Bitcoin Core Development Surges 60% After Years of Decline

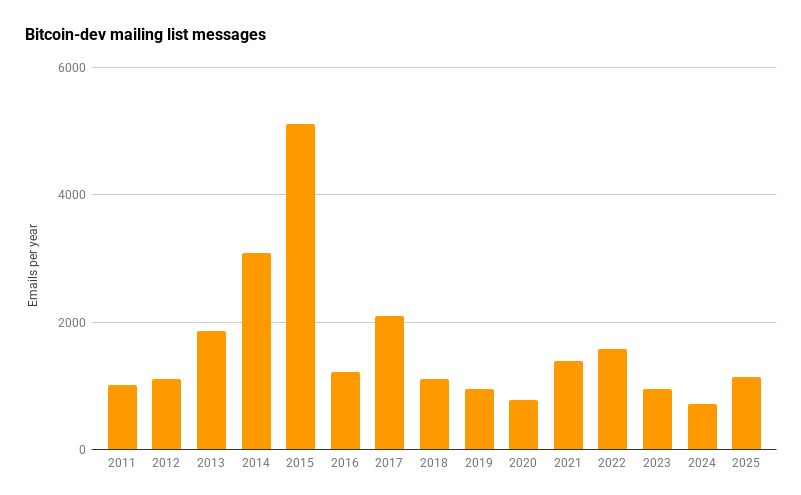

Bitcoin Core’s development activity jumped 60% in 2025 as measured by email volume to the Bitcoin Development Mailing List, reversing years of declining contributions and marking the protocol’s most active development period since its early years.

Source: X/@lopp

Source: X/@lopp

According to core contributor Jameson Lopp, the surge came as 135 different developers contributed code changes totaling 285,000 lines, while Bitcoin transferred $4.5 trillion in value throughout the year, averaging $144,000 per second according to CoinMetrics estimates.

The development renaissance unfolded against a backdrop of philosophical warfare over Bitcoin’s core purpose, with multiple competing proposals emerging to address concerns about blockchain spam.

Meanwhile, Bitcoin’s price recovered above $92,000 on Monday following a weekend geopolitical shock in Venezuela, as institutional money returned to crypto markets with $646 million flowing into ETFs on the first trading day of 2026.

Network Metrics Reveal Maturation Despite Price Stability

Bitcoin recorded the flattest year on record, with an average daily price change of just -0.02% in 2025, while the blockchain expanded from 626.5 GB to 710.1 GB, with an annual growth rate of 13.3%.

The network’s UTXO set actually shrank from 186.3 million to 165.8 million entries, removing one net UTXO every 1.5 seconds as efficiency improvements took hold.

Network hashrate also increased by 32% from 802 to 1,060 exahash per second, while the reachable node count rose by 18% to 24,298, according to Bitnodes data.

The median upstream bandwidth for reachable nodes also dropped 39% to 6.6 megabits per second, while Bitcoin Core code commits increased just 1% year over year to 2,541, suggesting more substantial changes per commit.

Jameson Lopp, who compiled the annual metrics, noted a concerning trend in physical security.

“At the beginning of 2025 I predicted we’d see an all-time high for wrench attacks, averaging one per week. Unfortunately, that prediction came true,” he wrote, referring to violent theft attempts targeting Bitcoin holders.

Adoption Surges As Data Storage Debates Intensify

Merchant adoption surged 53% in 2025, according to BTCmap cataloging, likely driven by Square enabling Bitcoin payments in point-of-sale terminals.

Corporate balance sheets also continued to hit all-time highs, with companies now holding nearly 7% of the Bitcoin supply as institutional accumulation accelerated.

Bitcoin OP_RETURN outputs dropped 47% year over year due to decreased interest in the Runes protocol that launched in 2024.

Despite this decline, 33 million inscriptions were stored on the blockchain in 2025, a 58% year-over-year increase. However, fee rates remained incredibly low, with inscriptions paying just $12 million in total fees.

The BSV fork lost another 64% against Bitcoin in 2025, now worth a mere 0.02% of the original protocol.

Lightning Network capacity also quietly surged to an all-time high of 5,805 BTC after dropping for most of the year, indicating renewed interest in the Layer 2 payment solution.

2025: Year of Security Audit and Controversial Upgrades

Bitcoin Core completed its first public third-party security audit in November after 16 years of operation, with Quarkslab’s 100-man-day assessment finding no critical vulnerabilities.

The audit, commissioned by the Open Source Technology Improvement Fund and funded by Brink, identified only two low-severity issues across the peer-to-peer layer, mempool, and consensus logic.

A month earlier, Bitcoin Core released version 30.0, removing the 80-byte OP_RETURN limit, increasing the default data carrier size to 100,000 bytes, and allowing multiple OP_RETURN outputs per transaction.

Adam Back, Blockstream CEO, defended the update as containing essential security patches from “200 most skilled people on the planet,” while critics warned of spam risks and potential legal liabilities.

The upgrade triggered an exodus to Bitcoin Knots, an alternative implementation that grew to represent 28% of network nodes.

Back in December, a proposal called “The Cat” by developer Claire Ostrom also proposed to permanently ban Ordinals inscriptions and NFTs by marking their dust-sized outputs as unspendable, prompting a fellow contributor, Greg Maxwell, to call it “outright theft” of millions in funds.

Bitcoin Recovery Follows Geopolitical Shock

As the Bitcoin community cheers growth, Akshat Siddhant, lead quant analyst at Mudrex, said institutional interest returned strongly following developments in Venezuela.

“If BTC closes above $93,700, momentum could carry it toward $100,000, with support forming near $88,500,” he said, noting the Fear-Greed Index turned neutral for the first time since October as crypto ETFs attracted fresh capital.

At the time of writing, Bitcoin is trading at $92,861, up 1.64% in the past 24 hours.

You May Also Like

Ultimea Unveils Skywave X100 Dual: 9.2.6 Wireless Home Theater Launching March 2026

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include: