NFT sales show modest $77M, Ethereum NFT sales drop 13%

According to CryptoSlam data, NFT sales volume has inched up by 1.77% to $77.10 million, essentially flat from last week’s $77.04 million.

- NFT sales stay flat at $77M while buyers surge over 23% week-over-week.

- Guild of Guardians Heroes jumps 162% as Immutable blockchain soars.

- $X@AI BRC-20 NFT leads weekly sales with an $809K top transaction.

Market participation has continued to surge, with NFT buyers rising by 23.45% to 490,600 and sellers climbing by 15.36% to 403,483. NFT transactions dropped by 18.99% to 1,100,748.

This happened as the Bitcoin (BTC) price has dipped to the $89,000 level as consolidation continues. Ethereum (ETH) has sustained the $3,000 level, holding above this key psychological level.

The global crypto market cap now stands at $3.05 trillion, down from last week’s $3.09 trillion.

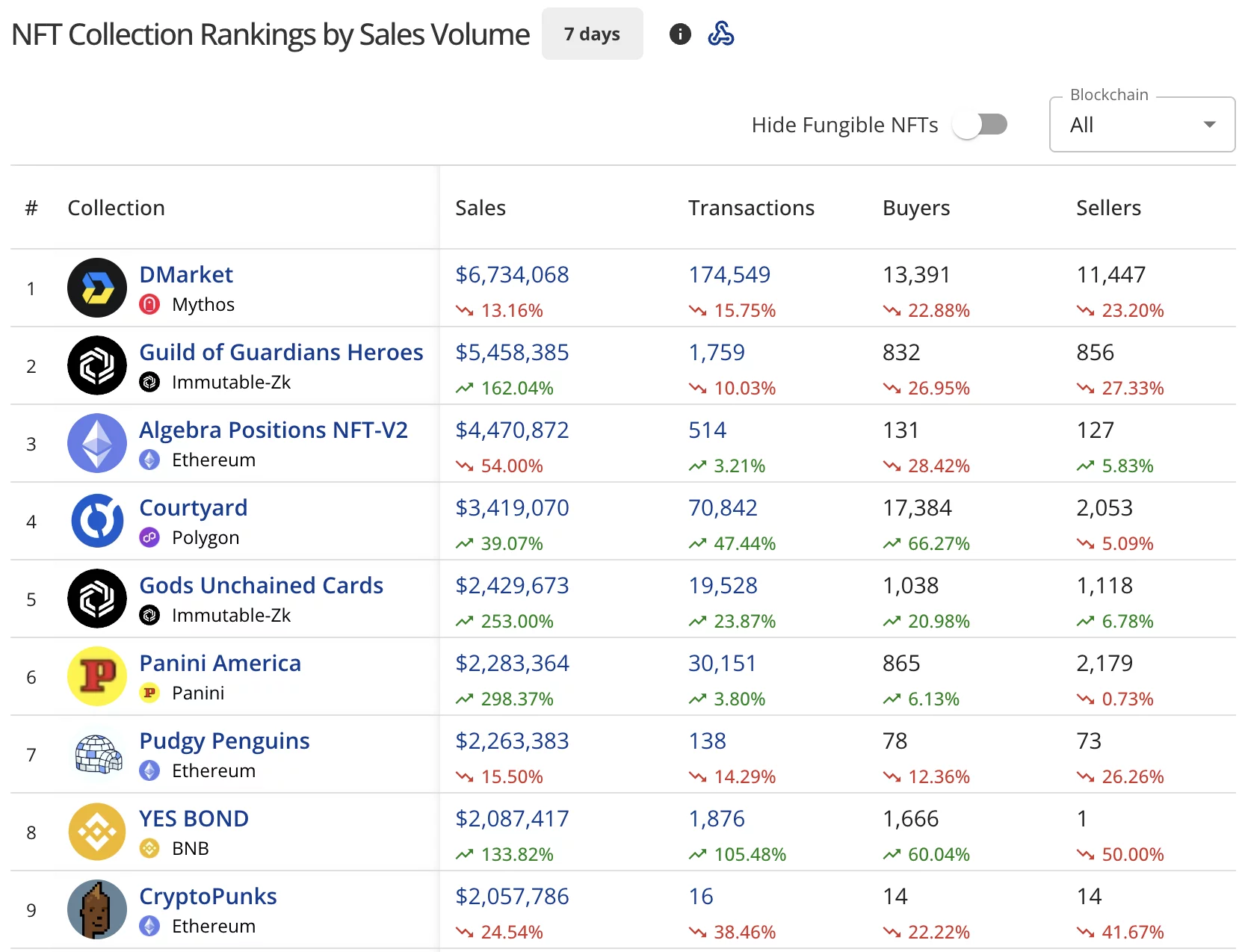

Guild of Guardians Heroes surges as rankings shuffle

DMarket on the Mythos blockchain has climbed to first place with $6.73 million in sales, down 13.16% from last week’s $7.77 million. The collection processed 174,549 transactions with 13,391 buyers and 11,447 sellers.

Guild of Guardians Heroes on Immutable-Zk surged to second with $5.46 million, exploding 162.04% from last week’s $2.04 million. The collection had 1,759 transactions with 832 buyers and 856 sellers.

Algebra Positions NFT-V2 on Ethereum dropped to third at $4.47 million, plunging 54.00% from last week’s $9.60 million. The collection saw 514 transactions with 131 buyers and 127 sellers.

Courtyard on Polygon (POL) secured fourth position with $3.42 million, up 39.07% from last week’s $2.45 million. The collection processed 70,842 transactions.

Gods Unchained Cards on Immutable-Zk entered the rankings at fifth with $2.43 million, soaring 253.00%. The collection recorded 19,528 transactions.

Panini America on the Panini blockchain placed sixth at $2.28 million, surging 298.37%. The collection had 30,151 transactions.

Pudgy Penguins dropped to seventh with $2.26 million, down 15.50% from last week’s $2.68 million. The Ethereum collection saw 138 transactions. YES BOND on BNB (BNB) entered at eighth with $2.09 million, up 133.82%.

CryptoPunks fell to ninth at $2.06 million, down 24.54% from last week’s $2.73 million. The collection had just 16 transactions with 14 buyers and 14 sellers.

