Hypurr NFT Fetches $467K After Airdrop As $400K Hack Hits Hyperliquid

An airdropped Hypurr NFT (non-fungible token) fetched one investor $467K while a $400K hack has hit the Hyperliquid ecosystem.

The collection, comprising 4,600 NFTs, was launched on the HyperEVM mainnet on Sunday, with the floor price for the digital assets soaring above $70K and trading volume around the NFTs surging to millions of dollars.

Hypurr NFTs Launched To Reward Early Hyperliquid Backers

Hyperliquid confirmed the launch of the NFTs in a recent X post, and said the goal behind the initiative is to “share a memento with those who believed in and contributed early on to Hyperliquid’s growth.”

“Each NFT is unique and captures the different moods, hobbies, tastes, and quirks of the Hyperliquid community, as depicted by Hypurr,” the project said in the post.

The NFTs were distributed to participants of Hyperliquid’s Genesis Event that took place last November, when the project launched its native HYPE token.

4,313 NFTs were allocated to participants of the event, while 144 Hypurr NFTs went to the Hyper Foundation. The remaining 143 NFTs were sent to developers and artists.

Investor Sells Hypurr NFT For $467K

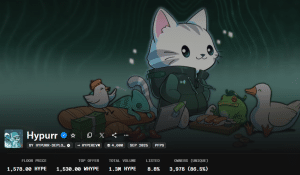

The floor price for the NFTs has skyrocketed to 1,578 HYPE, according to data from OpenSea. With the token trading at $47.73 as of 4:42 a.m. EST, this equates to around $75.31K.

The total trading volume for the collection has also soared to 1.3 million HYPE, which is more than $62 million at current prices.

HYPE’s price has also jumped over 7% in the last 24 hours, data from CoinMarketCap shows.

Hypurr NFT collection overview (Source: OpenSea)

There have, however, already been sales well above the floor price for Hypurr NFTs. The Hypurr #21 NFT with extremely rare “Knight Ghost Armor” and “Knight Helm Ghost” traits went for $467K on Sunday.

Demand for the collection was also high before the NFTs were even officially launched. DripTrade data shows that certain assets from the collection were sold for as much as $88K through OTC (over the counter) desks earlier this month.

Those trades were made possible through DripTrade’s OTC system, which gives buyers and sellers a way to agree on a set sale price before launch. Sellers are then required to fulfill the trade within seven days of receiving the NFT, or they will forfeit the collateral that they put forward as part of the agreement.

One X user, DidiTrading, revealed that they received a Hypurr NFT, but said that they will “give the market some time to find equilibrium” before selling the airdropped digital asset.

However, the high prices for the NFTs, which are essentially unique digital pictures of cats that were distributed for free, has drawn criticism online, especially amid the global cost-of-living crisis.

One X user, MoonOverlord, said that Crypto Twitter (CT) “is really a special place in hell,” and criticised recipients of the NFTs who were posting their $50K digital assets they received for free while the average person is “struggling to get by or buy groceries.”

Amid the backlash, there have also been questions around the actual utility of the NFTs. This is after the team said in an official document that “Hypurr NFTs may from time to time be associated with certain benefits, features, or entitlements (‘Utility’), but no Utility is promised or guaranteed under these Terms.”

The launch of the NFTs has also sparked debate about whether it could revive the NFT market after years of stagnation following its 2021 peak.

Hacker Steals $400K Worth Of Hypurr NFTs

While some received Hypurr NFTs for participating in Hyperliquid’s Genesis Event, one bad actor managed to come by eight of the digital assets by hacking into multiple wallets.

According to well-known on-chain sleuth ZachXBT, the hacker stole the NFTs through compromised wallets and profited around $400K.

According to the HyperEVM blockchain scanner HyperEVMScan, the hacker has a balance of just over 3.8 HYPE tokens, valued at around $185.53. This balance includes holdings in Lilly (Lilly), USD Coin (USDC) and two Hypurr NFTs.

The two NFTs are Hypurr #2485 and Hypurr #3800, according to the blockchain data.

You May Also Like

Golden Trump statue holding Bitcoin appears outside U.S. Capitol

First Multi-Asset Crypto ETP Opens Door to Institutional Adoption