Aptos inflation governance dilemma: AIP-119 proposal sparks controversy, ecological prosperity may be the solution

Author: Frank, PANews

Inflation governance has always been a core proposition of the public chain economic model and ecological development. Recently, the Aptos community has been caught in a heated debate over a proposal to reduce staking returns, AIP-119. Supporters see it as a necessary measure to curb inflation and activate ecological liquidity, while opponents warn that it may weaken the foundation of network decentralization and even cause capital outflows.

When the game between cost-cutting and open source collides with the redistribution of validator interests, the reform of Aptos not only concerns the future of the APT token economy, but also reflects the deep contradictions of PoS public chain governance. PANews analyzes the proposal disputes and compares the mainstream public chain models to explore how Aptos can find a way out between high inflation and low activity.

Inflation "surgery" triggers debate over whether it cures the disease or hurts the capital

AIP-119 was proposed by community member moonshiesty on the Aptos Foundation's GitHub on April 17, 2025. The specific proposal is to reduce the base staking reward rate of Aptos by 1% per month over the next three months, with the ultimate goal of reducing the annualized rate of return (APR) from about 7% (or 6.8%) at the time to 3.79%. From the content point of view, the proposal itself is not complicated. It just alleviates APT inflation by reducing staking rewards, which is beneficial to the long-term health of the ecosystem, but it will touch the core interests of large staking nodes that are accustomed to passive income, so it has caused a lot of debate in the community.

The mainstream support believes that in addition to being able to quickly reduce the inflation of APT, this proposal can also incentivize coin holders to transfer funds to other DeFi activities on the chain rather than relying solely on passive staking.

However, judging from the community’s discussions, the controversy surrounding this proposal is not limited to opposition from large holders. Many members have also raised concerns about the negative impact that this proposal may cause, from the perspective of small validators and the entire community.

There are opponents spending, and a significant reduction in staking rewards will have a greater impact on small validators. The profit margins of many validators are therefore compressed, and they may not be able to cover the cost of operating validators (about $30,000 per year), forcing them to exit the network. This indirectly weakens the decentralization of the Aptos network, and ultimately power and resources are concentrated and tilted towards large validators.

Eric Amnis, co-founder of Amnis Finance, made a specific calculation in the forum. Currently, the annual server cost of a validator holding 1 million APT is about $72,000 to $96,000 (but this figure is quite different from the $35,000 proposed by the proposer). However, if the rate of return is reduced to 3.9%, the final income may be only $13,000, so there will be a phenomenon of not making ends meet. Only when the holding amount reaches more than 10 million APT can it barely make a profit, which will directly eliminate small validators.

