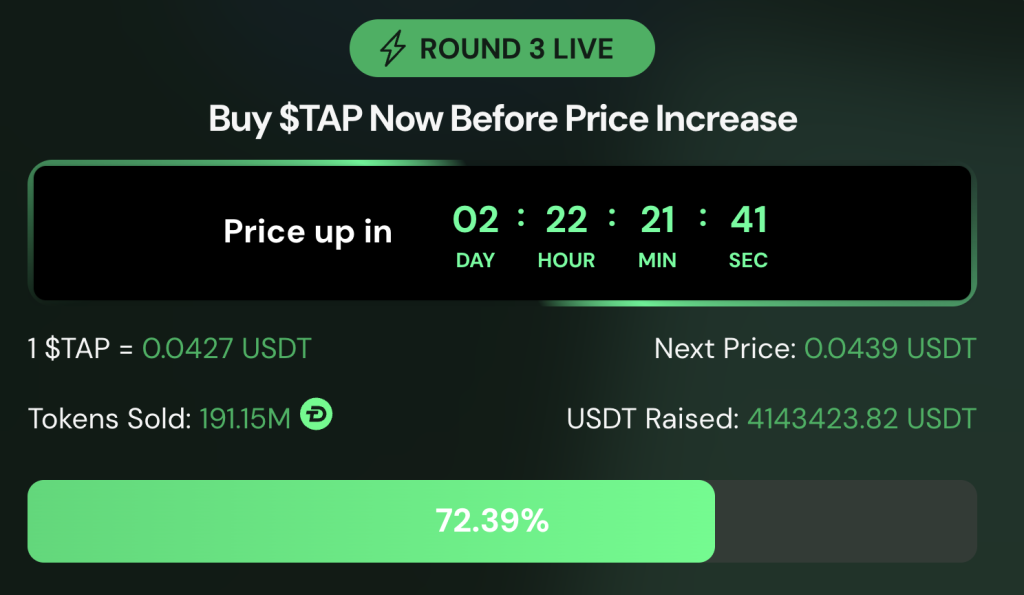

Digitap’s crypto presale is currently in Round 3, with $TAP priced at $0.0427 and the next stage set at $0.0439. So far, roughly 191 million tokens have been sold, raising about $4.1 million, with this stage over 72% completed.

Earlier presale participants entered at significantly lower prices, starting from $0.0125, while the confirmed launch price is $0.14. This progression illustrates how value accrual is structured through staged demand rather than post-listing speculation.

The price difference between the current stage and launch reflects a multiple driven by adoption milestones, not hype cycles. Because each stage closes independently, displayed percentages refer to stage completion rather than total presale progress.

This structure limits sudden dilution and provides predictable pricing, a key reason presales are often highlighted when discussing the best crypto to buy now during uncertain market conditions.

Two Privacy Plays: What To Watch As 2026 Approaches

Monero’s move above $700 reflects how scarcity, regulation, and derivatives access can drive sharp rallies in established privacy assets. However, overbought technicals and liquidity constraints introduce meaningful short-term risk.

Digitap, by contrast, operates at the opposite end of the spectrum. As a live platform in the crypto presale phase, it offers exposure to privacy and payments before market saturation. For investors evaluating the best crypto to buy now, the distinction is clear. Monero trades momentum. Digitap trades early utility, structured pricing, and controlled upside.

As privacy remains a defining theme for 2026, the key question is whether capital prefers mature resistance narratives or early platforms building the infrastructure that privacy demand ultimately flows into.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

- Presale https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Gold continues to hit new highs. How to invest in gold in the crypto market?

Layer Brett Picked As The Best Crypto To Buy Now By Experts Over Pi Coin & VeChain