Analysis: Mysterious whale hoards $340 million worth of BTC, but is the best time to buy the dip yet?

Compiled by: Tim, PANews

As the market plummets, the community is enthusiastic about bargain hunting

The cryptocurrency market has continued to plummet recently. As Bitcoin fell below the $80,000 mark, discussions about bottom fishing on social media have soared to the highest peak since July last year.

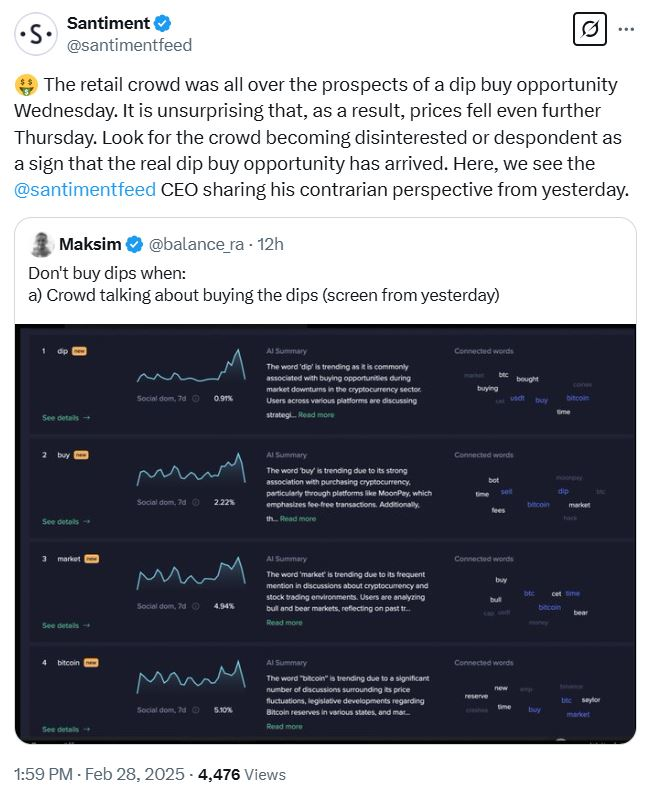

On-chain analysis platform Santiment posted on its X platform account on February 28 that by monitoring discussions among traders on social channels such as X, Reddit and Telegram from February 25 to 26, it was found that market sentiment showed strong confidence in this bottom-fishing.

Market bargain hunting interest has climbed to a seven-month high.

Mysterious whale hoards $340 million worth of BTC

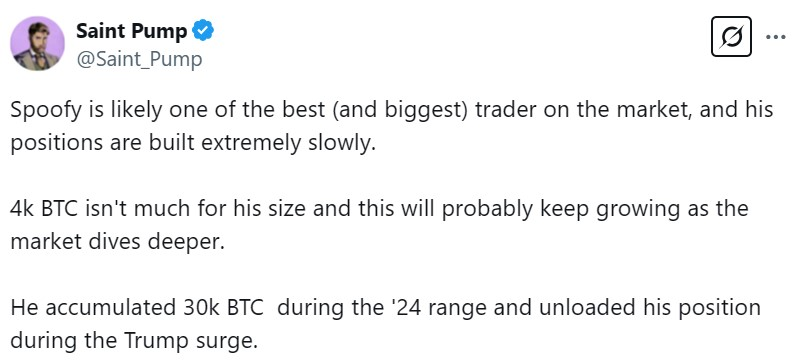

According to data disclosed by community members on February 27, a mysterious whale address accumulated 4,000 BTC during the period when the price of Bitcoin fluctuated between $82,000 and $85,000. Based on the current market price of Bitcoin, the position is worth about $344 million.

Saint Pump, a cryptocurrency analyst, confirmed that the whale address is one of the largest traders recognized in the industry - "Spoofy".

Spoofy continued to increase his holdings of BTC during the long bear market caused by the collapse of Luna stablecoin and the collapse of FTX exchange in 2022. On-chain data shows that the whale has purchased a total of 70,000 BTC during the process of Bitcoin price plummeting from $40,000 to $16,000.