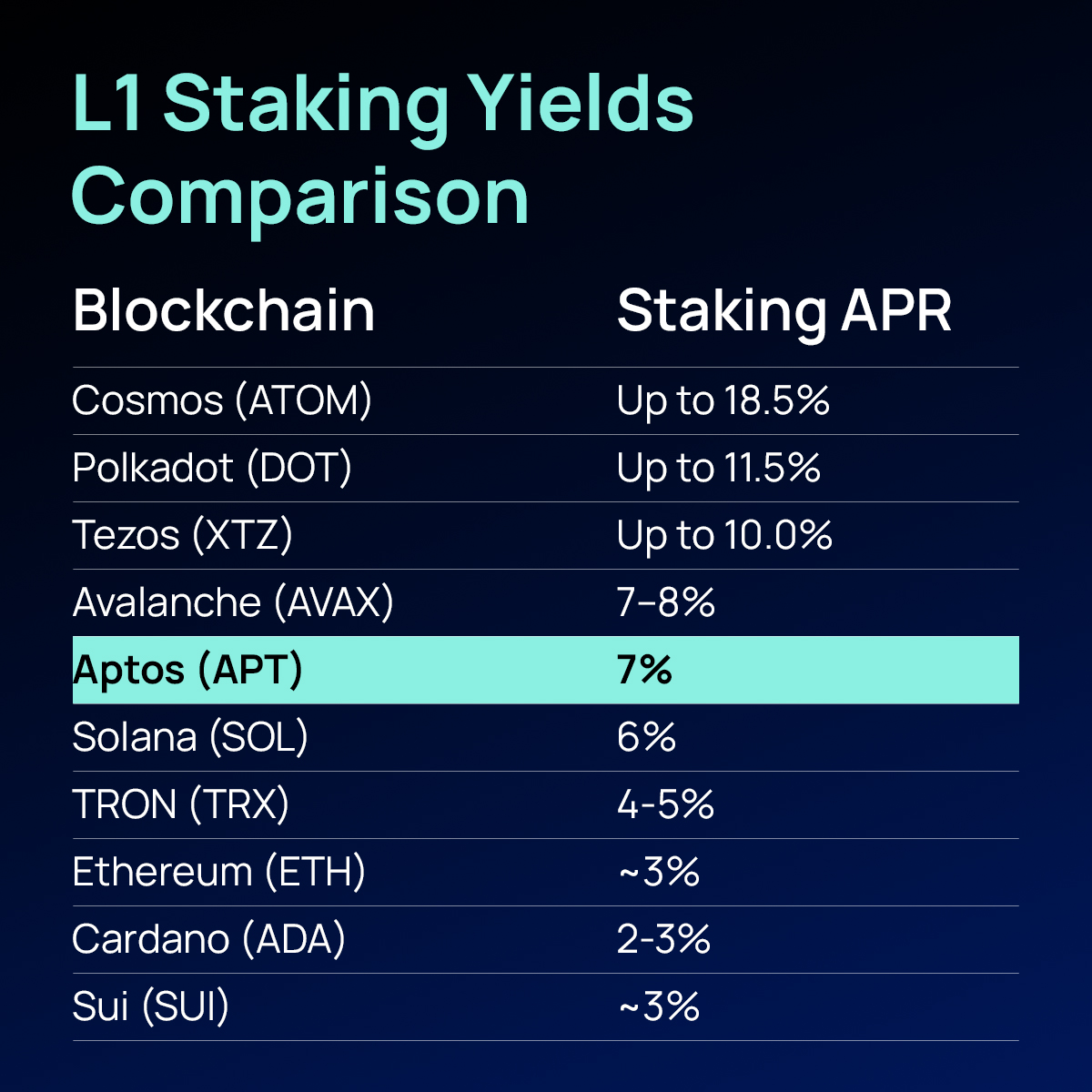

In addition, there are also comments that the reduced staking yield (3.79%) is uncompetitive compared to other chains that offer higher returns (such as Cosmos, about 15%), which may cause large investors and institutions seeking high returns to transfer funds to other networks, reduce Aptos' TVL and liquidity, and create a risk of capital outflow. In addition, a lower staking yield will also reduce the attractiveness of the AptosDeFi protocol to liquidity providers, affecting the growth of the protocol and user participation.

The universal problem of PoS governance: balancing rewards and inflation

In fact, this proposal is exactly the same as the SIMD-0228 proposal that was previously proposed on Solana and was ultimately rejected. Both attempts to curb network inflation by reducing the validator yield, which reflects the interest game problem in public chain governance. This governance problem is usually more prominent in the POS consensus mechanism.

Therefore, the best way to determine whether the Aptos proposal is reasonable is to compare how several public chains with similar mechanisms balance this issue and what effects they produce.

Currently, the token inflation model of Aptos is to increase by 7% every year. According to the AIP-30 proposal, the maximum reward rate is planned to decrease by 1.5% every year (relative to the previous year's value) until it reaches an annualized lower limit of 3.25% in more than 50 years. As of April, the pledge rate of APT reached 76%, maintaining a relatively high proportion among public chains. In terms of fee destruction, all transaction fees of Aptos will be destroyed at present, but since the on-chain fees of Aptos are only a few thousand dollars a day, this destruction is a drop in the bucket for resisting inflation.

Judging from the trend of the token over the past year, Solana is a relatively successful public chain in the POS mechanism. Unlike Aptos' current fixed issuance ratio, Solana's inflation model is a year-on-year decreasing model, with an initial value of 8%, and then a decrease of 15% each year, currently about 4.58%. Therefore, this dynamic inflation model seems to be exactly the expected goal after the Aptos proposal reform. However, for Solana, this inflation is still considered too high by the community, so the 0228 proposal came into being. In terms of pledge ratio, Solana's current pledge ratio is about 65%, lower than Aptos' 76%.

In terms of fee destruction, 50% of Solana's transaction fees were previously destroyed, but after the 0096 proposal was passed, this 50% destruction was canceled and rewarded to validators, which also caused Solana's inflation to become more serious. However, due to the high activity of the Solana network, it does not seem to be affected too much by inflation.

In addition, Sui, another public chain of the MOVE system, is often compared with Aptos. In terms of staking yield, Sui's yield is relatively low, only between 2.3% and 2.5. And the SUI token has a hard cap of 10 billion SUI, which fundamentally controls the possibility of unlimited issuance. In terms of staking rate, SUI's staking rate is about 76.73%, which is close to APT. However, in terms of fee destruction, Sui network chooses to use it as a reward and does not have a destruction mechanism. Relatively speaking, Sui's hard cap model seems to have reduced a lot of inflation anxiety in the community, so its price performance is also relatively bright.

