Strategy's Bitcoin leverage game: Wall Street short-selling sniping, large institutions holding shares and betting

Author: Nancy, PANews

As the price of Bitcoin returns to the high of $100,000 and the share price of MSTR continues to rise, the market's divergence on the valuation of Strategy (formerly MicroStrategy) is accelerating. On the one hand, many large global institutions are quietly increasing their holdings of MSTR shares, viewing it as an important financial tool for indirectly allocating Bitcoin; on the other hand, its highly volatile and deeply leveraged asset structure has also attracted the sniping of Wall Street shorts. As Strategy continues to increase its exposure to Bitcoin, it is evolving into a weather vane for Bitcoin price trends and the focus of capital leverage games.

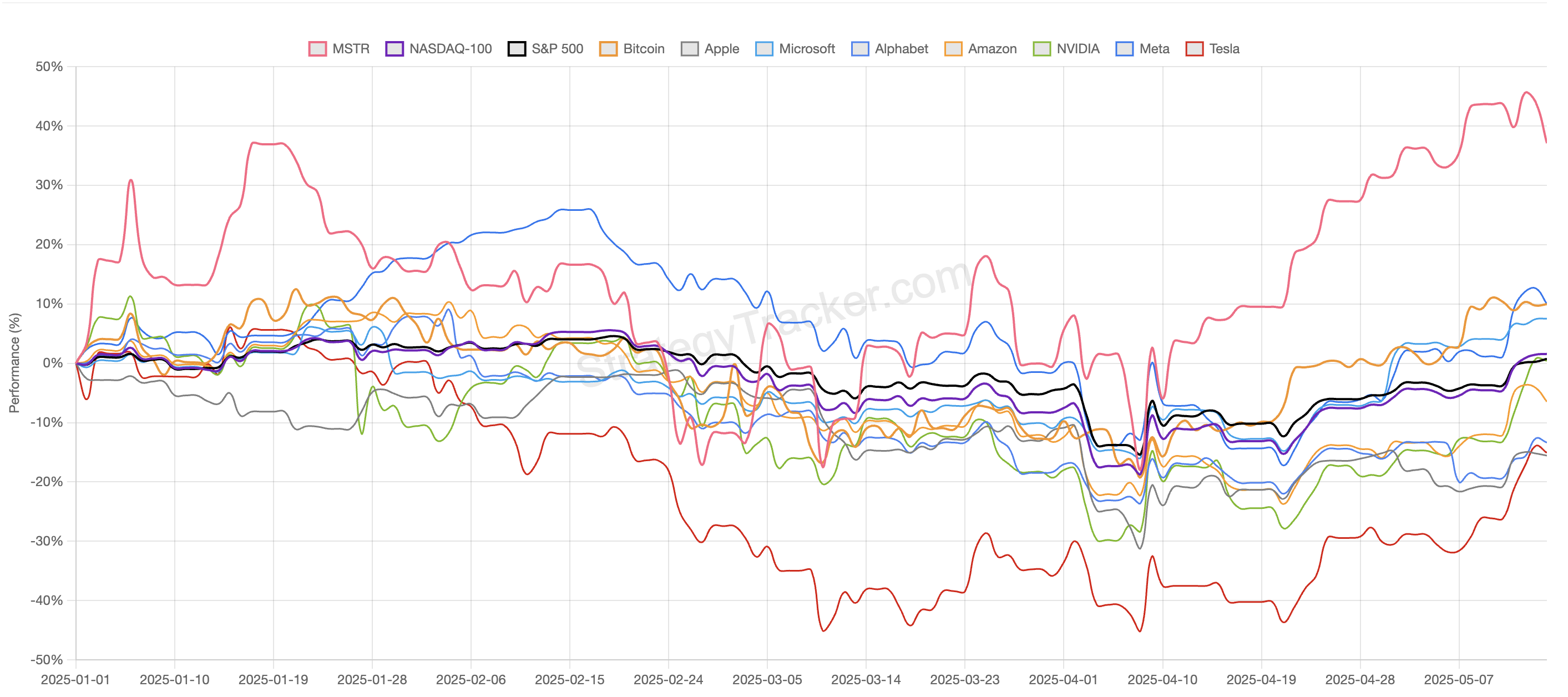

The stock price outperformed the technology giants and was targeted by Wall Street's big short sellers

