Stripe, Paradigm Open Tempo Blockchain to Public as Stablecoin Demand Accelerates

Stripe and Paradigm opened Tempo’s public testnet on Tuesday, expanding the operational capacity of the payments-focused blockchain unveiled in September. A Bloomberg report on Tuesday detailed how the rollout invites any company to begin building stablecoin payment applications on the network.

The companies confirmed that Tempo’s newest group of partners includes UBS, Cross River Bank, and prediction-market operator Kalshi.

They join existing participants such as Deutsche Bank, Nubank, OpenAI, and Anthropic, which have been testing live workloads to validate the chain’s performance. Other partners mentioned include DoorDash, Shopify, Standard Chartered, Visa, Coupang, and Revolut, with more firms like Klarna, Brex, Coastal, Mastercard, Ramp, Payoneer, Persona, and Figure joining after the initial announcement.

According to details, the Tempo blockchain applies a payments-first architecture that separates transaction lanes from the broader network to avoid congestion common on public blockchains. The design targets predictable settlement times and fee stability, aiming to prevent disruptions often triggered by spikes in speculative trading.

With a fixed fee of one-tenth of a cent per transaction, Tempo offers an alternative to traditional card rails that charge between one and three percent plus fixed costs.

This model also aligns with rising interest in microtransactions across fintech and AI firms, which increasingly prefer usage-based fees instead of monthly billing. Tempo also accepts any dollar-denominated stablecoin for transaction costs, including USDT and USDC, the two largest tokens in circulation.

Companies building on the Tempo blockchain can begin testing integrations today, according to project documentation.

Coastal Bank President Brian Hamilton said his institution is testing how the network’s structure could unlock new capabilities across fintech and embedded-finance partners.

Matt Huang, managing partner at Paradigm, which leads the project’s development effort, told Bloomberg his team will focus on real-world use cases for stablecoins.

The move continues a year-long trend of US institutional participation in crypto, further accelerated by the GENIUS ACT regulatory framework signed into law by President Donald Trump in July 2025.

Pepe Node Presale Nears $2.5M Target as Institutional Demand

As Tempo blockchain launch accelerates crypto adoption in the US, early-stage projects like PEPENODE are receiving speculative demand.

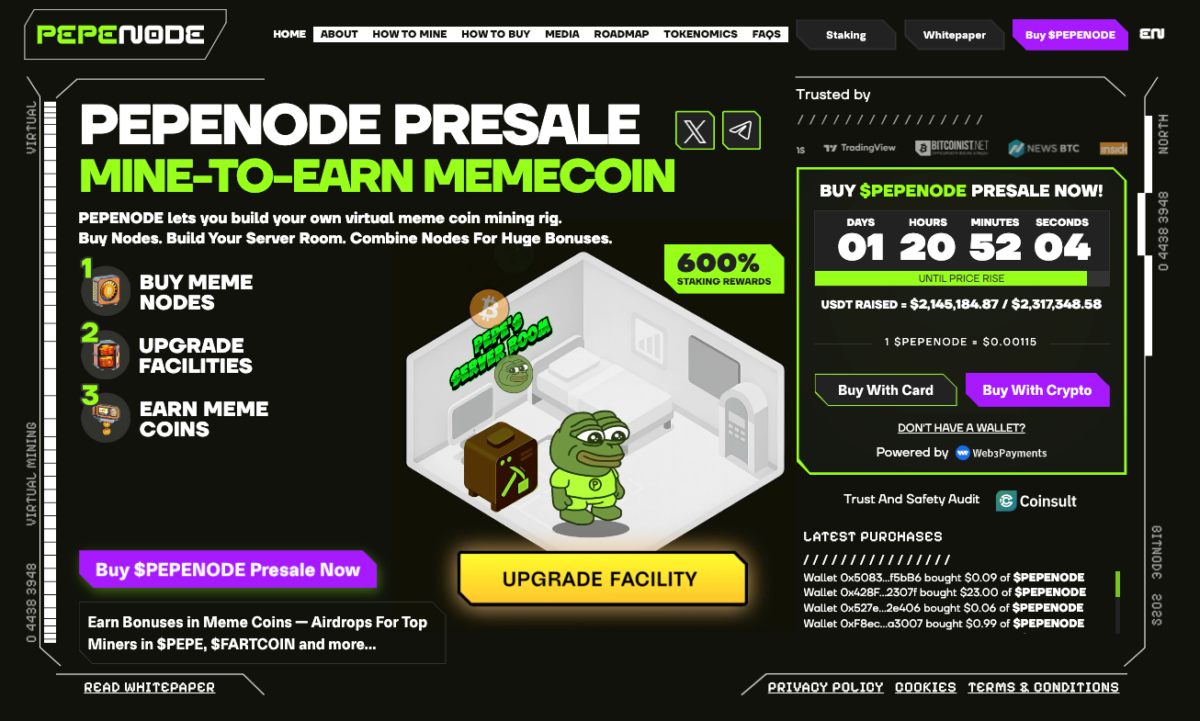

Pepe Node allows users to own virtual meme coin mining rigs, combine nodes for higher yields, and earn bonus rewards from network participation.

Pepe Node Presale

Currently priced at $0.0010, the Pepe Node presale has already raised over $2.3 million of its $2.5 million target. Investors can still join through the official Pepe Node website before the next price tier unlocks.

nextThe post Stripe, Paradigm Open Tempo Blockchain to Public as Stablecoin Demand Accelerates appeared first on Coinspeaker.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

Microsoft Corp. $MSFT blue box area offers a buying opportunity