Best Meme Coins to Buy – Turbo Price Prediction, Next 1000x Crypto

Turbo, one of the more recognizable meme coins in the crypto space, experienced an impressive resurgence, surging roughly 80% in the past seven days and reigniting discussions about the current state of the market.

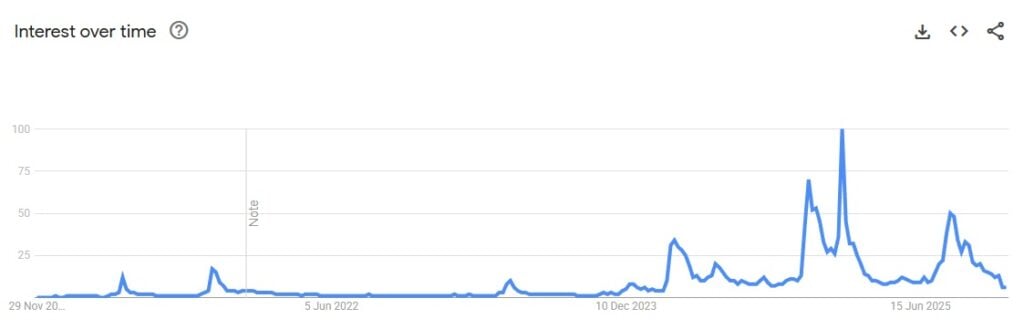

The sudden spike brought attention back to a sector many believed had gone dormant, yet broader data shows the overall meme coin landscape remains subdued. Global search trends reflect minimal interest compared to previous cycles, with search volume hovering near its lowest levels in years.

Source – Google Trends

While broader market sentiment shows uncertainty, especially with Bitcoin waiting for clearer direction, Turbo’s sudden rally highlights how quickly capital can rotate toward high-beta assets when conditions briefly turn favorable.

This article covers Turbo’s price forecast from expert Jacob Crypto Bury, whose full analysis is available in the video below or on his YouTube channel. It also highlights two crypto presales as some of the best meme coins to buy alongside $TURBO.

Can Turbo Spark a Meme Coin Revival?

Despite isolated pumps like Turbo’s, the general sentiment indicates that meme coins are far from staging a full market-wide comeback.

Turbo itself has had an eventful journey over the past year, once reaching a market cap of around $700 million before retracing sharply toward the $100 million range, where it appeared to form a double bottom.

Historically, this type of deep retracement often reflects extreme fear, where many holders capitulate and sell at a loss only for the market to reverse afterward. Conversely, earlier euphoric phases saw new buyers entering at peak levels, only to find themselves holding the top during later corrections.

Turbo Price Prediction

Turbo’s recent rally has sparked renewed speculation about its next major price level. The token bounced strongly from the $0.0013 support zone and briefly doubled toward $0.0026, showing significant buying pressure.

However, its current formation resembles a rising wedge, a pattern that often indicates the potential for a corrective move. If momentum weakens, a pullback toward the $0.0020 region becomes possible as traders take profits.

But if bullish volume continues holding steady, $TURBO could attempt another leg higher and possibly revisit previous resistance zones. Overall, the near-term outlook depends on whether buyers can maintain control despite the token being overbought on multiple timeframes.

Top Meme Coin Presales Investors Are Watching Now

Despite declining global interest in meme coins, tokens like Turbo can still capture attention when volatility spikes. Two emerging crypto presales are also drawing investors in as interest shifts toward early-stage opportunities.

Below is a detailed analysis of Bitcoin Hyper and Pepenode, both currently in presale, raising millions in funding, and recognized as some of the best meme coins to buy now.

Bitcoin Hyper (HYPER)

Bitcoin Hyper is a high-profile presale that has already raised nearly $29 million and is expected to launch in early 2026. The project aims to create a Bitcoin layer-2 solution using the Solana Virtual Machine, improving scalability, transaction speed, and overall usability for the network.

The team is actively building an ecosystem with a wallet, blockchain explorer, bridge, staking features, and even a meme coin launchpad. Early investors benefit from reduced selling pressure due to staking and long-term holders, which may help stabilize initial market activity.

While market conditions have become more challenging compared to earlier presales, Bitcoin Hyper remains one of the most promising opportunities in the current presale environment, and one of the best meme coins to buy now.

Visit Bitcoin Hyper

Pepenode (PEPENODE)

Pepenode is an innovative mine-to-earn meme coin platform built on the Ethereum blockchain, offering investors a gamified way to earn tokens. Users can create and upgrade virtual mining rigs that generate Pepenode tokens as well as established meme coins like Pepe and Fartcoin.

The project has already raised $2.2 million, with each token priced at $0.001168. It has also secured smart contract audits and offers a clear roadmap, complete issuer information, and transparent tokenomics with no private sales.

By upgrading virtual nodes, participants can maximize their mining efficiency and potential payouts, while staking Pepenode through compatible crypto wallets can yield up to 580% rewards.

This approach eliminates the need for traditional energy-intensive mining, offering an eco-friendly and accessible alternative. Overall, Pepenode combines utility, engagement, and earning potential for early-stage investors.

Visit Pepenode

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy