Disney (DIS) Stock Takes Hit as Kimmel Controversy Rocks ABC Network

TLDR

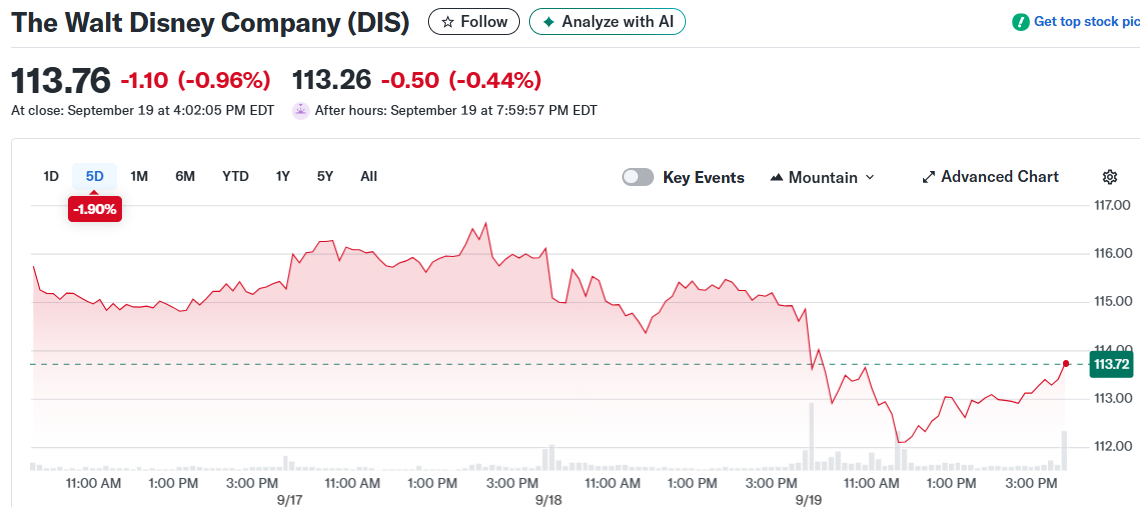

- Disney stock dropped 1.9% over the week, closing at $113.76 down from $115.96 high

- ABC suspended Jimmy Kimmel’s show after controversial remarks, sparking immediate market reaction

- Streaming segment turned profitable with ESPN partnerships driving growth

- Traditional TV division continues facing subscriber decline challenges

- Analysts maintain positive outlook with $5.85 EPS guidance for full year

Disney shares experienced a bumpy ride this week, closing at $113.76 after falling from a weekly high of $115.96. The 1.9% decline came as the entertainment giant navigated both operational challenges and media-related controversies.

The Walt Disney Company (DIS)

The Walt Disney Company (DIS)

Trading volume peaked at nearly 8.9 million shares during Friday’s session. The stock moved within a $111.93 to $114.22 range over the past two days.

Disney’s market cap sits at $204.5 billion with a trailing P/E ratio of 18.17. This valuation aligns with historical media sector benchmarks.

The company had been struggling to break through resistance levels around $117-$118 throughout September. Previous gains earlier in the month proved short-lived as selling pressure emerged.

Streaming Success Meets Broadcasting Turbulence

Disney’s direct-to-consumer streaming business recently turned profitable, marking a key milestone. ESPN’s digital transformation and new partnership deals have generated analyst optimism about future revenue streams.

However, the traditional television division continues facing headwinds. Linear TV subscriber declines and Disney+ pricing concerns remain investor worries.

The company’s latest quarterly results showed mixed signals across different segments. While streaming profits improved, entertainment division challenges persisted.

ABC’s decision to suspend Jimmy Kimmel’s show created immediate market volatility. The move followed politically charged on-air comments that sparked public debate.

Celebrity Mark Ruffalo publicly criticized the suspension decision on social media. His comments suggested the cancellation could hurt Disney’s stock performance further.

Initial reports indicated a 7% stock drop following the ABC announcement. However, the actual closing decline proved less severe at around 2% for the trading session.

Analyst Confidence Remains Strong

Despite recent challenges, no Wall Street analysts issued sell ratings on Disney shares. The research community maintains a generally constructive view on the company’s long-term prospects.

Theme park investments have started generating improved returns according to recent financial data. The parks and experiences division continues showing steady operating profit growth.

Management reaffirmed full-year earnings guidance of $5.85 per share. This target assumes double-digit gains in entertainment and sports segments.

Disney’s international expansion plans include additional theme park developments. The company also plans deeper partnerships with NFL and WWE for ESPN content.

Free cash flow remains strong despite moderate debt levels across the business. This financial position supports continued share buyback programs and dividend payments.

The current dividend yield stands near 0.88% for income-focused investors. Disney’s balance sheet provides flexibility for strategic investments and shareholder returns.

Recent streaming price increases have created some subscriber churn concerns. Management continues balancing revenue growth with customer retention strategies.

ESPN’s digital pivot represents a major strategic shift for the sports broadcasting unit. New distribution partnerships could unlock additional revenue opportunities in coming quarters.

Disney’s exposure to high-profile media events highlights ongoing portfolio risks. The entertainment business remains sensitive to public relations challenges and content controversies.

The November earnings report will provide updated guidance on streaming subscriber trends and theme park performance metrics.

The post Disney (DIS) Stock Takes Hit as Kimmel Controversy Rocks ABC Network appeared first on CoinCentral.

추천 콘텐츠

PayPal Expands PYUSD Stablecoin to 9 New Blockchains Through LayerZero Integration

TON Technical Analysis Feb 14