Elon Musk’s SpaceX Shifts $94.48M in Bitcoin with $1T IPO Predictions

TLDR

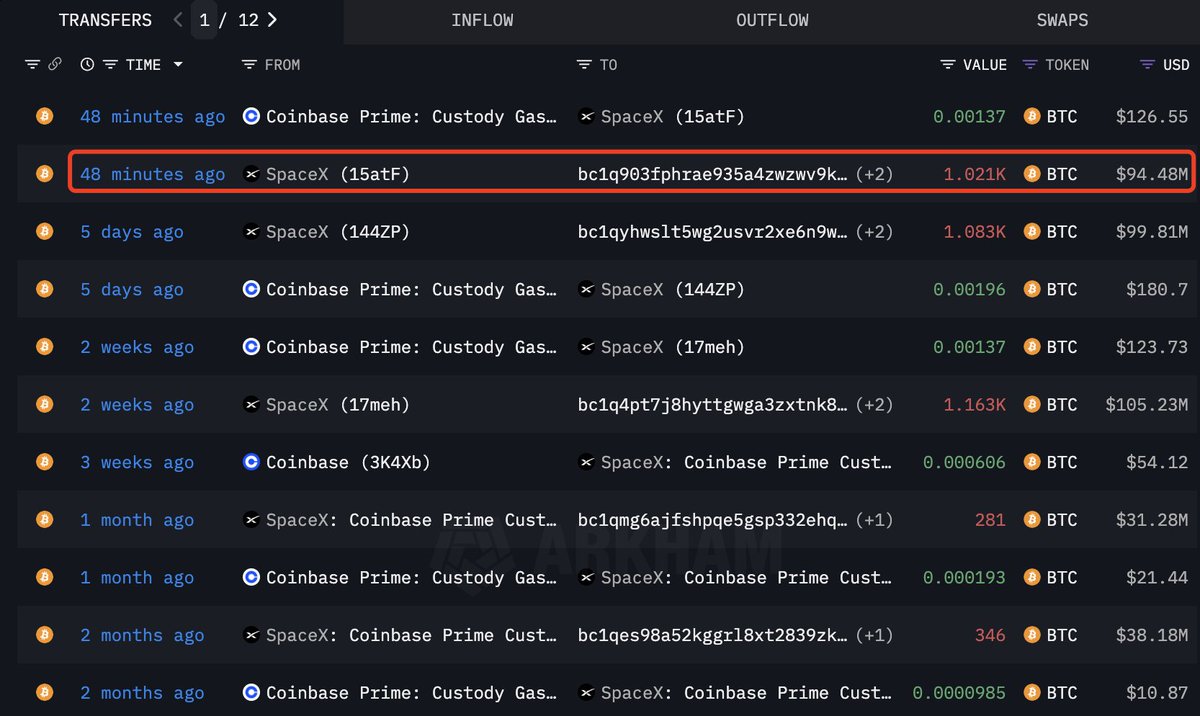

- SpaceX transferred 1,021 BTC worth $94.48M, likely for Coinbase Prime custody.

- The company’s Bitcoin stash is valued at around $368.8M after recent transfers.

- SpaceX’s upcoming IPO could raise over $30B and target a valuation of $1.5T.

- Analysts link the Bitcoin transfers to SpaceX’s broader plans for a big 2025 rotation.

SpaceX has transferred another 1,021 BTC, worth approximately $94.48 million, fueling speculation about its upcoming IPO. With predictions of a $1.5 trillion valuation, the company’s moves in the Bitcoin market are drawing attention. Analysts suggest that these transactions may indicate consolidation rather than selling, as SpaceX prepares for its massive public offering. The Bitcoin shifts, linked to Coinbase Prime, could be a strategic step in their financial preparations.

SpaceX Transfers $94.48M in Bitcoin, Boosting $1T IPO Speculation

SpaceX has recently moved another large amount of Bitcoin, transferring 1,021 BTC, valued at $94.48 million. This is part of the ongoing series of transactions tied to the company’s Bitcoin holdings. As the Bitcoin market reacts to these movements, speculation about SpaceX’s future continues to rise.

Industry analysts believe that these moves are likely related to Coinbase Prime, an institutional custody platform, and may reflect the company’s growing focus on preparing for a significant IPO in the near future.

According to blockchain analytics, this recent transfer is the latest in a string of Bitcoin movements by SpaceX. Previous transfers, including one in late November, involved over 1,100 BTC. The patterns suggest that the company may be consolidating its Bitcoin holdings in preparation for further financial maneuvers. With the company reportedly moving toward a major public offering, the value of these Bitcoin assets could play a key role in bolstering SpaceX’s financial standing.

SpaceX’s Growing Bitcoin Holdings and Their Potential Role in IPO Plans

SpaceX’s known Bitcoin holdings currently stand at around $368.8 million. This substantial stash of cryptocurrency has raised eyebrows in the financial community. The movement of large sums of Bitcoin, particularly through Coinbase Prime, signals that the company is likely making strategic decisions regarding its digital assets.

With plans for an IPO that could raise over $30 billion, the cryptocurrency transactions may be part of SpaceX’s strategy to optimize its balance sheet for its upcoming market debut.

While SpaceX has not publicly commented on the reasons behind these recent transfers, the repeated pattern of large Bitcoin transactions is hard to ignore. It suggests that the company may be shifting its cryptocurrency assets for strategic purposes, potentially ahead of its anticipated IPO. Some analysts speculate that SpaceX is consolidating its holdings to position itself more favorably when it enters the public market.

SpaceX’s IPO Expectations: Aiming for $1.5 Trillion Valuation

According to recent reports, SpaceX is preparing for an IPO that could raise upwards of $30 billion. With a target valuation of around $1.5 trillion, the listing could become one of the largest in history.

This ambition has fueled significant interest, as market observers watch closely to see if the company can live up to these projections. Additionally, prediction markets like Polymarket show growing confidence in SpaceX’s potential, with a 67% probability that the company’s market cap could exceed $1 trillion.

The excitement surrounding SpaceX’s IPO is not just about the sheer scale of the offering but also about its potential to reshape the aerospace and technology sectors. The company’s innovative approach to space travel, combined with its massive Bitcoin holdings, places SpaceX in a unique position to captivate both institutional investors and the broader public. The IPO could become a landmark event in the financial world, depending on how the market reacts to SpaceX’s entry.

The Link Between Bitcoin Moves and IPO Preparations

As SpaceX continues to rotate its Bitcoin holdings, the moves seem to be a part of a broader financial strategy. The company’s CEO, Elon Musk, is known for his strategic thinking and ability to navigate complex financial markets. By transferring large sums of Bitcoin to Coinbase Prime, SpaceX may be setting the stage for its IPO, ensuring that it has the liquidity and flexibility needed to attract institutional investors.

While the company has not made any official statements regarding the connection between its Bitcoin holdings and the upcoming IPO, the timing and scale of these transactions strongly suggest that the cryptocurrency is playing a role in the company’s broader financial strategy. As SpaceX prepares for what could be one of the largest IPOs in history, its Bitcoin holdings may provide a cushion against volatility and an additional asset to leverage during the offering.

The post Elon Musk’s SpaceX Shifts $94.48M in Bitcoin with $1T IPO Predictions appeared first on CoinCentral.

You May Also Like

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058