Bitcoin Crash Sparks Investor Panic as Treasury Crisis Unfolds: A Financial Wake-Up Call

In recent weeks, the cryptocurrency market has experienced significant turbulence, with losses mounting across major digital assets. Concerns about the sustainability of corporate crypto treasuries, regulatory scrutiny, and evolving DeFi policies are shaping the outlook for investors and industry stakeholders. As Bitcoin approaches a six-month low and Ethereum holdings plunge into billions of dollars in unrealized losses, the sector’s future uncertainty prompts a reassessment of blockchain-based financial solutions and regulations.

- Crypto markets extend decline for a fourth consecutive week amid fresh reports of massive unrealized losses, notably at the world’s largest Ether holder.

- Bitcoin hits a six-month low, raising questions about the resilience of the current bull market cycle.

- BlackRock’s proposed staked Ether ETF intensifies pressure on existing corporate crypto treasuries, with some firms facing ‘Hotel California’-like traps.

- The SEC prepares for a roundtable on privacy and financial surveillance, amid rising concerns over privacy rights in crypto.

- Industry innovation continues, with Coinbase launching ETH-backed loans and Mastercard simplifying crypto addresses via Polygon.

Cryptocurrency markets have continued to slide for the fourth straight week, fueling worries about the endurance of the ongoing bull run. Major price declines and rising unrealized losses in corporate digital asset treasuries signal a challenging environment for investors. These developments come as regulatory agencies and institutional players weigh their roles in shaping the future of blockchain-based finance.

On Thursday, a report from 10X Research highlighted a stark reality: BitMine Immersion Technologies, the largest corporate Ether (ETH) holder, currently faces an unrealized loss of approximately $3.7 billion. The firm’s holdings are valued at about $1,000 below the purchase price per ETH, illustrating the downward pressure across the crypto landscape. Such losses make it increasingly difficult for these firms to attract new retail investors or expand their holdings, leaving existing shareholders with significant paper losses—an analogy often referred to as the ‘Hotel California’ scenario, where shareholders are ‘trapped’ unless they sell at a steep loss.

BTC/USD, 1-day chart, year-to-date. Source: Cointelegraph/TradingViewBitMine’s $3.7 Billion Loss and the “Hotel California” Dilemma

The declining net asset value (NAV) is compounded by the increasing regulatory scrutiny, with the MSCI stock market index evaluating the exclusion of corporate crypto treasuries holding more than half their assets in digital currencies. The consultation runs through December 31, with a decision expected in January 2026, potentially impacting how firms report and manage their crypto holdings.

Meanwhile, Bitcoin’s price dipped to around $82,000 on Friday, reaching its lowest in six months, reflecting broader market tension. The decline raises questions about whether a new sustained bear market is on the horizon, despite the digital asset’s role as a hedge in rising inflation environments.

Regulatory and Industry Movements

The SEC’s upcoming roundtable on December 15 focuses on privacy and financial surveillance, amid heightened debate over privacy rights in the crypto ecosystem. Developments such as the Tornado Cash developer guilty verdict and privacy token surges signal growing industry concern, especially with regulatory entities contemplating stricter oversight.

