Saylor Hints at Fresh Bitcoin Buy as It Hovers Below $90K

Michael Saylor signaled he may be back in the market for more Bitcoin, posting “Back to More Orange Dots” on X alongside a portfolio chart on December 14. Such a well-worn tease typically precedes a purchase by his company, Strategy (MicroStrategy).

The hint comes days after Strategy disclosed its largest purchase since late July: 10,624 BTC (about $963 million) on Dec. 12, at an average price of $90,615.

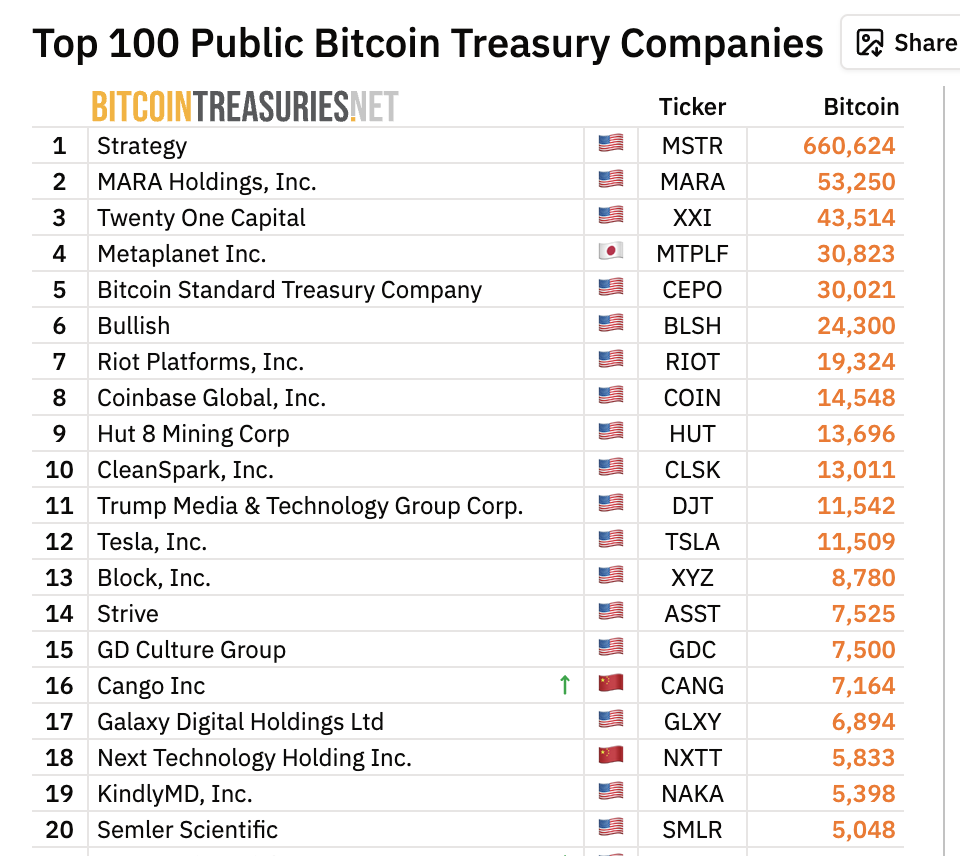

That buy lifted the company’s stash to ~660,000+ BTC, making it the world’s biggest corporate holder of the asset. Public trackers put the trove’s notional value in the high-$50 billion range at recent prices.

Top-20 Bitcoin holders | Source: bitcointreasuries.net

Crypto market backdrop: what’s driving the tape

Spot price (today): Bitcoin has been oscillating between $89.5k and $90k in recent sessions, after a dip below $90k late last week. Read our Bitcoin price prediction to learn more.

7-day performance: According to Dec. 15 data on CoinMarketCap, BTC is down roughly ~3% week over week (about $92.7k → $89.6k) amid choppy risk sentiment.

Why the pressure? November–December saw bouts of spot-ETF outflows, including a record $523M single-day redemption from BlackRock’s fund. It was also affected by macro jitters, such as central-bank moves and rate expectations, which whipsawed risk assets. BTC’s break below $90k on Nov. 18 underscored the fragile tone.

What analysts think of Bitcoin price

Forecasts remain split. JPMorgan has floated scenarios ranging from a stabilization “floor” to a potential catch-up with gold’s market dynamics in 2026, implying substantial upside if conditions align. The bank’s views were summarized across major outlets this month.

Why Saylor’s tease matters

Strategy’s buys have often acted as signaling events for corporate treasury adoption and as incremental demand shocks in thinner markets. If Sunday’s message foreshadows another allocation, it would extend a December accumulation streak that already added five-figure coins to Strategy’s balance sheet.

nextThe post Saylor Hints at Fresh Bitcoin Buy as It Hovers Below $90K appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

SOLANA NETWORK Withstands 6 Tbps DDoS Without Downtime