U.S. Bitcoin ETFs See $330M Inflows, Led by BlackRock’s IBIT with $231.6M

- BlackRock’s IBIT leads ETF inflows with $231.6 million on February 6.

- The inflows into IBIT occurred the day after the ETF fell 13%

U.S. spot Bitcoin exchange-traded funds recorded a net inflow of $330.67 million on February 6. Among all funds, BlackRock’s Bitcoin ETF alone posted the highest inflows, as this marked IBIT’s 11th day of net inflows in 2026.

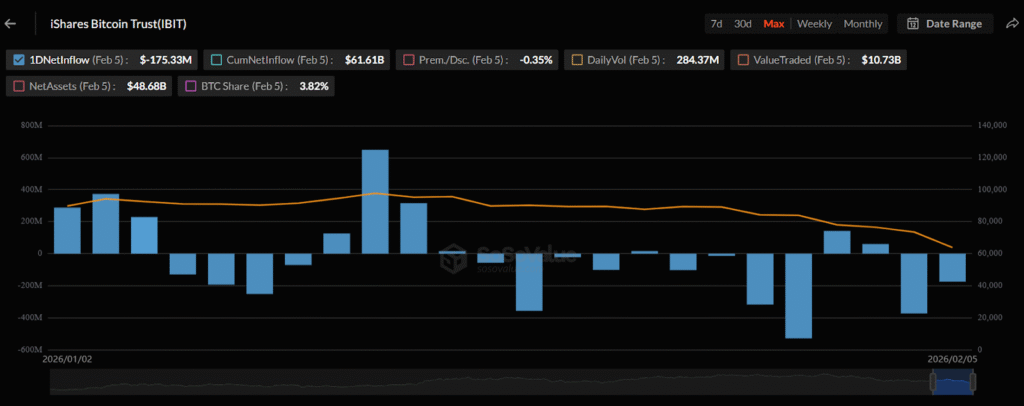

According to SoSoValue data, BlackRock’s iShares Bitcoin Trust(IBIT) alone saw $231.6 million in inflows on friday, whereas ARK 21Shares Bitcoin ETF(ARKB) saw $43.25 million in inflows, Bitwise Bitcoin ETF(BITB) saw $28.70 million in inflows.

Then, Grayscale Bitcoin Mini Trust(BTC) recorded $20.13 million and Invesco Galaxy Bitcoin ETF(BTCO) posted nearly $7 million net inflows amid broader crypto downturn, and a majorly unstable week for Bitcoin.

As on the same day Bitcoin price had fallen sharply near $60,000 and bounced back today and touched $71,000, and Bitcoin is trading at $67,931 with 2.65% up, still it is down over 18.12% over a past week and 27% down for the past month, as per the CoinMarketCap. Amid this unstable spot market, crypto participants closely monitor ETF flows to gauge institutional interest in a particular asset.

Source: SoSoValue

Source: SoSoValue

With that, IBIT had posted $548.77 outflows as of Wednesday and Thursday, but saw massive positive flows on Friday.

IBIT Shares Fall 13% and Rebound the Next Day

As the IBIT’s inflows happened the following day, where IBIT fell 13% in a single day, marking its second-largest one-day decline, on Thursday since launch. Its biggest drop came on May 8, 2024, when it lost 15% in a day. Also, on the same day, IBIT set a new record for daily trading volume on Thursday, with $10 billion in shares changing hands, according to Bloomberg ETF analyst Eric Balchunas. Then, as per the Google Finance data, the IBIT bounced back 9.92% on Friday, closing at $39.68.

On a contrary U.S. spot Ethereum traded funds recorded a $21.37 million outflows on Friday while four of funds saw net inflows, only BlackRock’s iShares Ethereum Trust(ETHA) posted $45.44 million total outflows which wiped away other funds inflows, as per SoSoValue data, which highlights the differing investor sentiment between Bitcoin and Ethereum ETFs.

Highlighted Crypto News:

Cardano (ADA) Bears on the March: Rising Momentum Threatens $0.20 Support

추천 콘텐츠

FullProgramlarIndir.app | Download Free Full Programs (2026)

XRP at a Crucial Turning Point: Where Will It Go Next?