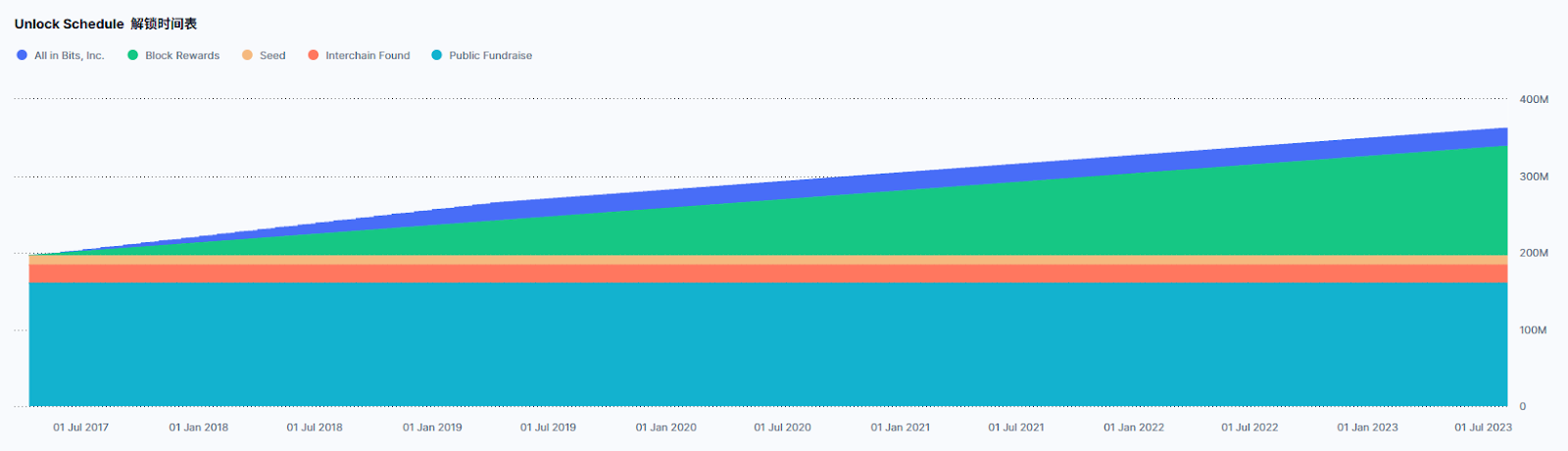

In addition, the staking income of Cosmos is relatively typical, up to 14.26%. From the perspective of the number of tokens in circulation, it also shows a continuous climbing effect. At present, the staking rate of Cosmos is about 59%, and this inflation will continue before it reaches 67%. However, although the staking income is high, the price trend of ATOM tokens has continued to fall. From a high of $44 to a low of $3.81, a drop of 91%.

Aptos’s choice: save money or increase revenue?

In general, among the major POS public chains, no one can perfectly solve the balance between inflation rate and network participation. In the process of solving these games, on the one hand, it is necessary to control the inflation rate to maintain the healthy development of the token economic model, and on the other hand, it is necessary to attract validators to participate in network governance through relatively reasonable staking income. Ethereum has achieved deflation through POS transformation and basic fee destruction. But ETH does not seem to have ushered in a rise in token prices due to solving the inflation problem. On the contrary, Solana has recently passed the 0096 proposal to increase inflation, and the 0028 proposal to reduce deflation has been rejected by the community. But this does not seem to have much impact on Solana's token price. In the final analysis, it is because Solana's network activity has always ranked among the top public chains.

Solving inflation is like saving money, and improving network activity is like opening up new sources of income. For an active network, the balance between opening up new sources of income and saving money is naturally important, but for a network that is not very lively at the moment. How to improve activity is the real way to improve network tokens. Judging from the problems currently encountered by Aptos, Aptos' TVL is only 1.1 billion US dollars, ranking 11th among public chains. The overall data is not impressive, and the current number of validators in the entire network is 149, and the number of complete nodes is 495, which is not too high. Once many validators withdraw due to reduced yields, there is indeed the possibility of serious damage.

Therefore, for Aptos, while considering "throttling" through AIP-119, it may be more important to consider its potential impact on the validator ecosystem and network decentralization. Compared with radically cutting rewards, the more urgent choice at this stage may be how to "open source" - that is, to increase the activity of the network and attract more high-quality projects to settle in, so as to build a truly prosperous and sustainable ecosystem. This may be the key to supporting the long-term value of APT.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%