Top 3 Crypto Picks for a Market Reset: Only One Has Less Than 5% Phase 6 Supply Left

The post Top 3 Crypto Picks for a Market Reset: Only One Has Less Than 5% Phase 6 Supply Left appeared first on Coinpedia Fintech News

As the market prepares for a possible reset, investors are searching for cryptocurrencies that can hold value through volatility while still offering strong upside for 2026. Many large-cap assets are showing signs of exhaustion, while a new DeFi token under $0.04 is gaining momentum at a much faster pace. With fewer than 5% of its Phase 6 supply left, this rising project is drawing more attention than ever before — and is now standing beside major names in investor watchlists.

Ripple (XRP)

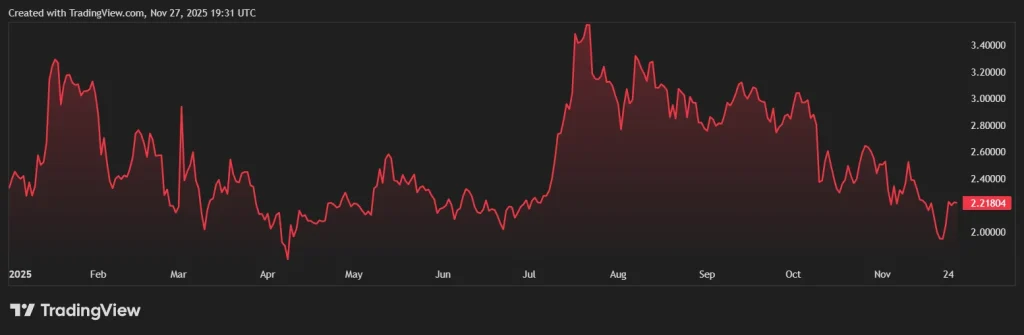

Ripple’s XRP continues to hover around $2.20, supported by a market cap close to $126B. Although XRP remains one of the strongest legacy altcoins, it has struggled to break through its next resistance zone. The first barrier sits at $2.60 to $2.65, where sellers push back on every attempt to build upward momentum.

A higher resistance level between $2.80 and $2.90 has remained untouched for months. Even during periods of broader market strength, XRP has failed to reclaim these levels. Without new catalysts, analysts suggest that XRP may remain stuck within its current trading band.

XRP’s size is also working against it. With a multibillion-dollar market cap, it is harder for the token to deliver strong gains during market resets. Investors who once relied on XRP’s early explosive cycles now say the token’s growth is slowing, pushing them to explore earlier-stage opportunities.

Avalanche (AVAX)

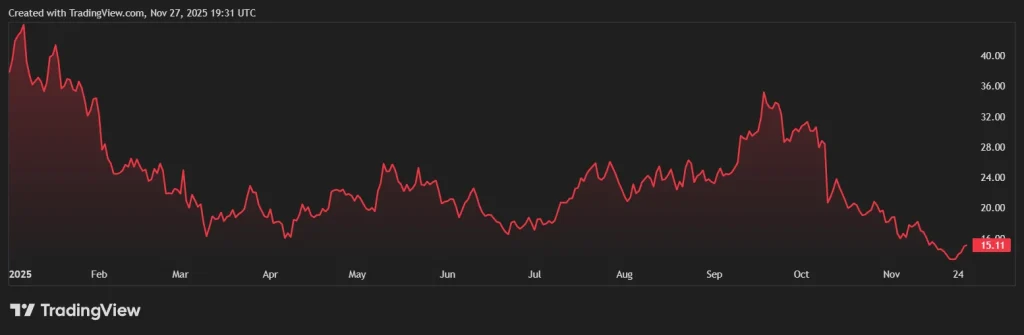

Avalanche (AVAX) maintains a solid position in the DeFi and Web3 landscape. Trading near $15.50, with a market cap estimated around $10B, the token remains one of the more active L1 networks. However, AVAX’s price momentum has weakened over the past months.

The first major resistance sits at $20, while a stronger barrier exists at $25. AVAX has tested these zones repeatedly without a confirmed breakout. Analysts note that unless volume increases significantly, the next move may be sideways rather than upward.

AVAX does have strong development activity, but like XRP, its size limits rapid appreciation. Avalanche has also been competing with faster L2 networks, making its long-term upside more stable but less explosive. Many early AVAX investors now say they are looking for smaller tokens with more aggressive growth curves — especially those still under $0.05 with r utilities behind them.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is becoming one of the most notable new crypto projects in the DeFi space. The team is building a decentralized lending protocol focused on yield, safe borrowing, collateral rules and liquidation protection. Instead of depending on hype, Mutuum Finance is positioned as a long-term DeFi ecosystem designed for real use.

The token launched in early 2025 at $0.01 and has now reached $0.035, marking a 250% increase. The project has raised $19M, and the community has grown to 18,200 holders. Out of the 4B MUTM supply, 1.82B tokens were allocated to the offering, with more than 800M already sold.

Now in Phase 6, allocation has crossed 95%, leaving less than 5% of tokens available at the current price. This rapid sellout has created strong urgency among buyers, especially as new investors discover the project through social channels and DeFi forums.

Why Analysts See MUTM Outperforming XRP and AVAX

XRP’s large market cap limits how fast it can expand. Even with positive news, XRP rarely moves sharply anymore. AVAX is in a similar situation — strong tech, strong ecosystem, slower price appreciation. MUTM is still early and priced under $0.04. That gives it far more room to grow during a market reset.

XRP is tied to payments but lacks the yield-generating mechanics that DeFi investors prefer. AVAX offers an L1 solution but competes with dozens of faster L2 systems. Mutuum Finance integrates mtTokens, which increase in value as borrowers repay interest. The token also uses a buy-and-distribute model: MUTM purchased on the open market with a part of protocol fees is redistributed to users who stake mtTokens in the safety module. This creates built-in demand that XRP and AVAX do not match.

Increasing Urgency

Mutuum Finance is nearing a major milestone. According to the team’s official X account, V1 will launch on the Sepolia Testnet in Q4 2025. This first version includes the liquidity pool, mtTokens, debt-tracking token and liquidation bot, with ETH and USDT supported immediately.

Security has been a major focus.

- The project has completed a CertiK audit, scoring 90/100.

- Halborn Security is reviewing the final lending and borrowing contracts for additional assurance.

Community activity is also rising thanks to the 24-hour leaderboard, which rewards the top contributor with $500 in MUTM each day. This keeps participation high and encourages steady inflow.

With less than 5% of Phase 6 supply remaining, urgency is increasing at its fastest rate yet. A recent whale allocation above $100K pushed the allocation even closer to completion, signaling strong confidence from larger investors.

Final Takeaway

As market conditions shift into a possible reset, XRP and AVAX show slower growth potential due to size and resistance limitations. Meanwhile, Mutuum Finance has surged 250%, raised over $19M and is nearing full Phase 6 allocation with fewer than 5% of tokens left.

With strong audits, a confirmed V1 launch, mtToken yield mechanics, a buy-and-distribute model and rising investor interest, MUTM stands out as one of the top cryptocurrencies to watch for Q1 2026, and the shrinking supply adds intense urgency for anyone observing the final phase.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Here’s How Consumers May Benefit From Lower Interest Rates