Dogecoin Sees Sharp Price Swings As Market Uncertainty Rises Leaving DOGE Investors Split On Plan Of Action

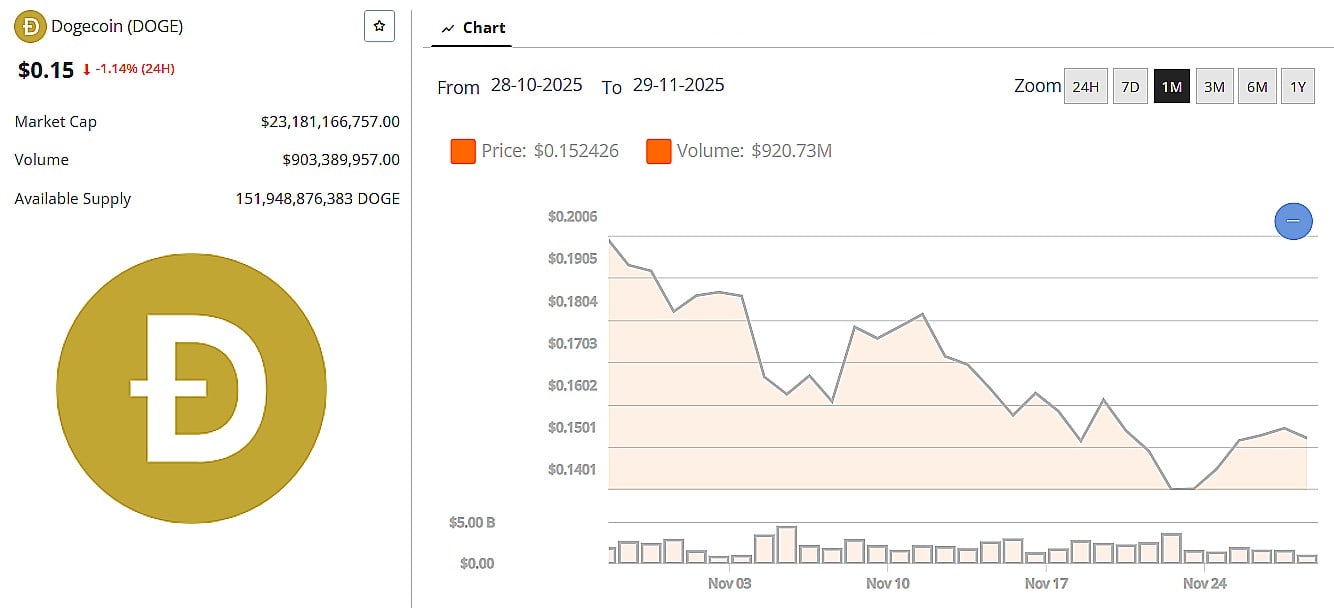

After hitting a November low of $0.14 on Sunday, DOGE has recovered to just above its familiar support zone of $0.15 (a level DOGE has defended repeatedly throughout 2025), although the decline to $0.14 has left the $0.15 support zone clearly weakened.

DOGE charts are showing a clean death cross, a pattern many traders interpret as a strong bearish signal. Some market watchers have floated the possibility of a deeper 40% decline toward $0.095 if buyers don’t return soon.

While DOGE wrestles with fading momentum, another asset is quietly drawing attention: Remittix (RTX), the PayFi project preparing a major reveal and expanding its ecosystem with a newly launched wallet on the Apple App Store.

With December fast approaching, the final month of the year could split investor sentiment. DOGE is struggling with technical signals while Remittix leans into product progress.

Dogecoin Price Outlook for December: Key Levels to Watch

Dogecoin enters December at a crucial technical and sentiment-driven crossroads, prompting analysts to revisit its historical patterns and reassess whether the current structure supports a sustainable recovery into 2026. While the asset has shown signs of stabilization around the 12-hour falling wedge pattern, its broader outlook remains uncertain due to shifting liquidity, macro conditions and the volatility typical of meme-driven assets. DOGE currently trades at $0.15, and although intraday structure has improved, researchers warn that confidence in cycle-based forecasting remains limited.

After touching a November low of $0.14 over the weekend, DOGE followed the market up early in the week, but its recovery has stalled at $0.15. Dogecoin price source: Brave New Coin DOGE market data.

