Bitcoin Prepares for October Rally as September Crash Strikes Again

TLDR

- Bitcoin trades around $109,000 as September ends flat after early gains were erased

- October historically performs well for Bitcoin, with 10 green months out of 12 since 2013

- Nearly $1.7 billion in long positions were liquidated during September’s pullback

- Bitcoin ETFs saw $1.13 billion in outflows over four consecutive days this week

- Q4 historically delivers strong returns for Bitcoin, averaging 85% gains since 2013

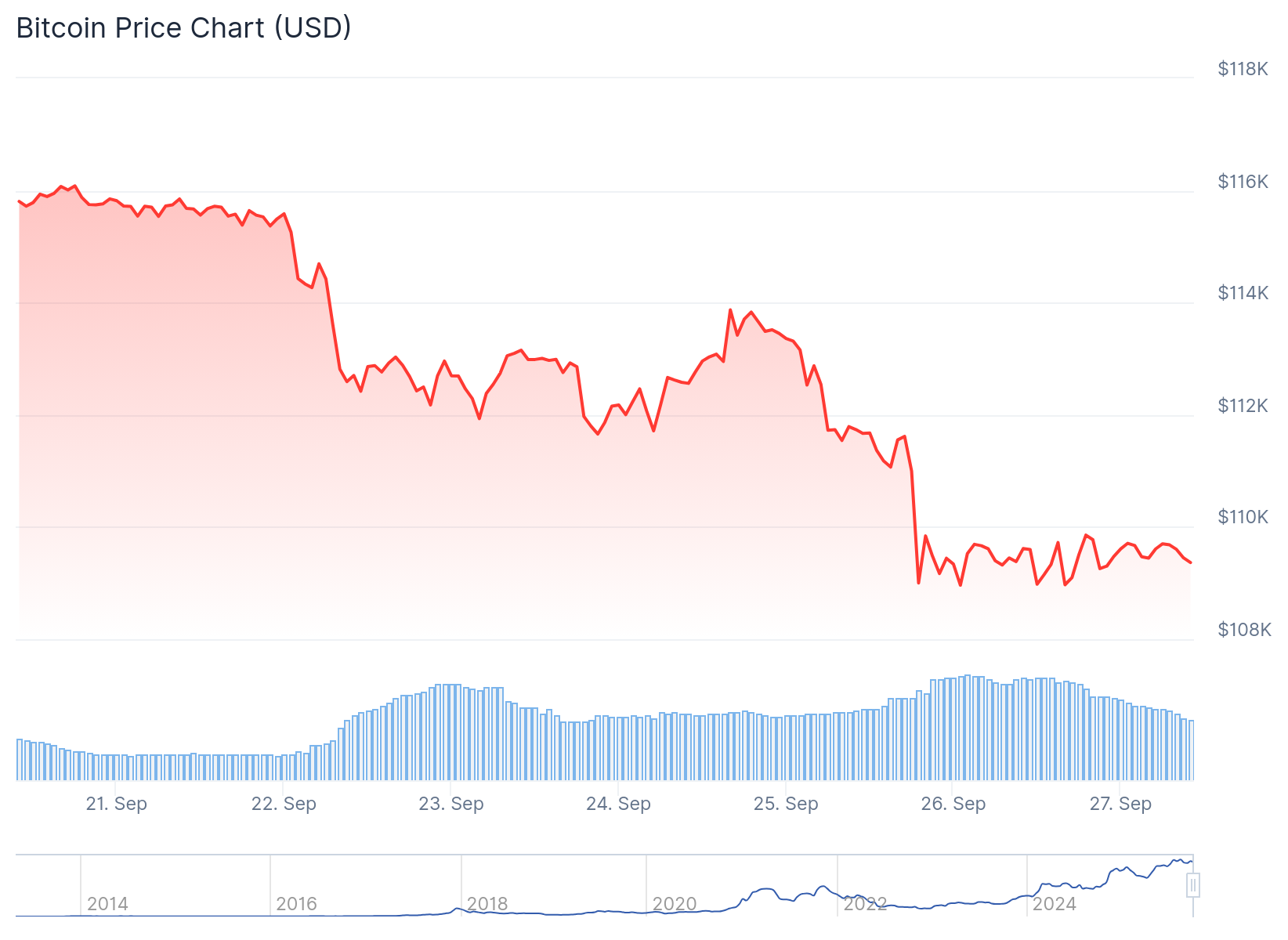

Bitcoin is trading near $109,000 as September draws to a close, with traders already looking ahead to October’s historically strong performance. The world’s largest cryptocurrency has endured another challenging September, living up to its reputation as the worst month for crypto markets.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

September started with promise but quickly turned sour. What began as one of the most encouraging Septembers in recent years has now flattened out completely. Nearly all early gains have been wiped away, leaving the month with just a 1% gain according to historical data from Coinglass.

The selloff hit leveraged traders hard. Close to $1.7 billion in long positions were liquidated during the month’s decline. This massive liquidation event shook confidence among retail investors who had bet on continued upward momentum.

Institutional Money Flows Out

Institutions also pulled back from Bitcoin exposure during September’s turbulence. Bitcoin spot ETFs experienced four straight days of outflows, losing $1.13 billion over the week. Ethereum ETFs faced similar pressure with $795.8 million in outflows during the same period.

The Fear and Greed Index dropped to 33, firmly in “fear” territory. This level of panic among market participants often signals potential buying opportunities for contrarian investors. When retail sentiment turns negative, institutional buyers sometimes view it as an entry point.

Bitcoin’s price action reflects this uncertainty. The cryptocurrency slipped below its 200-day trend line at $112,400, with the next key support level at $104,000. Technical indicators show momentum fading, with the RSI dropping to 38, indicating weakness in the short term.

