Coinbase Joins The Fray, Reportedly Working On Polymarket Competitor

Coinbase to launch a regulated prediction markets platform with Kalshi, and is giving users event-based trading across several sectors.

Coinbase is expanding again. The company is developing a prediction markets platform that will offer event-based trading across several sectors.

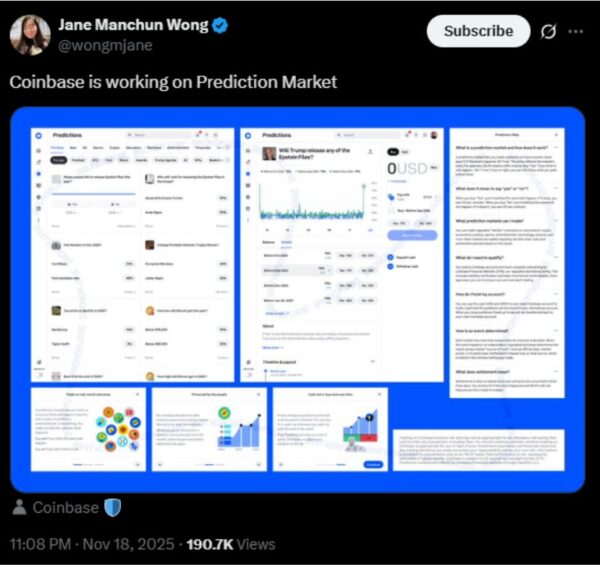

Leaked images shared by tech researcher Jane Manchun Wong show the upcoming service and indicate that Coinbase plans to link the product directly to Kalshi. This is another step in Coinbase’s push to become a complete exchange for both crypto and traditional financial products.

Coinbase Prediction Markets Planned Through Kalshi

Screenshots posted by Wong show a clear view of Coinbase’s new interface.

The images include a branded prediction market layout, an FAQ section and a guide that explains how event contracts work. A notice in the screenshots states that the platform is offered by Coinbase Financial Markets, the derivatives division of Coinbase.

Kalshi appears throughout the interface as the regulated partner supporting the event contracts.

Coinbase is reportedly working on partnering with Kalshi | source- X

Coinbase is reportedly working on partnering with Kalshi | source- X

Kalshi operates under the supervision of the Commodity Futures Trading Commission and its regulatory status allows it to offer event-based trading within a controlled framework.

Coinbase plans to rely on that structure so that users can trade event contracts through a platform that follows United States rules.

One screenshot indicates that users will be able to participate with USDC or regular US dollars. Coinbase already works with Kalshi as the custodian for its USDC-backed event contracts. It stores the stablecoin reserves in cold storage, which gives the partnership an added layer of security.

This collaboration indicates a clear goal. Coinbase wants to position itself as a unified exchange for crypto, derivatives and event-based markets.

Exchange Ambition Through Regulated Event Trading

Trading volumes for prediction markets have grown recently. Kalshi reached more than four billion dollars in monthly volume.

Polymarket also reported increases as users flocked to trade outcomes tied to elections, policy decisions and major public events. Notably, other exchanges are moving in the same direction. Crypto.com now offers a prediction platform that links to Trump Media.

Several exchange services are adding prediction markets to their services | source: X

Several exchange services are adding prediction markets to their services | source: X

Gemini is working on its own product as part of a larger plan to build a super app and it even recently submitted filings to become a designated contract market through the CFTC.

Coinbase sees an opening here, and is likely attempting to take advantage of it. A prediction markets product would give the exchange a way to reach new users and broaden its base.

By combining event contracts with USDC support, Coinbase can deliver a trading option that is familiar to crypto users and accessible to newcomers.

The leaked screenshots show categories like sports, science, economics, politics and technology and new markets appear to be added regularly.

This fits Coinbase’s plan to create a more flexible exchange where traders respond to global events as easily as they trade crypto assets.

Related Reading: Kalshi Users Gain Secure USDC Trading Through Coinbase Custody

Using Kalshi’s Framework To Ensure Compliance

Coinbase Financial Markets will run the prediction market under Kalshi’s regulatory umbrella.

This setup means users can trade event contracts through a secure and supervised system. Kalshi already offers regulated event trading so Coinbase gains a strong foundation without building new compliance structures from the ground up.

Coinbase’s role as custodian for Kalshi’s USDC reserves strengthens this link. Holding the stablecoin supply in cold storage offers transparency and security. It also helps both companies maintain trust in a segment that often faces legal questions.

The partnership will also likely reduce friction for users. Event contracts will be available through a familiar Coinbase interface and traders can use their existing USDC or dollar balances instead of switching platforms.

This approach combines traditional finance and crypto trading into a single environment.

The post Coinbase Joins The Fray, Reportedly Working On Polymarket Competitor appeared first on Live Bitcoin News.

You May Also Like

Shibarium May No Longer Turbocharge Shiba Inu Price Rally, Here’s Reason

👨🏿🚀TechCabal Daily – When banks go cashless