Recent chart analysis highlights conditional upside. The 4-hour inverse head-and-shoulders pattern suggests a short-term move toward $0.18, but analysts stress that breakouts historically fail without volume exceeding key averages. Fractal commentators reiterate that historical analogs for meme assets have weak forward-tested reliability, making liquidity clusters and real-time momentum far more relevant than aging price models.

In the near term, traders are watching DOGE’s reaction to resistance zones at $0.160 – $0.162, $0.173 and $0.185, with a retest of $0.154 potentially enabling a relief rally toward $0.20–$0.23 if support holds. Analysts continue to view $0.133–$0.147 as critical downside protection. Model-based platforms outline optimistic late-2025 ranges of up to $0.39 , but any long-term targets in the $1 to $5 range depend heavily on speculative cycle theories. With a market cap of roughly $23.1 billion and more than 151.9 billion DOGE in circulation, traders are urged to treat technical signals as guides, not guarantees, and apply disciplined risk management in a market where sentiment can shift rapidly.

Of course market sentiment will also lean heavily on Bitcoin’s behavior. Currently just over $91k having recently bounced from $82,175, continued upward trajectory for Bitcoin could help Dogecoin stabilize. But for now, the technical picture points to caution.

At the same time, investors are watching Remittix closely as the project prepares fresh announcements and expands its payment infrastructure, creating a strong narrative contrast during DOGE’s volatile December start.

Remittix: PayFi Project Gains Traction With App Store Wallet Launch

While Dogecoin’s volatility tightens, Remittix is taking a different approach, shipping products rather than depending on sentiment. RTX is building PayFi tools that let users send crypto and have it delivered as local money in bank accounts across more than 30 countries, a real utility play at a time when meme coins are under pressure.

The most impressive development so far is the Remittix Wallet – now LIVE on the Apple App Store. The wallet currently functions as a full crypto wallet (Phase 1), and the team has already confirmed that crypto-to-fiat transfers, the core PayFi feature, will be rolled out in a December update. An Android version is also in progress.

Other traction points:

-

$28.2M+ raised

-

686M+ RTX sold

-

Current price: $0.1166

-

CertiK-verified contracts and a fully doxxed team

-

Live wallet beta moving real payments

-

A 15% USDT referral program, claimable daily

-

Confirmed BitMart listing, with more CEX announcements coming

These updates have positioned Remittix as one of the most credible utility-centered projects launching into 2025.

Dogecoin vs Remittix: Two Very Different December Bets

| Feature | Remittix | Dogecoin |

| Category | PayFi payments token | Meme coin/transactional token |

| Core Utility | Crypto-to-fiat transfers and global settlement | Peer-to-peer tipping and transfers |

| Market Position | Early-stage utility with growing adoption | Large cap and high volatility |

| Technical Strength | PayFi ecosystem and audited contracts | Simple PoW network and meme culture |

| Institutional Outlook | Strong (audit, listings, App Store wallet) | Moderate (ETF adds legitimacy) |

| Key Catalysts | BitMart and LBank listings, AppStore wallet launch and Certik #1 ranking | GDOG ETF and social sentiment |

| Long-term Thesis | Utility-driven and real-world usage | Community-based speculation |

Is Remittix the Best Crypto to Buy Now?

Here is why traders are shifting toward RTX:

-

Real PayFi utility instead of speculation

-

#1 CertiK ranking for pre-launch tokens

-

BitMart listing; LBank listing incoming

-

Strong referral reward system (15% in USDT)

As DOGE holders reassess long-term upside, Remittix is positioning itself as a utility-first alternative with actual momentum.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway:https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Frequently Asked Questions

1. What is driving Dogecoin’s price right now?

At $0.15 Dogecoin is holding support, but mixed sentiment and a broad market rotation have softened momentum.

2. Why are some investors shifting to Remittix?

The App Store launch of the Remittix Wallet gives RTX real-world utility, which appeals to traders looking for utility based products and ecosystems – rather than hype.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

You May Also Like

ETH Exit Queue Gridlocks As Validators Pile Up

TheWell Bioscience Launches VitroPrime™ 3D Culture and Imaging Plate for Organoid and 3D Cell Culture Workflows