October’s Track Record

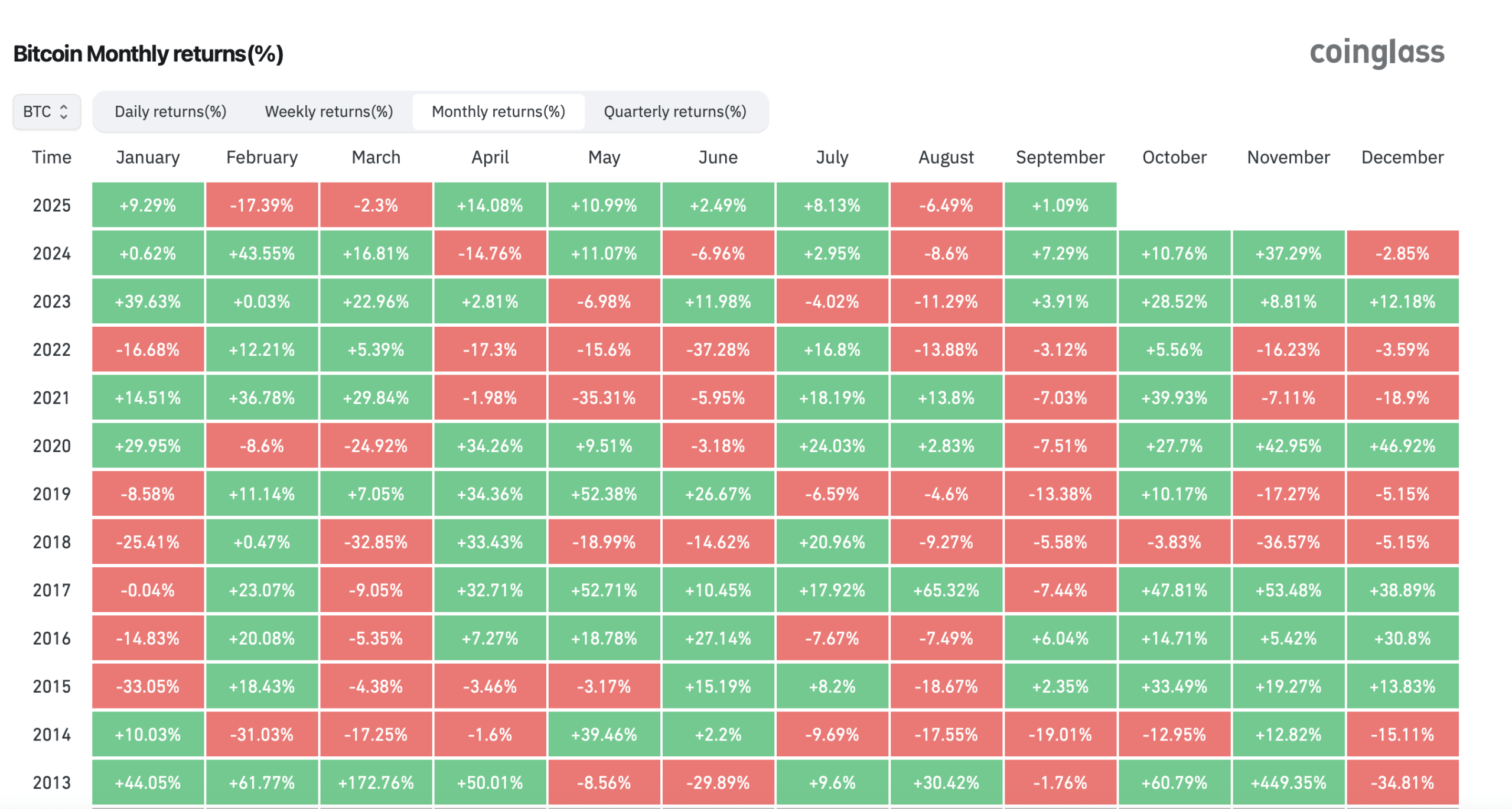

Despite September’s poor showing, October presents a different picture entirely. Data from Coinglass reveals that October has delivered positive returns in 10 of the last 12 years since 2013. The month has earned the nickname “Uptober” among crypto traders for good reason.

Source: Coinglass

Source: Coinglass

Some October performances stand out as exceptional. In 2013, Bitcoin gained 60.79% during the month. Other strong years include 2015 with 33.49% gains, 2017 with 47.81%, and 2021 with 39.93% returns. Even in weaker years, October typically delivered solid gains.

Only two Octobers since 2013 ended in the red. Bitcoin fell 12.95% in October 2014 and declined 3.83% in October 2018. These exceptions prove that historical patterns don’t guarantee future results, but the overall track record remains compelling.

The current setup heading into October appears favorable. Bitcoin hasn’t experienced a major blow-off top that would need cooling off. There’s also no capitulation selloff to recover from. The market feels reset after September’s modest decline.

Q4 Strength Expected

Looking beyond October, the fourth quarter historically favors Bitcoin performance. Since 2013, Q4 has averaged 85% returns for the cryptocurrency. November alone typically brings 46% gains on average, while October contributes around 21%.

Several factors could support a Q4 rally. Potential Federal Reserve rate cuts may weaken the dollar and boost risk assets like Bitcoin. A supply-demand imbalance also favors higher prices, with institutional demand projected at $3 trillion against only $77 billion worth of new Bitcoin issued annually.

Market participants remain cautious but optimistic about the months ahead. The combination of seasonal patterns, potential policy changes, and supply dynamics creates conditions that have historically supported Bitcoin rallies.

Bitcoin currently trades at $109,590, showing slight gains in the past 24 hours as September comes to an end.

The post Bitcoin Prepares for October Rally as September Crash Strikes Again appeared first on CoinCentral.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

Mystake Review 2023 – Unveil the Gaming Experience