1,200,000 PI Tokens in 24 Hours: Is Pi Network’s Price Ready for a Further Rebound?

Pi Network’s team has been quite active lately, introducing interesting initiatives for the community and rolling out important updates.

However, the price of its native token hasn’t managed to stage a decisive breakout and remains in red territory on both the weekly and monthly timeframes. One key factor, though, hints that a surge could be knocking on the door.

Abandoning Exchanges

Earlier this week, PI plunged to $0.19, but in the following days the bulls reclaimed some of the losses, and the price is now hovering around $0.20 (per CoinGecko’s data).

While this might represent just a minor resurgence, the recent shift from exchanges towards self-custody methods suggests a more substantial pump could be on the way. Data shows that over 1.2 million tokens have left such centralized platforms in the past 24 hours, typically translating to reduced selling pressure.

As of this writing, there are roughly 428 million PI situated on exchanges, with more than half stored on Gate.io. Bitget comes in second with 147.6 million assets.

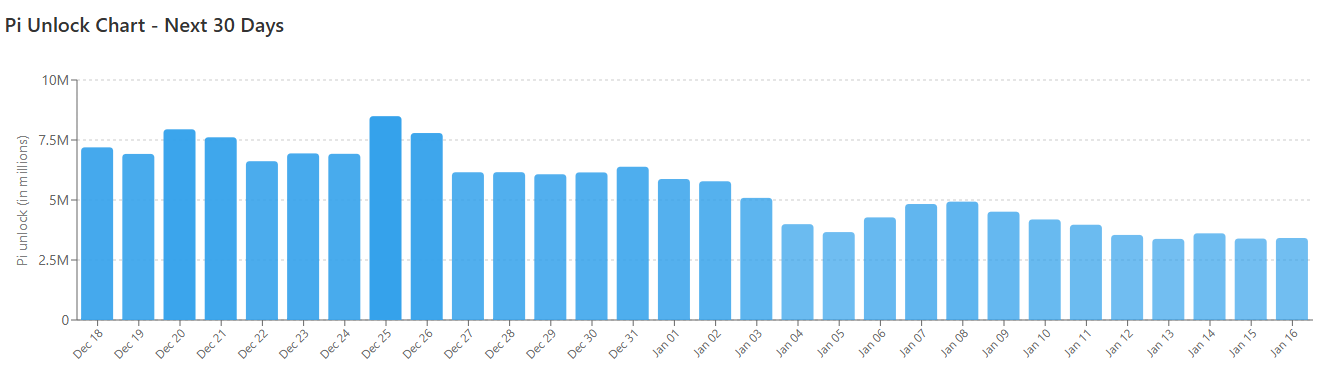

In addition, the upcoming token unlocks are less aggressive than those seen in the last few months. Nearly 165 million coins are set for release in the next 30 days, representing an average daily unlock of around 5.5 million units.

PI Token Unlocks, Source: piscan.io

PI Token Unlocks, Source: piscan.io

Some of PI’s die-hard fans remain optimistic and keep outlining bullish forecasts. Recently, X user Web3_Vibes suggested that the price could head north once it bounces off the support level around $0.192. Others have predicted scenarios where PI reaches the astonishing target of $100 and even beyond. That, of course, seems quite preposterous and even impossible as of now.

Some Community Members are Losing Patience

Despite the optimism shared above, many industry participants are disappointed with PI’s negative performance. X user pinetworkmembers claimed the project began as an “ambitious idea” but has turned into “years of tapping a button, unclear timelines, shifting goals, and endless ‘coming soon’ updates.”

X user Pi Update also stands in the bearish corner. They claimed the token is “starting to look like a case study in hype outrunning execution,” adding that holders continue to wait for basic improvements such as clear tokenomics, real liquidity, and a use case that extends beyond the native ecosystem.

In conclusion, the X user argued that vague promises from the Core Team and community enthusiasm can’t unlock the project’s full potential.

The post 1,200,000 PI Tokens in 24 Hours: Is Pi Network’s Price Ready for a Further Rebound? appeared first on CryptoPotato.

You May Also Like

Bitcoin Has Taken Gold’s Role In Today’s World, Eric Trump Says

Tether CEO: AI Bubble Poses Biggest Risk to Bitcoin in 2026