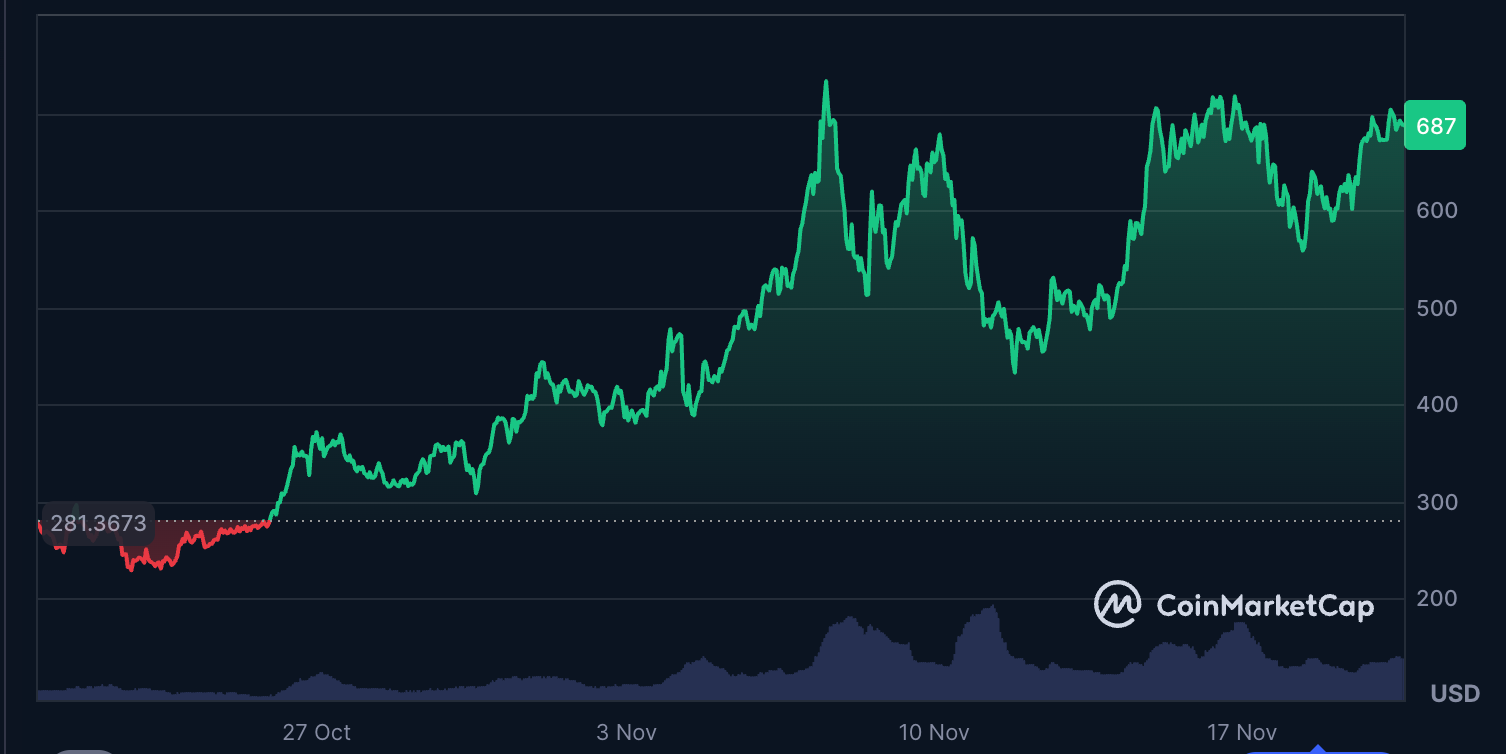

Privacy tokens like Zcash experienced a price surge beginning in October. Source: CoinMarketCap

Privacy tokens like Zcash experienced a price surge beginning in October. Source: CoinMarketCap

Crypto Lending Expands and Industry Innovations Continue

Coinbase has launched Ether-backed loans, enabling U.S. users to borrow USDC against their ETH holdings without selling. Powered by Morpho and operating on the Coinbase-backed blockchain platform Base, the new offering allows loans of up to $1 million. This development highlights the increasing integration of DeFi lending protocols into mainstream crypto services.

In a broader trend, Coinbase’s on-chain lending markets have already processed over $1.25 billion in loans backed by $1.37 billion collateral, with over 13,500 wallets actively borrowing. Concurrently, Mastercard is leveraging Polygon to introduce username-based crypto transactions, simplifying wallet addresses while enhancing trust in digital asset transfers.

DeFi and Blockchain for Social Good

The DeFi Education Fund advocates for using blockchain technology to combat global poverty through reducing transaction costs and expanding financial inclusion. The organization estimates that DeFi could cut remittance fees for unbanked individuals by up to 80%, addressing critical economic barriers in underserved communities worldwide.

Many industry advocates see blockchain and DeFi as vital tools to improve access, transparency, and efficiency in financial systems—especially as regulations tighten and market volatility persists.

As the digital asset space evolves, policymakers and industry leaders are navigating a complex landscape of innovation, regulation, and risk. The coming months will be critical in defining the future trajectory of cryptocurrencies and blockchain-based finance worldwide.

This article was originally published as Bitcoin Crash Sparks Investor Panic as Treasury Crisis Unfolds: A Financial Wake-Up Call on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

US Fed Slashes Interest Rates by 25 BPS: How Will Bitcoin’s Price React?

Lyft Stock Hits Three-Year High After Waymo Partnership