Ethereum Exit Queue Crosses 2.6 Million ETH With 44-Day Wait Time, Is A $12 Billion Sell-Off Coming?

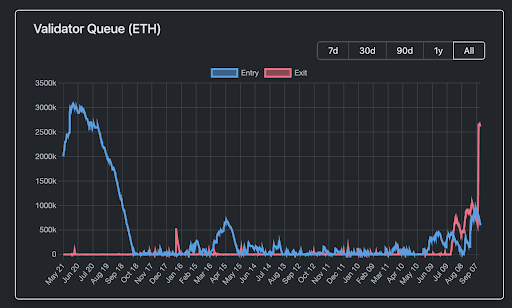

Ethereum is facing its largest validator exit in history as more than 2.6 million ETH, worth over $12 billion, have entered the withdrawal queue. According to on-chain data from ValidatorQueue.com, the exit backlog has surged to unexpected levels, and the investors making the withdrawals are now facing a wait time of more than 44 days before their ETH is fully unstaked. This sudden spike in withdrawals raises serious questions about the possibility of looming selling pressure and how it might affect the Ethereum price.

Largest Exit Queue Ever Recorded

According to data from ValidatorQueue.com, about 2.6 million ETH were queued up to be unstaked, its largest exit number on record. This exit queue number dwarfs all previous periods of validator exits since Ethereum’s transition to proof-of-stake in September 2022. At its peak, the ETH tokens in the queue were worth about $12 billion.

Interestingly, the chart data from ValidatorQueue shows a growing trend of more validators unstaking their ETH in recent weeks, as evidenced by the parabolic rise since mid-August. Analyst MartyParty commented on social media platform X, stating, “Ethereum Staking Exit Queue parabolic.” Such a large-scale withdrawal event highlights growing unease among stakers, and institutional participants or large staking providers are behind the sudden mass exits.

The exit queue has witnessed a parabolic rise in recent months that is hard to ignore. This rise started in July 2025, when the average number of ETH waiting to be unstaked jumped from below 10,000 ETH to about 250,000 ETH within a matter of days. By the end of the month, the exit queue had escalated and climbed past 740,000 ETH. August also saw a similar rise, with queue numbers averaging around 800,000 ETH before crossing 1 million ETH at the end of the month.

Now, the queue numbers have more than doubled in September, reaching a peak of 2.63 million ETH last week. As it stands, there are more than 2.4 million ETH waiting to leave the network. The backlog is so large that validators are facing an estimated 43 days and 3 hours of wait time before their ETH can be fully unstaked.

Implications For Ethereum Price

With more than $12 billion in ETH queued for withdrawal, the looming question is whether this will translate into significant sell pressure on exchanges. If these withdrawals are liquidated, the Ethereum price could face downward pressure. This would damage Ethereum’s rally, which has picked up this week.

However, not all unstaked ETH is necessarily heading for the open market. Some may be repositioned into restaking protocols or into Spot Ethereum ETFs.

On the other hand, ETH staking has slowed down massively. At the time of writing, 451,950 ETH are currently in the entry queue to be staked. This is a 53% decline from 959,717 ETH on September 5.

At the time of writing, Ethereum is trading at $4,572, up by 2.1% in the past 24 hours.

추천 콘텐츠

Fed Decides On Interest Rates Today—Here’s What To Watch For

Stronger capital, bigger loans: Africa’s banking outlook for 2026