At the recent Sohn Investment Conference in New York, legendary Wall Street short seller and former hedge fund manager Jim Chanos said he was shorting Strategy and buying Bitcoin at the same time, calling it an arbitrage opportunity of "buy at $1 and sell at $2.5."

He pointed out that Strategy holds more than 500,000 bitcoins through high leverage, and the current stock price has a high premium compared to the actual holdings. He criticized the emergence of a number of companies imitating Strategy in the market, selling the concept of buying bitcoins through corporate structures to retail investors and using this to gain high valuations, calling this logic "absurd."

Over the past year, MicroStrategy's stock price has risen by more than 220%, while Bitcoin has only risen by about 70%. Chanos believes that this transaction is a "barometer" for observing retail speculation.

Chanos is a well-known and influential investor on Wall Street. As the founder of Kynikos Associates, a hedge fund focusing on short-selling strategies, he is known for his in-depth fundamental analysis and his ability to keenly identify corporate financial fraud and business model flaws. His classic short-selling cases include Enron, WorldCom, and Luckin Coffee. However, in recent years, he has also suffered serious losses from shorting Tesla, and some funds have been closed or adjusted their strategies.

It is worth noting that this is not the first time that Strategy has become the target of a well-known short seller. In December last year, Citron Research, a well-known short-selling institution, announced that it had shorted Strategy. Although it was bullish on Bitcoin as a whole at the time, it believed that MSTR had seriously deviated from Bitcoin's fundamentals. This news once caused MSTR to plummet in the short term, but due to the optimistic market sentiment driven by the rise of Bitcoin, and the increase in market visibility and liquidity brought by MSTR's inclusion in the Nasdaq 100 Index, this short selling ultimately failed.

In addition to external short-selling pressure, Strategy executives have also been selling shares frequently. It was disclosed that Jarrod M. Patten, who has served as a director of the company for more than 20 years, has sold a total of about $5.2 million worth of shares since April this year, and plans to sell another $300,000 this week.

Despite this, MSTR's recent stock price performance remains strong. According to MSTR-tracker data, Strategy's total market value has reached US$109.82 billion, ranking 183rd in global asset market value. MSTR has risen by about 37.1% this year, not only outperforming Bitcoin, but also ahead of technology giants such as Microsoft, Nvidia, Apple and Amazon.

Q1 financial report shows huge loss of more than 4 billion US dollars, with over 1,000 institutions betting on shares

