Stablecoins Fuel $670B Loans According to Visa, Boosting $BEST

KEY POINTS: Visa report shows that over $670B in on-chain lending has been powered by stablecoins.

Visa report shows that over $670B in on-chain lending has been powered by stablecoins. KPMG highlights that using stablecoins can reduce payment settlement times to seconds and cut fees by up to 99%.

KPMG highlights that using stablecoins can reduce payment settlement times to seconds and cut fees by up to 99%. Best Wallet and its native $BEST token can make your crypto investments easier and faster.

Best Wallet and its native $BEST token can make your crypto investments easier and faster.

Visa reports that stablecoins have already fueled a massive new lending market, powering over $670B in loans across blockchain platforms in the last five years. This ‘on-chain’ lending reached a monthly volume of $51.7B in August 2025, with an average borrowing rate of around 6.7%, comparable to traditional markets.

The surge in blockchain-based lending can largely be attributed to newfound clarity from the U.S. government, particularly following the passage of the GENIUS Act. This landmark legislation introduced the first federal guidelines for stablecoins, providing banks and financial institutions with the confidence they need to enter the world of blockchain-driven finance.

As a result, two dominant players, Tether’s $USDT and Circle’s $USDC, now dominate the stablecoin market, fueling the majority of lending activity. This is especially true on leading platforms like Aave and Compound, where blockchain-based lending is rapidly gaining momentum.

On the payments front, KPMG has highlighted stablecoins as a near-term solution to the sluggish and costly cross-border system. Right now, banks rely on a network that handles roughly $150T annually but takes several days to settle and costs an average of $24 to $35 per transaction.

KPMG says using stablecoins on a blockchain can drop settlement times to just seconds or minutes, and transaction fees could fall by a staggering 99%. This efficiency is also freeing up huge amounts of capital that banks currently have to lock up in nostro and vostro accounts around the world.

The biggest names in finance are already jumping on board: JPMorgan handles a whopping $2B in transactions daily on its private blockchain, while PayPal made waves in 2023 by launching its own stablecoin.

Both reports highlight that stablecoins are uniquely poised to revolutionize and automate global lending and capital markets. It’s clear—the digital dollar is gearing up for its big entrance into the heart of mainstream finance.

Best Wallet: Stop Juggling Apps, Start Thriving in Web3

As much as it’s exciting and a little risky, if we’re being honest, dealing with crypto can be a real headache. There are too many chains, too many confusing wallets, and the fear of losing a seed phrase. But not anymore, thanks to Best Wallet and its native Best Wallet Token ($BEST).

It’s built to be your ultimate Web3 super-app, putting you in total control without the complexity. It’s non-custodial, so your keys are yours, but it’s backed with security powered by Fireblocks MPC-CMP tech.

