Digitap Vs BlockDAG: Which Token Has 50x Potential In Wall Street’s Next Banking Rotation?

The crypto market thrives on narratives. Some tokens rise due to hype, while others rise because of their clear use. Right now, BlockDAG is one of the trending names. Traders are debating whether it can deliver massive returns.

At the same time, another project is moving quietly through its presale. Digitap is presenting itself as a token with real utility, a clear design, and a vision that lines up with how money is changing.

The comparison is worth making. One project builds on technical promises, the other leans into a practical story about how people spend and manage funds.

BlockDAG and the Race for Scalability

BlockDAG has caught attention due to its unique structure. The project does not follow the single-chain model of Bitcoin or Ethereum. Instead, it is built on a directed acyclic graph. This model lets multiple blocks connect at once. In theory, it means faster settlement and more transactions per second. Supporters argue that it solves the old problem of congestion.

The idea is simple: more speed, less waiting. BlockDAG positions itself as a foundation for future financial systems. It has even been compared with Ethereum’s early days, when people saw the potential of smart contracts before most knew how they would be used.

But BlockDAG’s story is still mostly about technology. The project has bold plans, but it still shows little proof of adoption in daily use. It remains a speculative bet.

Traders hope the hype is enough to lift it higher during the next rotation of capital into crypto projects. That may happen, but questions remain. Can the project move beyond theory and hype?

Why Utility, Not Hype, Sets Digitap Apart

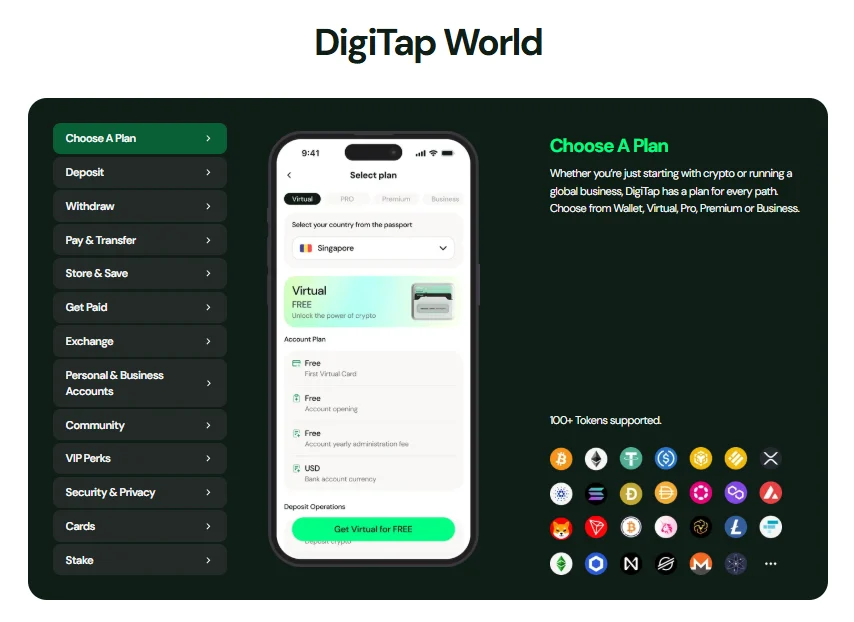

Digitap tells a different story. Instead of focusing only on speed or technical design, it speaks directly to how money works in practice. The project aims to build an omni-banking platform that combines crypto and fiat into one place. The $TAP token is at the center of this vision.

The utility is clear. $TAP is designed for payments, rewards, and governance inside the Digitap system. Every transaction feeds into a buyback and burn model, reducing supply over time. This creates scarcity while linking the token directly to platform activity. Unlike many speculative coins, $TAP is tied to clear functions: fee payments, cashback rewards, and tiered benefits.

Another edge is the privacy-first stance. Digitap offers no-KYC onboarding and offshore accounts, which appeal to freelancers, global workers, and the unbanked. With multi-currency accounts, instant transfers, and Visa-linked cards, the idea looks practical.

In short, Digitap frames itself as a one-stop finance app blending crypto and fiat. While BlockDAG leans on tech promises, Digitap offers an experience today that people can use to pay, send, and store funds without friction.

Early Entry, Fixed Supply, Real Rewards

The presale gives an early look at interest. Digitap is close to the $200,000 mark. The total supply is capped at two billion tokens, with no future minting. Early adopters can stake and earn rates of up to 124% APR, which are drawn from fixed pools rather than inflationary emissions. This design is meant to protect value while rewarding loyalty.

Team tokens are locked for five years, another sign of commitment. Tokens bought during the presale will be claimable shortly after launch, which gives participants quick access. Unlike projects that promise years of waiting, Digitap plans to move fast once the presale ends.

The pitch is simple: enter early, benefit from scarcity, and gain rewards that are structured to last. Compared with BlockDAG’s still-developing model, Digitap’s tokenomics look more concrete.

Why Digitap May Be the Smarter 50x Play

BlockDAG is an exciting idea. Its technical design may solve speed and scaling issues. Traders looking for hype-driven moves may find it attractive. But it remains a project with questions about adoption and use. The token’s future depends heavily on whether the vision can turn into a working system that people actually need.

Digitap, on the other hand, connects directly with everyday finance. Its edge lies in utility: payments, rewards, privacy, and real spending options. The presale shows early momentum, and the deflationary design creates a foundation for long-term value.

For those watching where the next 50x move might come from, both projects are worth monitoring. But the smarter play may be Digitap. It offers asymmetry: a low entry price, a clear use case, and a token economy that rewards activity. This is why Digitap could prove to be the project that delivers when the next banking rotation arrives.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Social: https://linktr.ee/digitap.app

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

USD/INR edges lower as Indian Rupee gains on improving equity inflows