Misfortunes never come singly, the macro-economy is once again in trouble

On February 25, Bitcoin fell below the $90,000 mark, the day after US President Trump announced that he would impose a 25% tariff on Canada and Mexico.

With Trump's threat to impose a 10% tariff on China on February 28 and other macroeconomic uncertainties, Bitcoin continued to give up its post-election gains and eventually fell below the psychological support level of $80,000.

Santiment's public opinion tracking system screens cryptocurrency vertical social media channels to capture the top ten keywords with the most significant increase in mentions in the past 14 days. Data source: Santiment

The market is reflexive, and it may not be the best time to enter the market

However, analysis platform Santiment pointed out that the market's surging enthusiasm for bottom-fishing may not be the best entry signal, because asset prices usually fluctuate in the opposite direction of expectations.

“Ideally, we are waiting for the market herd’s euphoria to subside, signaling that retail investors have incurred enough losses to create the conditions for a technical rebound,” Santiment said in its analysis.

“Market trends often go against the consensus of the group, so when market optimism gradually cools down and the voices of bargain hunting continue to weaken, it should be regarded as a potential bullish signal.”

Based on its methodology, Santiment’s public opinion monitoring system scans cryptocurrency vertical social media platforms such as X (formerly Twitter) and Telegram to capture the top ten keywords with the largest month-on-month increase in mentions in the past two weeks.

According to CoinMarketCap data, Bitcoin has fallen by more than 21% in the past 30 trading days and another 5% in the past 24 hours. The current price is about US$80,400; Ethereum's decline in the same period exceeded 30%, and it fell 7.54% in 24 hours, and is now trading around US$2,139.

“It would not be surprising if the current crypto asset prices fell further after the retail crowd flocked to the bargain hunting machine,” Santiment pointed out in a follow-up analysis.

Source: Santiment

When is the best time to buy at the bottom?

Santiment emphasized in its latest analysis: “Real bargain hunting opportunities often appear when the market group’s interest fades or even falls into despair. At this time, special attention should be paid to abnormal trading volume and large-amount transfer signals on the chain.”

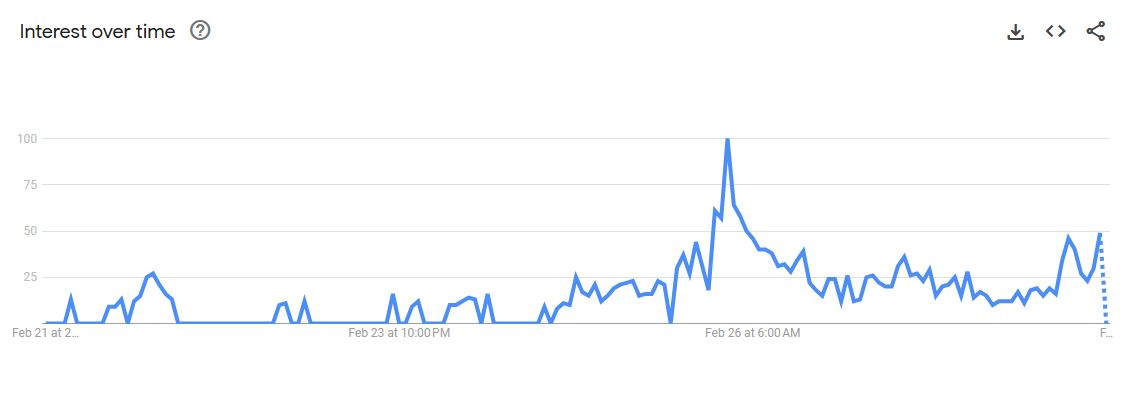

According to Google Trends data, the search popularity of "bottom-fishing" showed typical market sentiment reversal characteristics in the week ending February 28. After soaring to a peak of 100 on February 26, the keyword's popularity has now fallen back to 49 points (out of 100).

Google Trends data shows that search interest in the investment term "bottom fishing" has surged recently.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates