Ozak AI Surges to $5.21M While the Rest of the Market Sinks — Is This the Most Resilient Token of 2025?

While a deep red wave washes over the crypto market, Ozak AI ($OZ) is proving to be an outlier. The AI-powered blockchain ecosystem’s presale surges to $5.16 million in funding, directly contradicting the bearish sentiment.

The project attributes its strength to its core utility, leveraging advanced predictive AI agents to provide secure on-chain solutions. Analysts are now calling $OZ the most resilient token of 2025, suggesting a paradigm shift toward intelligent, utility-first crypto investments.

Ozak AI Sees Rapid Growth in Presale Activity

Ozak AI’s final presale round is moving swiftly with great fanfare, with the price set at $0.014 in round 7. The effort has already raised $5.21 million by selling over 1.05 billion tokens, demonstrating strong and sustained investor interest despite the larger market decline.

Since its initial presale price of $0.001, the value has climbed by 1300%. After this last round, the project is planned to list for $1, indicating that current investors might earn returns of more than 7000%, making the presale token $OZ a low investment with massive returns potential.

Ozak AI Capabilities and Security

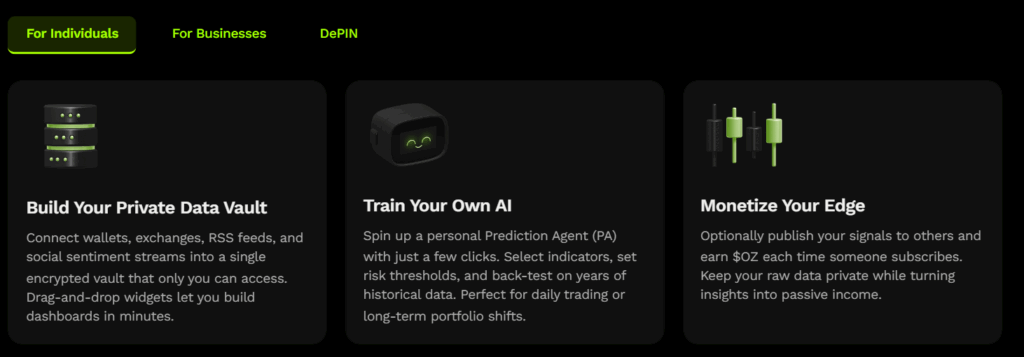

Ozak AI’s focus on breakthrough AI solutions stimulates investors’ interest in its future prospects. This platform contains AI technologies, which use real-time market data and a decentralized network to deliver reasonably accurate predicting insights for all financial markets.

The platform utilizes Ozak Streaming Network (OSN) to collect data from numerous sources and store it in Ozak Data Vault. Further analyses through prediction agents powered by a technical stack includes neural networks and linear regression. The final results can be visualized through the Eon Dashboard. The entire system is linked by DePIN (Decentralized Physical Infrastructure Network), which enables scalable data movement across the network.

Additionally, Sherlock and CertiK’s security and transparency checks strengthen Ozak AI’s ecosystem and increase trust among its growing user base.

Key Partnerships of Ozak AI

Ozak AI’s ecosystem benefits from deep integrations with important network partners. Among them, a few are Spheron, whose a decentralized setup to expedite AI operations and provide developer tools.

Ozak AI partners with Celo, which is an Ethereum Layer 2 which is for speedy, low-cost payment systems. Meganet, a decentralized network with over 6.5 million active nodes, is partnered to supply live data to Ozak AI agents.

Then, the recent one is Openledger, an AI-blockchain infrastructure that partners with Ozak AI agents to give community datasets for better predictions and on-chain training.

Conclusion

Ozak AI’s rapid presale growth, outstanding utility, and powerful AI-driven ecosystem put it far ahead. Despite the negative market, the effort continues to gain investor trust. Ozak AI, with a listing price of $1, is shaping up to be one of 2025’s most robust and high-potential tokens.

For more information about Ozak AI, visit the links below:

- Website: https://ozak.ai/

- Twitter/X: https://x.com/OzakAGI

- Telegram: https://t.me/OzakAGI

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth