NFT sales drop 28% to $98m, Bored Ape Yacht Club sales surge 100%

According to CryptoSlam’s data, NFT (non-fungible token) sales volume has declined by 28.42% to $98.18 million, down from last week.

However, market participation has bucked the trend, with NFT buyers surging by 22.86% to 626,341 and sellers climbing by 13.54% to 469,316.

NFT transactions fell by 5.08% to 1,458,311. The global crypto market cap has also dropped and now stands at $3.71 trillion, down from last week’s $3.75 trillion.

- NFT sales fell 28% to $98.18M, but buyers surged 22.86% to 626,341.

- BAYC sales jumped 108%, while DMarket and DX Terminal saw declines.

- Ethereum led networks with $41.72M in NFT sales, up nearly 20% weekly.

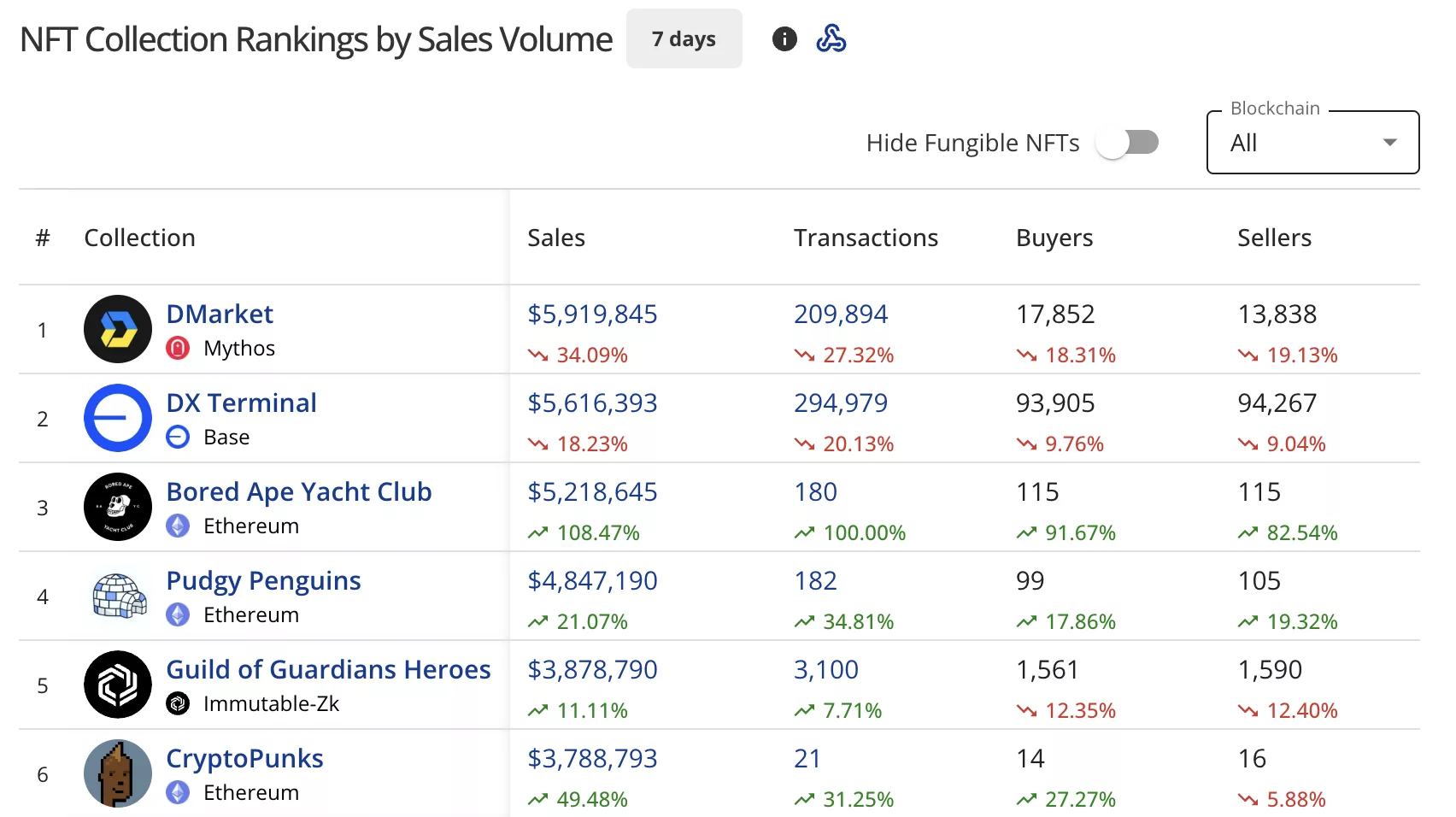

DMarket’s decline, BAYC’s comeback

DMarket, on the Mythos blockchain, is down 34.09% from last week’s $9.05 million. Yet it still maintains first place with $5.92 million in sales. The collection processed 209,894 transactions with 17,852 buyers and 13,838 sellers.

DX Terminal on Base held second position at $5.62 million, down 18.23% from last week’s $7.56 million. The collection recorded 294,979 transactions.

Bored Ape Yacht Club stormed back into the top rankings at third place with $5.22 million in sales, surging 108.47%.

The Ethereum (ETH) collection had 180 transactions with 115 buyers and 115 sellers.

Pudgy Penguins climbed to fourth with $4.85 million, up 21.07% from last week’s $3.80 million. The collection saw 182 transactions with 99 buyers and 105 sellers.

Guild of Guardians Heroes on Immutable-Zk secured fifth place at $3.88 million, up 11.11% from last week’s $3.45 million. The collection had 3,100 transactions.

CryptoPunks entered the top six with $3.79 million, surging 49.48%. The Ethereum collection processed just 21 transactions with 14 buyers and 16 sellers.

