Injective Highlights How Tokenization Could Unlock $30 Trillion in Asset Markets

- Injective has published new research that positions its blockchain as a full-stack platform for regulated real-world asset tokenization.

- The adoption is increasing, with growing tokenized RWA volumes and consistent on-chain activity throughout Injective’s ecosystem.

Injective has released new research outlining how its blockchain is structured to support real-world asset tokenization at an institutional level. The report frames tokenization as a direct evolution of traditional securitization, where ownership claims on assets such as equities, bonds, treasuries, real estate, and fiat instruments are moved onto programmable blockchain rails.

According to the research, tokenization is a more advanced version of conventional securitization models that integrates programmability with faster settlement and near-instant settlement, while reducing the need for intermediaries. As a result, issuers can automate corporate action and compliance logic on-chain. Investors, in turn, benefit from immutable records and transparent settlement flows.

In addition, Injective brings back the structural benefit of liquidity. Fractional ownership allows for smaller capital investments, and 24/7 trading eliminates time zone restrictions that are prevalent in traditional markets.

According to the report, these features enable the more efficient circulation of assets without compromising overviews by auditors and regulators. Injective argues that these features solve real frictions that have existed in the capital markets for a long time, rather than merely putting existing systems on blockchain rails.

Permissioned Token Standards Embed Compliance At Issuance

As per the report, the permissioned token standard is at the heart of the Injective model because the standard inherently inscribes access rules within smart contracts. Issuers are able to implement allowlists and transfer restrictions without off-chain enforcement. The study observes that such a strategy has multiple asset classes and is flexible across jurisdictions.

Injective also provides direct integration with custody and compliance providers. That design choice is meant to minimize onboarding friction for banks, asset managers, and other regulated entities entering tokenization markets.

Once issued, assets can flow into different liquidity environments. Public liquidity networks utilize automated smart contracts, whereas institutional networks employ professional market makers that facilitate greater volume trading.

Tokenized Asset Demand Rises

Injective’s research cites its operational history as a sign of institutional readiness. Injective has processed over 1.1 billion transactions since the mainnet launch in 2021 and has yet to experience downtime or security breaches. In 2024, the ecosystem broadened with more stablecoin integrations and tokenized financial products., which the report views as indicators of institutional readiness.

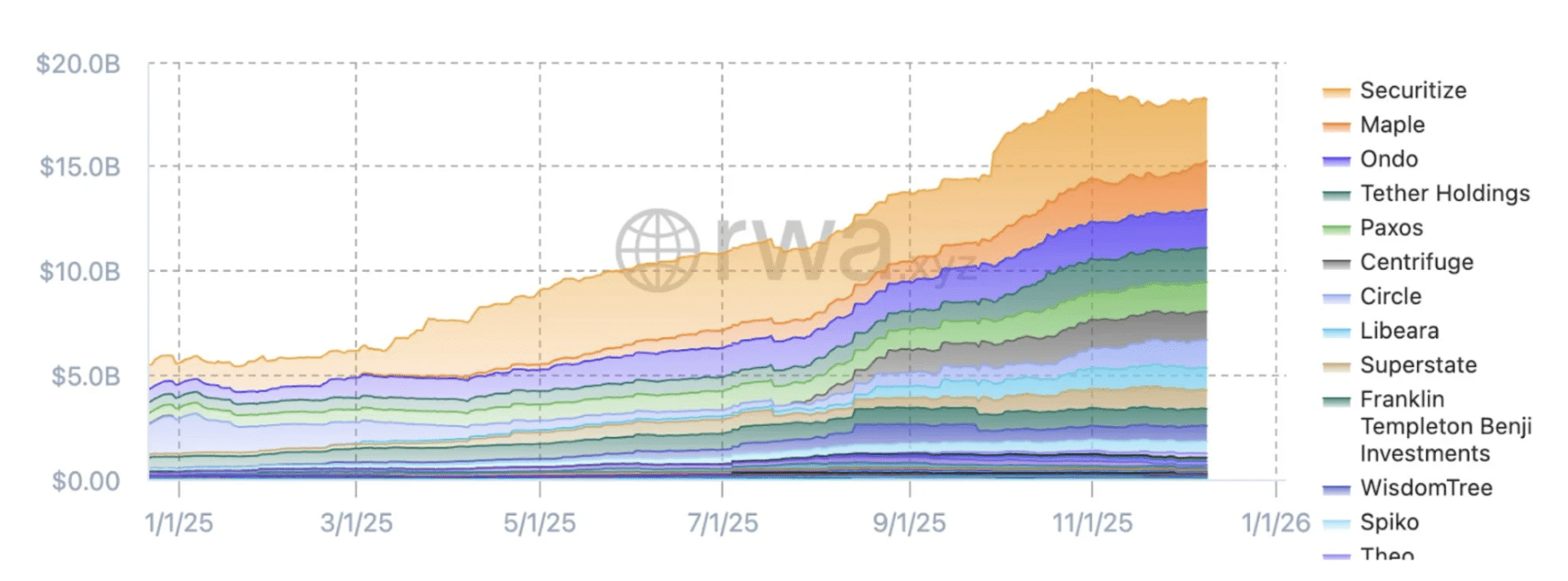

According to Securitize, tokenized real-world assets have passed the $20 billion mark for cumulative asset value. Excluding stablecoins, the sector grew to $18.2 billion by the end of 2025, up from about $5.5 billion at the start of the year. Tokenized treasuries went from $4 billion to $9 billion in the same period.

Source: Securitize

Source: Securitize

Separately, Messari reported that Injective hit $6 billion in perpetual real-world asset trading volume. As of press time, INJ is trading at around $5.64, up 9.74% in the last 24 hours and 2% in the last seven days.

]]>추천 콘텐츠

Ripple inches closer to full MiCA license to expand across EU via Luxembourg

XRPL Validator Reveals Why He Just Vetoed New Amendment