Reddit, Inc. (RDDT) Stock: Drops 4.23% Despite Google AI Content Deal Talks

TLDRs;

- Reddit stock fell 4.23% despite reports of new AI deal talks with Google.

- Discussions build on a previous $60M agreement, now targeting deeper AI integration and traffic boosts.

- Reddit Pro tools position the platform as a stronger partner for publishers amid rising search visibility.

- Investors remain cautious, questioning whether partnerships will deliver near-term revenue impact.

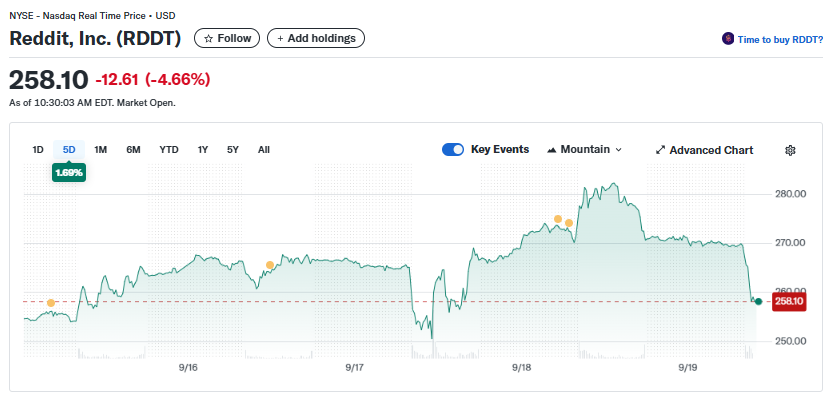

Reddit shares fell more than 4% in Friday morning trading, even as news emerged that the company is in early talks with Google to expand their AI content-sharing agreement.

The discussions reportedly aim to build upon Reddit’s previous US$60 million deal with the tech giant, which gave Google access to Reddit’s treasure trove of user-generated discussions for search and AI products.

This time, however, the focus is on tighter integration with Google’s AI tools, a move that could see Reddit content play a more visible role across Google’s platforms.

Reddit, Inc. (RDDT)

Reddit, Inc. (RDDT)

What the Expanded Deal Could Mean

The potential new agreement is not just about selling data access. Instead, insiders suggest it could evolve into a two-way partnership model.

Reddit could receive stronger visibility within Google’s search ecosystem, driving community participation and traffic, while Google gains richer datasets to train AI tools like Search Generative Experience (SGE).

Analysts note that Reddit’s highly authentic, community-driven discussions are uniquely valuable compared to traditional web data. Such content could help Google enhance the quality, nuance, and trustworthiness of AI-generated results.

Reddit Pro and Publisher Tools Fuel Strategy

The timing of these talks aligns with Reddit’s push to attract media outlets and publishers via its Reddit Pro business suite.

The company recently rolled out AI-powered analytics tools that allow publishers to track article engagement, sync RSS feeds, and target relevant communities with AI recommendations.

Major media outlets, including NBC News, The Atlantic, and Associated Press, tested the features during beta. The tools highlight Reddit’s strategic effort to strengthen its role as both a content hub and traffic driver, a move that aligns closely with Google’s growing reliance on Reddit search visibility.

Market Reaction and Broader Implications

Despite the promising AI opportunity, investors appeared cautious. Reddit’s stock traded at 259.27, down 4.23% intraday, suggesting skepticism about whether potential Google partnerships will translate into immediate revenue growth.

If finalized, however, the agreement could carry long-term upside. For Google, it secures access to authentic data that enhances AI models. For Reddit, it presents a chance to monetize its community-driven ecosystem more effectively and reinforce its growing importance in the digital content pipeline.

Still, the stock drop reflects concerns that such partnerships may not offset Reddit’s monetization challenges quickly enough, a reminder that Wall Street often values short-term certainty over long-term potential.

The post Reddit, Inc. (RDDT) Stock: Drops 4.23% Despite Google AI Content Deal Talks appeared first on CoinCentral.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Trump will never allow a MAGA defeat - and the implications are unthinkable