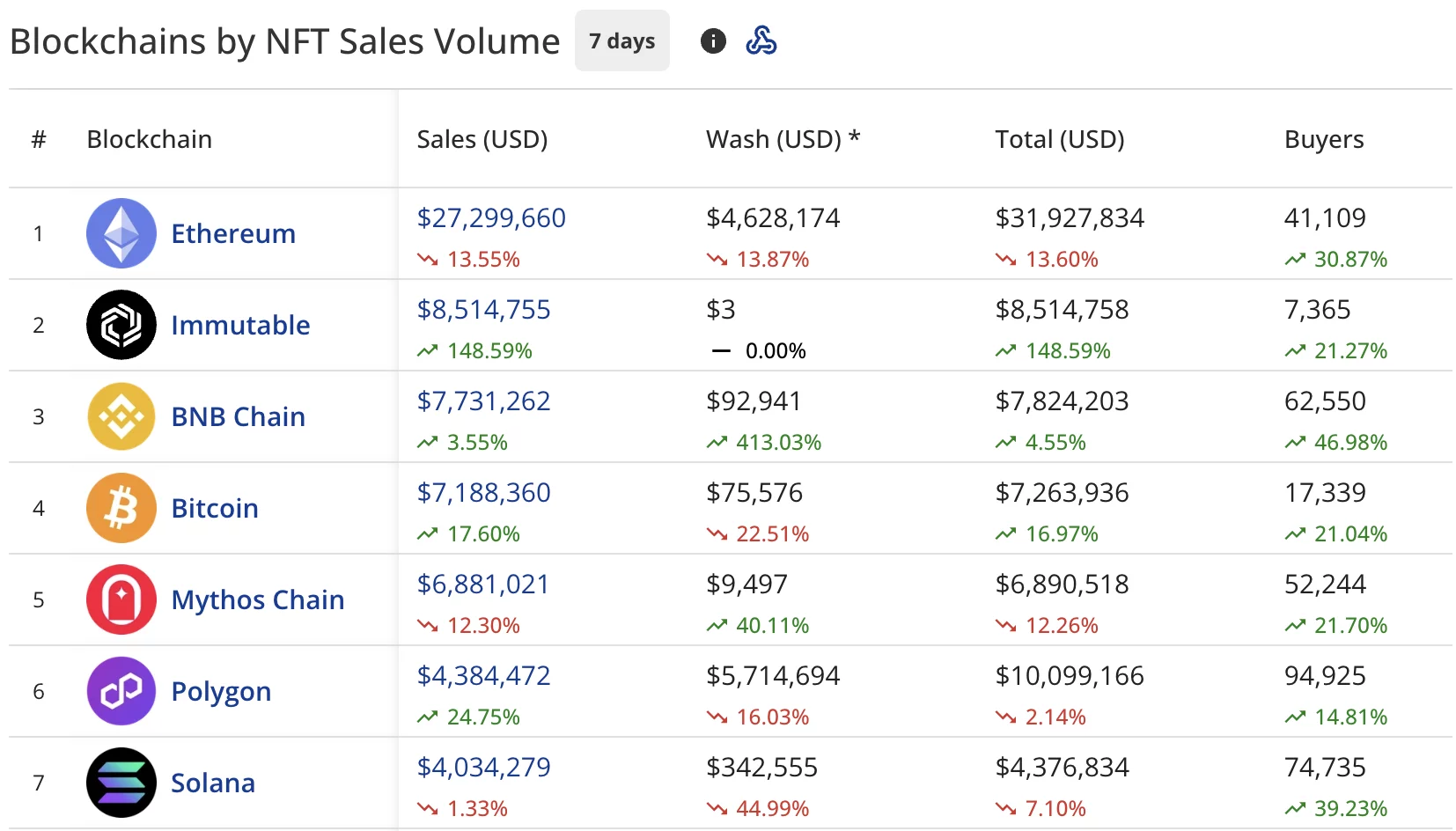

Immutable surges to second as Ethereum declines

Ethereum maintained first position with $27.30 million in sales, down 13.55% from last week’s $31.86 million.

The network recorded $4.63 million in wash trading, bringing its total to $31.93 million. Buyers jumped 30.87% to 41,109.

Immutable (IMX) exploded to second place with $8.51 million, surging 148.59% from last week’s $3.35 million. The blockchain had 7,365 buyers, up 21.27%.

BNB Chain held third with $7.73 million, up 3.55% from last week’s $7.30 million. The blockchain recorded $92,941 in wash trading, with buyers soaring 46.98% to 62,550.

Bitcoin secured fourth position at $7.19 million, up 17.60% from last week’s $6.27 million. The network saw 17,339 buyers, up 21.04%.

Mythos Chain dropped to fifth with $6.88 million, down 12.30% from last week’s $7.91 million. The blockchain attracted 52,244 buyers, up 21.70%.

Polygon placed sixth at $4.38 million, up 24.75% from last week’s $3.42 million. The blockchain recorded $5.71 million in wash trading, with buyers rising 14.81% to 94,925.

Solana (SOL) landed in seventh with $4.03 million, down 1.33% from last week’s $4.30 million. The network had 74,735 buyers, up 39.23%.

Bitcoin BRC-20 NFT tops sales chart

A $X@AI BRC-20 NFT led individual sales at $809,337.16 (8.7195 BTC), sold two days ago, marking the highest-value sale of the week.