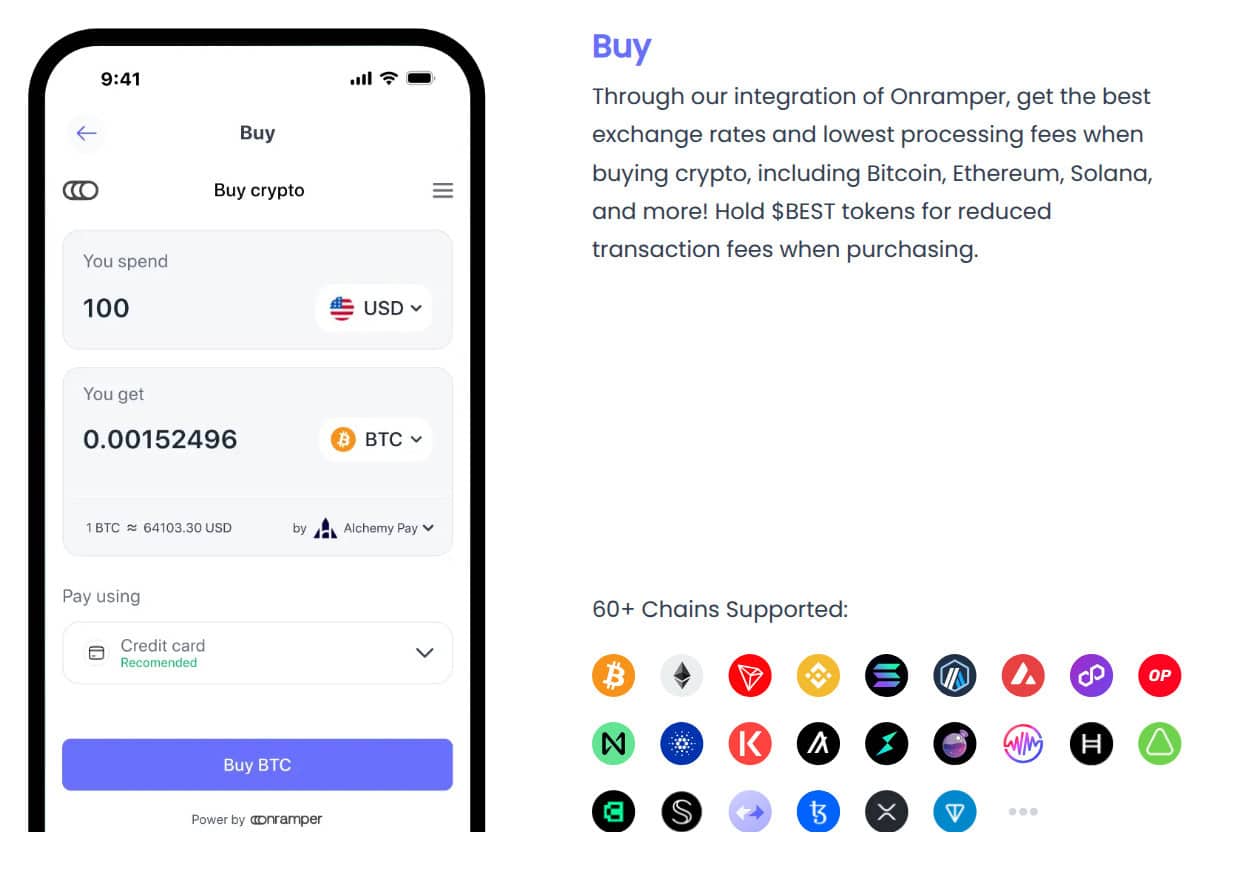

Best Wallet aims to be a multi-chain powerhouse by supporting over 60 different blockchains in the future. It currently supports six, including Ethereum, Solana, and BNB Chain, but it also has the ambition to include the ones fuelling the stablecoin revolution.

It features an integrated DEX aggregator that automatically finds the cheapest and fastest routes across hundreds of exchanges and bridges, ensuring you always get the best rate.

$BEST: Your All-Access Pass to Higher Returns

If you’re ready to get serious about stablecoin lending or exploring the next big token, you need the Best Wallet Token ($BEST). It’s your VIP membership to the entire Best Wallet ecosystem, and it’s designed to put more money back in your pocket.

Holding $BEST unlocks a stack of financial superpowers. You get significant discounts on trades, swaps, and cross-chain transactions inside the wallet.

What sets $BEST apart? For starters, holders get exclusive early access to the hottest token presales and project launches through the in-app ‘Upcoming Tokens’ feature—no waiting, just opportunities.

But that’s not all. You can supercharge your passive income with boosted APY on staking, while also having a voice in the future of the ecosystem through governance rights. And coming soon, the Best Card will let you enjoy cash back and discounts when spending your cryptocurrency.

The $BEST token is more than just hype—it’s a powerful utility that amplifies your advantages in the fast-evolving world of digital finance. With over $16M raised in its presale, the momentum is undeniable, and people are already seeing its potential.

Unsure how to get in on the deal? Follow our ‘How to Buy Best Wallet Token’ guide for all the information.

You May Also Like

Ultimea Unveils Skywave X100 Dual: 9.2.6 Wireless Home Theater Launching March 2026

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be