Bitcoin Price Back Above $91K On December Rate Cut Hopes As SpaceX Moves $105M In BTC

The Bitcoin price surged 4% in the past 24 hours to trade at $91,393 as of 2:41 a.m. EST on trading volume that rose 14% to $75.7 billion.

BTC rebounded over the last day, climbing above $91,000 as rising expectations of a US Federal Reserve rate cut drove a wave of renewed investor interest.

Markets now price in roughly an 85% chance of a quarter-point reduction in December, a sharp jump from a measly 44% chance a week ago, according to data from CME FedWatch.

If a rate cut occurs, lower rates could lift “risk assets” such as Bitcoin by increasing liquidity and boosting appetite for higher-yielding assets.

Meanwhile, as the largest crypto by market capitalization recovered, a crypto wallet associated with SpaceX moved 1,163 BTC valued at around $105 million to a new wallet, according to Arkham Intelligence data.

However, it remains unclear whether SpaceX moved the coins for custody purposes or with the intent to sell them.

Bitcoin finally broke out of a fragile $81,000-$89,000 zone, a zone that highlighted the market’s lack of liquidity and demand.

Can the recovery be sustained and Bitcoin’s price rise even higher?

Bitcoin Price Poised For A Sustained Recovery

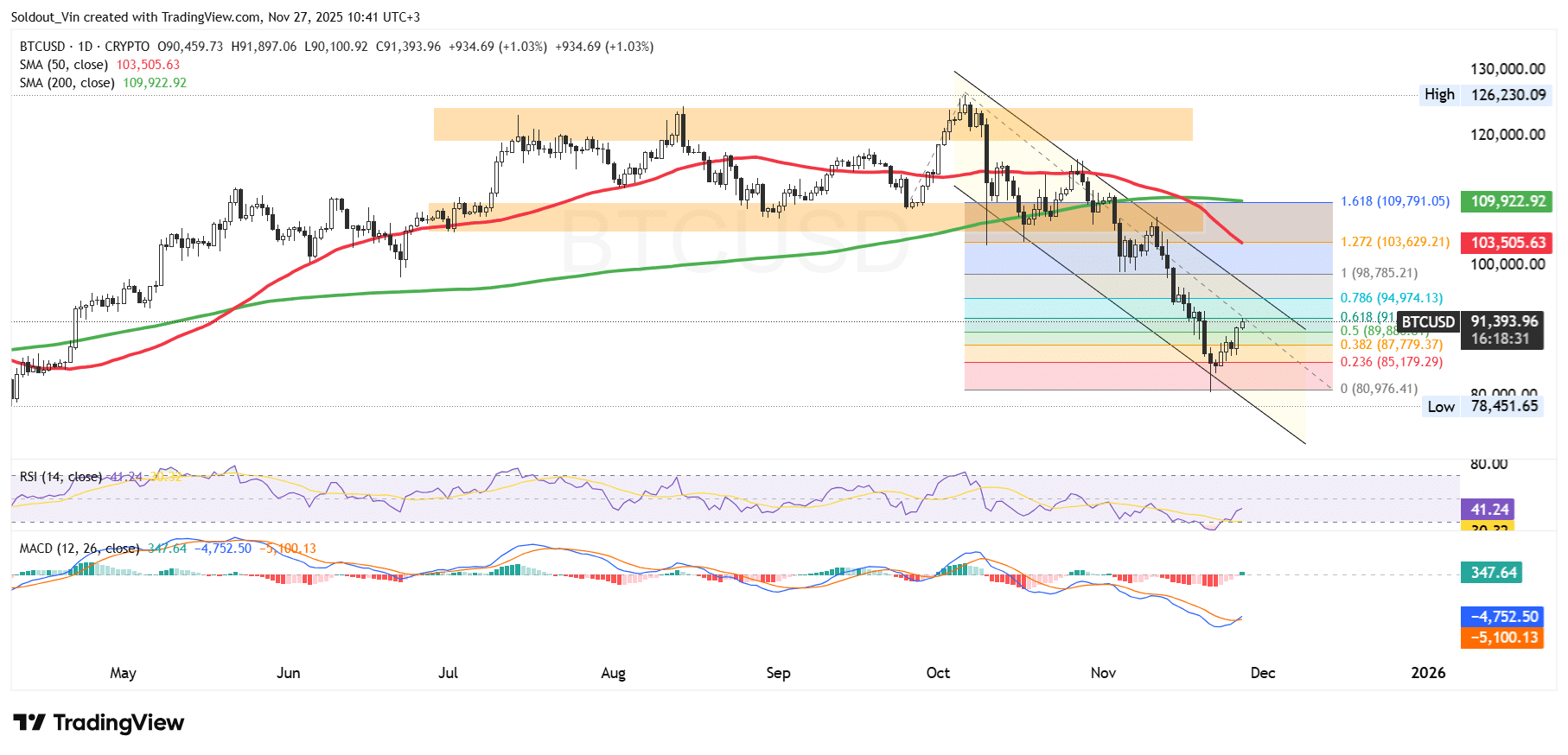

After a sustained surge from May, the BTC price was rejected above the $123,000 zone, forcing it to trade sideways between this level and the $107,400 support.

However, the Bitcoin price could not hold that level, leading the bears to push the crypto into a well-defined falling channel, with BTC crossing key Fibonacci support levels. BTC is now surging toward the 0.5 Fibonacci ($89,880) and the 0.618 Fibonacci ($91,982) levels.

The sustained bearish trend has pushed BTC’s price below both the 50-day and 200-day Simple Moving Averages (SMAs), suggesting the bearish trend remains in place.

Meanwhile, on the daily chart, the Relative Strength Index (RSI) is recovering from oversold territory, currently at 41, suggesting buyers are taking back control.

The Moving Average Convergence Divergence (MACD) also supports the recovery attempt, as the blue MACD line has crossed above the orange signal line. With green bars now forming on the histogram, BTC is currently riding positive momentum.

BTC/USD Price Analysis Source: TradingView

BTC/USD Price Analysis Source: TradingView

BTC Price Prediction

According to the BTC/USD chart analysis, the Bitcoin price is attempting a short-term rebound after touching the lower Fibonacci zone near the 0.236–0.382 levels, which often act as reaction points during corrective phases.

If momentum continues to improve, the next key resistance for BTC lies around the 0.5 and 0.618 Fibonacci retracements at $89,800–$91,800, where sellers are likely to re-enter.

A successful breakout from the descending channel could open the path toward the $95,000–$98,500 zone, which falls within the 0.786 Fib level and a prior consolidation region.

However, if the Bitcoin price fails to hold above recent lows, a retest of the $80,000–$82,000 support range becomes possible, as it aligns with the Fib bottom and previous liquidity levels.

Related News:

You May Also Like

ETH Exit Queue Gridlocks As Validators Pile Up

TheWell Bioscience Launches VitroPrime™ 3D Culture and Imaging Plate for Organoid and 3D Cell Culture Workflows