CryptoPunks #1925 placed second at $547,161.69 (195 ETH), sold four days ago.

Three additional CryptoPunks rounded out the top five:

- CryptoPunks #6615 sold for $153,356.75 (47.99 ETH) two days ago

- CryptoPunks #309 sold for $134,530.52 (42 ETH) two days ago

- CryptoPunks #5203 sold for $111,158.93 (35 ETH) a day ago

You May Also Like

OpenClaw fuels demand for high-spec Macs, with Apple delaying delivery times for high-memory models by up to six weeks.

Fed Chair Powell says FOMC is divided on additional rate cuts in 2025

Powell said the Federal Open Market Committee is weighing interest rates on a meeting-by-meeting basis, with no long-term consensus. US Federal Reserve Chair Jerome Powell said the 19 members of the Federal Open Market Committee (FOMC) remain divided on additional interest rate cuts in 2025.At Wednesday’s press conference after the Fed’s 25-basis-point rate cut, Powell said the central bank is trying to balance its dual mandate of maximum employment and price stability in an unusual environment where the labor market is weakening even as inflation remains elevated. Powell said:Powell said that the “median” FOMC projection from the Federal Reserve’s Summary of Economic Projections (SEP), the Fed’s quarterly outlook for the US economy that informs interest rate decisions, projected interest rates at 3.6% at the end of 2025, 3.4% by the end of 2026, and 3.1% at the end of 2027.Read more