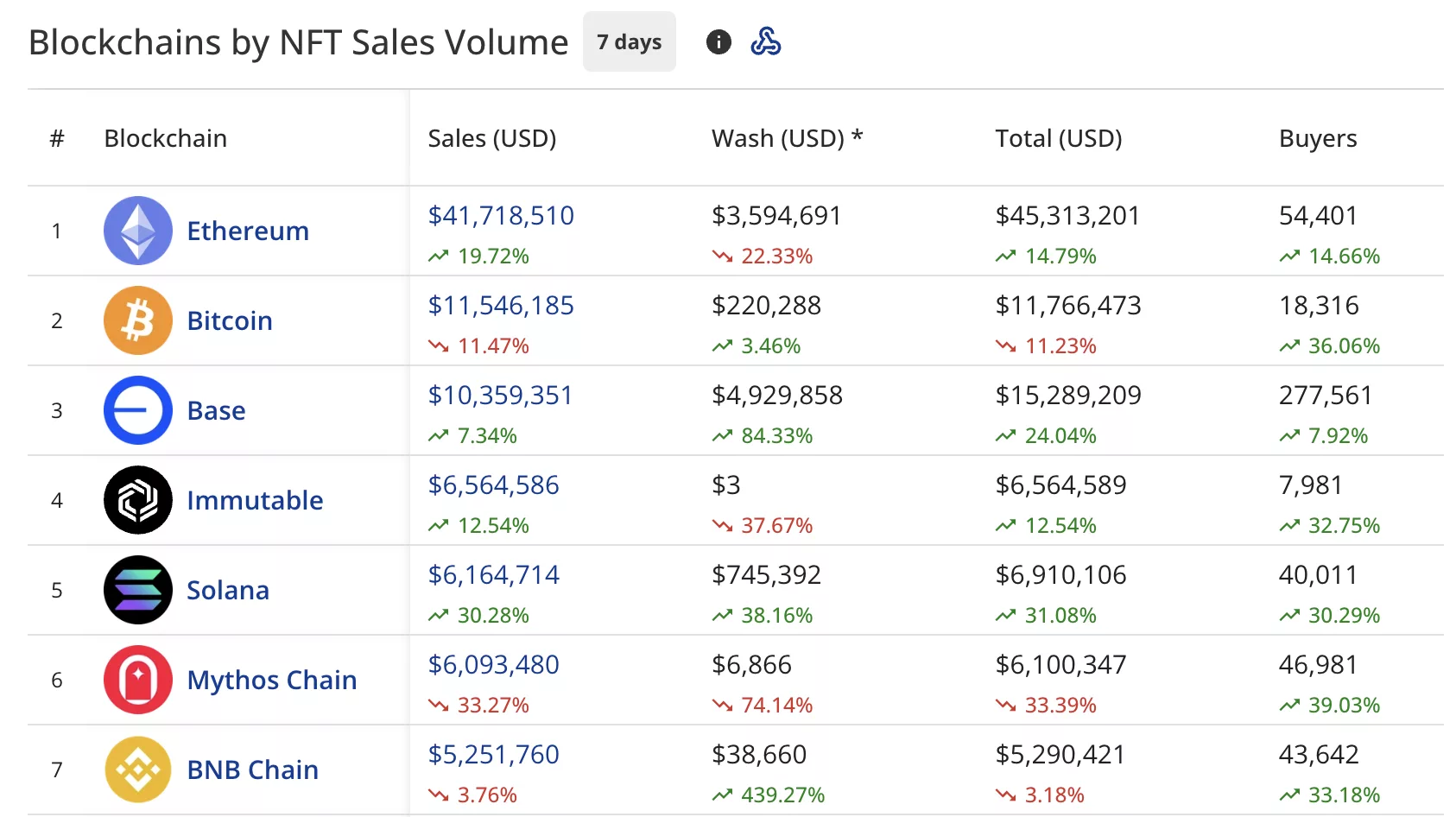

Ethereum extends lead

Ethereum strengthened its position at the top with $41.72 million in sales, up 19.72% from last week’s $35.04 million.

The network recorded $3.59 million in wash trading, bringing its total to $45.31 million. Buyers increased by 14.66% to 54,401.

Bitcoin (BTC) held second place with $11.55 million, down 11.47% from last week’s $13.17 million. The network saw 18,316 buyers, up 36.06%.

Base remained in third with $10.36 million, up 7.34% from last week’s $10.19 million. The blockchain recorded $4.93 million in wash trading, with buyers rising 7.92% to 277,561.

Immutable (IMX) climbed to fourth position with $6.56 million, up 12.54% from last week’s $5.73 million. The network had 7,981 buyers, up 32.75%.

Solana (SOL) secured fifth place with $6.16 million, surging 30.28% from last week’s $4.92 million. The blockchain attracted 40,011 buyers, up 30.29%.

Mythos Chain dropped to sixth at $6.09 million, down 33.27% from last week’s $9.27 million. The blockchain had 46,981 buyers, up 39.03%.

BNB Chain (BNB) rounded out the top seven with $5.25 million, down 3.76% from last week’s $5.33 million. Buyers jumped 33.18% to 43,642.

CryptoPunk leads high-value transactions

- CryptoPunks #8407 topped individual sales at $413,469.94 (100 ETH), sold five days ago.

- Bored Ape Yacht Club #3105 placed second at $359,769.63 (90 ETH), sold three days ago.

- V1 Cryptopunks Wrapped #4350 sold for $248,839.14 (62.9 ETH) seven days ago.

- Autoglyphs #256 fetched $222,558.91 (59 WETH) two days ago.

- CryptoPunks #7378 completed the top five at $212,360.44 (51 ETH), sold five days ago.

You May Also Like

China Launches Cross-Border QR Code Payment Trial

GBP/USD has moved into a range-trading phase – UOB Group