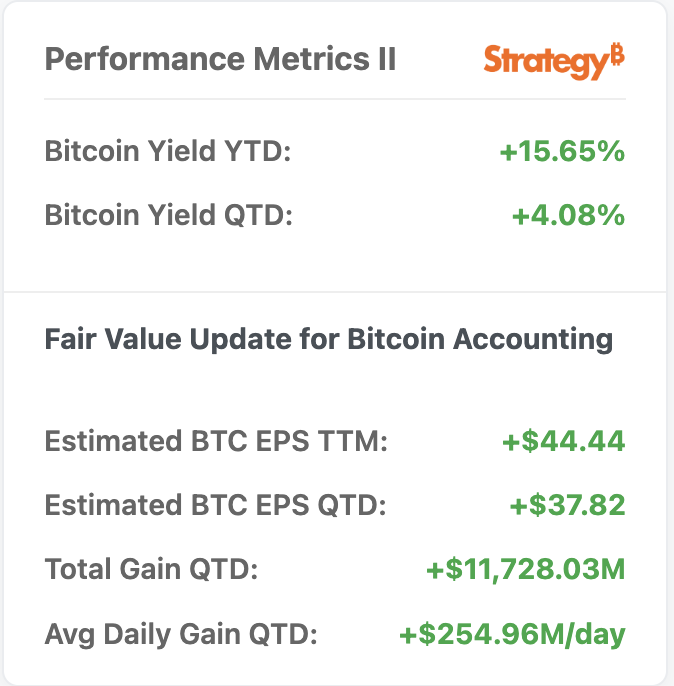

MSTR-tracker data shows that as of May 16, Strategy holds a total of 568,840 BTC, with a year-to-date Bitcoin investment return of 15.65%. According to the latest data, Bitcoin earnings per share (EPS) are expected to reach $37.82 this quarter.

However, in contrast to the impressive return on Bitcoin, Strategy's financial performance in the latest quarter was under pressure due to the pullback in Bitcoin prices in the late first quarter of this year. The company's recently released first quarter 2025 financial report showed that revenue fell 3.6% year-on-year to $111.1 million, which fell short of market expectations, and its net loss was as high as $4.23 billion (loss per share of $16.49), which was significantly higher than market expectations.

To ease financial pressure and further expand its Bitcoin asset exposure, Strategy is accelerating its capital operation strategy. Earlier this month, Strategy announced a new $21 billion public market common stock issuance plan, and has raised its BTC yield target from 15% to 25%, and its BTC dollar yield target from $10 billion to $15 billion. Immediately afterwards, Strategy further announced that it would launch a new "42/42 plan" aimed at raising $84 billion in two years to purchase Bitcoin. In response, Wall Street analysts expressed support, and analysts from Benchmark and TD Cowen reiterated their buy ratings for the company, believing that its capital raising strategy is feasible.

Unlike most company stocks, which correspond to the market sales performance of the company's products, Strategy's stock is positioned as a "smart lever" for Bitcoin. Its founder Saylor specifically told this narrative when the company was renamed Strategy. This forms a gap area of about 45% between traditional assets (such as SPDR S&P 500 ETF and Invesco QQQ Trust, whose volatility levels are between 15-20) and Bitcoin (volatility levels are between 50-60). Strategy's common stock target volatility is even higher than Bitcoin itself, aiming to achieve a volatility level of 80-90, while maintaining what Saylor calls "smart leverage" through a combination of equity issuance and convertible bonds.

Despite the airdrop attack, there are also many large institutional investors who have paid for Strategy's strategy. The recent bets by institutional investors on Strategy have also boosted market confidence. According to Fintel data, to date, a total of 1,487 institutions hold Strategy shares, with a total holding of 139 million shares, with a current total value of approximately US$55.175 billion.

Citadel Advisors

Citadel Advisors is one of the world's largest hedge funds. According to the 13F filing, as of the first quarter of this year, Citadel Advisors held a total of MSTR shares worth more than $6.69 billion, or about 23.22 million shares, making it one of Strategy's largest shareholders.

Vanguard Group

As of Q1 2025, Vanguard Group, one of the world's largest mutual fund management companies, holds approximately 20.58 million shares of MSTR, valued at over US$5.93 billion.

Susquehanna International Group

Susquehanna International Group is a world-renowned hedge fund company. As of the first quarter of 2025, the company held MSTR shares worth more than US$5.73 billion, approximately 19.88 million shares.

Jane Street

The 13F filing shows that as of Q1 2025, Jane Street, one of the world's top hedge funds, held more than 16 million shares of MSTR, worth nearly $4.63 billion.

Capital International

According to the 13F filing submitted by Capital International in the first quarter of this year, the institution holds nearly 14.68 million shares of MSTR, worth approximately US$4.23 billion.

BlackRock

As of the first quarter of this year, BlackRock, one of the world's largest asset management giants, held approximately 14.42 million shares of MSTR, worth more than US$4.15 billion.

CalPERS

CalPERS is the second largest public pension fund in the United States, managing more than $300 billion in assets. As of Q1 2025, CalPERS holds 357,000 shares of MSTR, valued at approximately $102 million.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End