XRP Price Slumps 2.3% As Ripple CTO David Schwartz Announces Exit

The XRP price has dropped 2.3% in the last 24 hours to trade at $2.86 as 3.30 a.m. EST amid news that David Schwartz will step down as Rippple’s Chief Technology Officer (CTO).

While he will no longer handle day-to-day responsibilities as CTO, Schwartz assured the XRP community that he is not leaving entirely. He intends to stay engaged and continue contributing to the ecosystem, reinforcing his long-standing commitment to Ripple and its community.

Schwartz’s ongoing involvement as a board member is expected to provide continuity and technical guidance. Ripple’s engineering is now led by Dennis Jarosch, who carries the task of advancing Ripple’s tech innovations.

Investors will watch closely for any new product announcements or partnerships that could boost the XRP price and adoption.

XRP Active Addresses Drop as Price Holds Steady

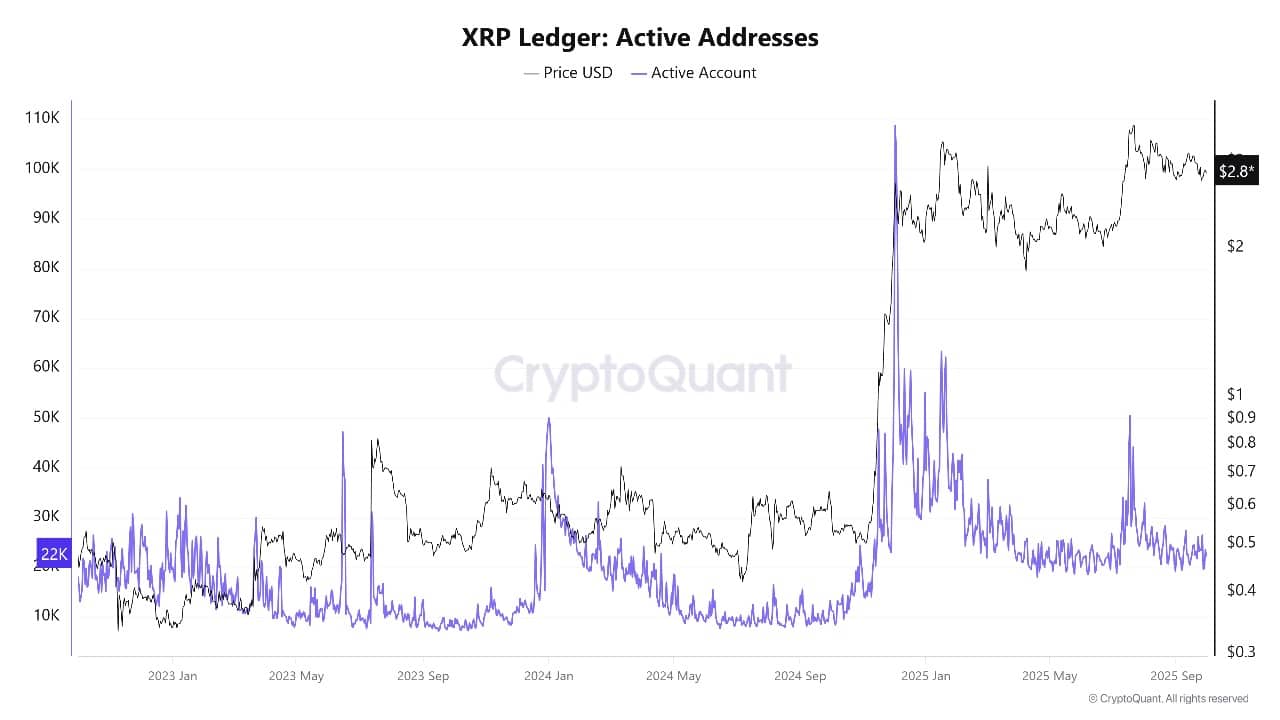

New data shows that activity on the XRP Ledger has slowed down even though XRP’s price is holding above $0.50. According to CryptoQuant, the number of active addresses has dropped to around 22,000 per day.

This is much lower than the spikes seen in late 2024 and early 2025, when daily active addresses went above 100,000.

Back then, XRP also rallied strongly, moving above $2.50. But in recent months, while network activity has cooled, XRP has stayed fairly stable in price.

This means that fewer retail users are active on the network, but larger or long-term investors may still be supporting the price.

The gap between low address activity and steady price performance suggests that XRP is being held more for investment than frequent transactions.

XRP Ledger Active Addresses Source: CryptoQuant

XRP Price Drops Amid Leadership Change

XRP price declined from recent highs, hitting a low near $2.81 before bouncing to around $2.86 in the last 24 hours. The coin is still above its important 200-day simple moving average (SMA) at $2.56, which acts as a strong support level and dampens deeper losses.

The 50-day SMA at $2.94 serves as resistance, meaning XRP needs to clear this to regain upward momentum.

XRPUSDT Analysis Source: Tradingview

Looking at the chart, the XRP price is trading between key Fibonacci retracement levels from its recent peak near $3.66 to the low around $2.07. The price currently sits close to the 0.618 retracement level at $2.68, a common support zone during corrections.

Technical indicators reflect neutral market conditions. The Relative Strength Index (RSI) is near 46.49, suggesting no strong momentum either way. The MACD is slightly below the signal line but close to neutrality, signalling possible price consolidation.

The Average Directional Index (ADX) reads 14.88, indicating a weak trend, which means the market may be waiting for new catalysts.

If XRP breaks above the 50-day SMA at $2.94, the next resistance zone lies between $3.00 and $3.20. Surpassing this could trigger renewed buying and a test of higher levels near the $3.60 peak.

However, if the price falls below the 200-day SMA at $2.56, XRP might revisit lower supports near $2.41 and $2.07, risking further short-term selling.

XRP remains supported by key moving averages and Fibonacci levels, while technical indicators suggest a wait-and-see market.

Related Articles:

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures