XRP News: Ripple Completes $1B GTreasury Deal to Boost Corporate Adoption

The post XRP News: Ripple Completes $1B GTreasury Deal to Boost Corporate Adoption appeared first on Coinpedia Fintech News

Ripple has completed its $1 billion acquisition of GTreasury, expanding its reach into corporate finance and digital asset services. Meanwhile, XRP price has slipped to $2.2245, down from this week’s high and about 42% below its yearly peak of $3.6680.

Ripple Expands Into Global Liquidity Management

With GTreasury now fully integrated, Ripple is positioning itself as more than a blockchain company. GTreasury’s corporate clients will be able to use Ripple’s digital asset infrastructure directly through the systems they already rely on. This setup allows real-time settlements and on-demand liquidity without requiring companies to manage crypto wallets or understand complex blockchain processes.

GTreasury brings over 40 years of treasury-management experience, serving 800+ corporations across 160 countries and connecting with 13,000 banks. It processes $12.5 trillion in payments annually, accounting for roughly 10–15% of global cross-border payments.

By bringing GTreasury into its ecosystem, Ripple gains access to a massive traditional finance market that has historically moved slowly toward blockchain adoption.

- Also Read :

- XRP ETF Inflows Near $1 Billion Faster Than Bitcoin and Ethereum ETFs

- ,

Strengthening Ripple’s Institutional Finance Stack

The GTreasury deal completes Ripple’s major 2025 expansion plan. Alongside Rail, Palisade, and Ripple Prime, this acquisition helps Ripple offer a full suite of tools for institutions looking to adopt digital assets.

Senior Executive Officer Reece Merrick noted that these acquisitions are focused on solving real operational challenges for treasurers and CFOs, reducing friction, lowering risk, and providing secure, scalable infrastructure for global companies.

XRP Outlook Shifts as Ripple Moves Deeper Into Institutional Finance

The crypto community has reacted with a mix of optimism and caution. Analyst Bill Morgan praised the positive implications for both RLUSD and XRP, hinting at potential growth.

Meanwhile, market watcher EGRAG CRYPTO suggested that investors who do not fully understand the changes may want to reconsider their positions, reflecting the uncertainty that often accompanies major developments.

Ripple’s acquisition of GTreasury marks an important step in connecting traditional finance with digital assets. By simplifying access for large corporations and offering more efficient payment solutions, Ripple is reshaping how XRP fits into the broader institutional landscape.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Ripple bought GTreasury to expand into corporate finance, offering real-time liquidity and modernizing how treasurers manage global payments.

By adding major corporate payment flows, Ripple strengthens real utility for XRP, which may boost confidence in its long-term adoption.

Yes. Companies can access digital asset benefits through systems they already use, removing the need for wallets or deep blockchain knowledge.

You May Also Like

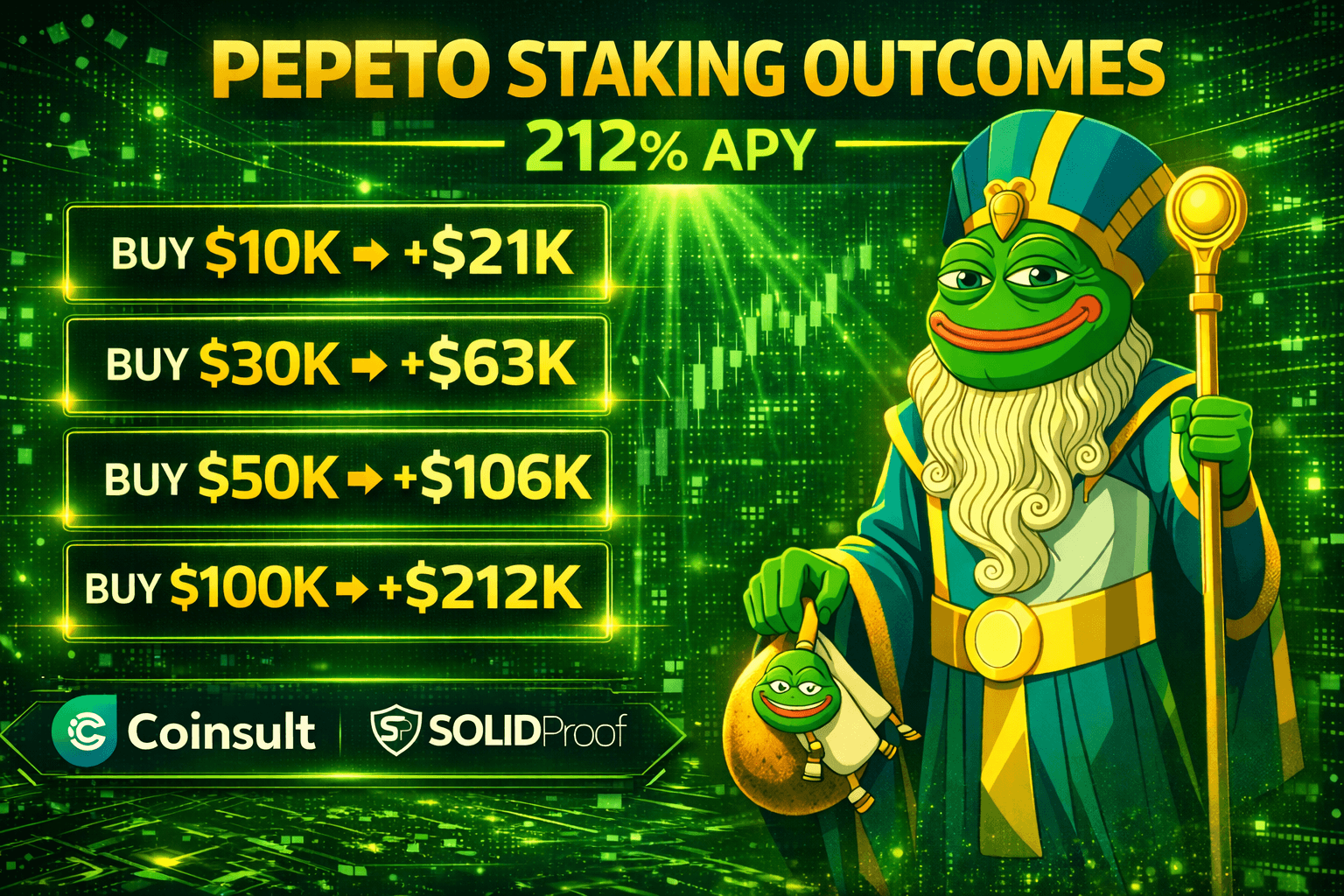

Top 100x Coin to Buy: Pepeto, XRP, Dogecoin, and Solana Lead the Market Pulse This February

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.