Bitcoin Price Prediction 2026: $300,000 Target and the Next Crypto to Explode in This Cycle

The post Bitcoin Price Prediction 2026: $300,000 Target and the Next Crypto to Explode in This Cycle appeared first on Coinpedia Fintech News

If you invest in crypto, you need to track Bitcoin closely because Bitcoin drives the whole market. When BTC goes up, most altcoins follow. But the real question is: is Bitcoin still the best choice to make serious money in crypto today, or are there better opportunities with bigger upside?

Bitcoin made people rich because they got in early, back when most people laughed at it and called it a bubble. The ones who understood what blockchain really was didn’t follow the crowd… they positioned first.

Today, Bitcoin can still outperform many classic assets like real estate, gold, and stocks. But let’s be honest: it’s no longer a life-changing 100x play. At this size, a 100x move would require a massive, almost impossible jump in market cap, something you shouldn’t expect anytime soon, especially not in the next 10 years.

So the real question becomes: where is the next “early Bitcoin” opportunity in crypto?

Because every cycle has one.

2020 gave Dogecoin with 100x+ returns.

2021 gave Shiba with 1000x+ returns.

2023 gave PEPE with 500x+ returns.

2025 gave BONK with 1000x+ returns.

What does that tell you? The biggest money in crypto isn’t made by chasing what’s already huge, it’s made by finding the next breakout early. That’s how a $10,000 position can realistically turn into a million… or more. We will see now which point can bitcoin go and what this will impact the market because bitcoin is related to all other coins

Bitcoin Price Prediction: How High Can Bitcoin Go in 2026?

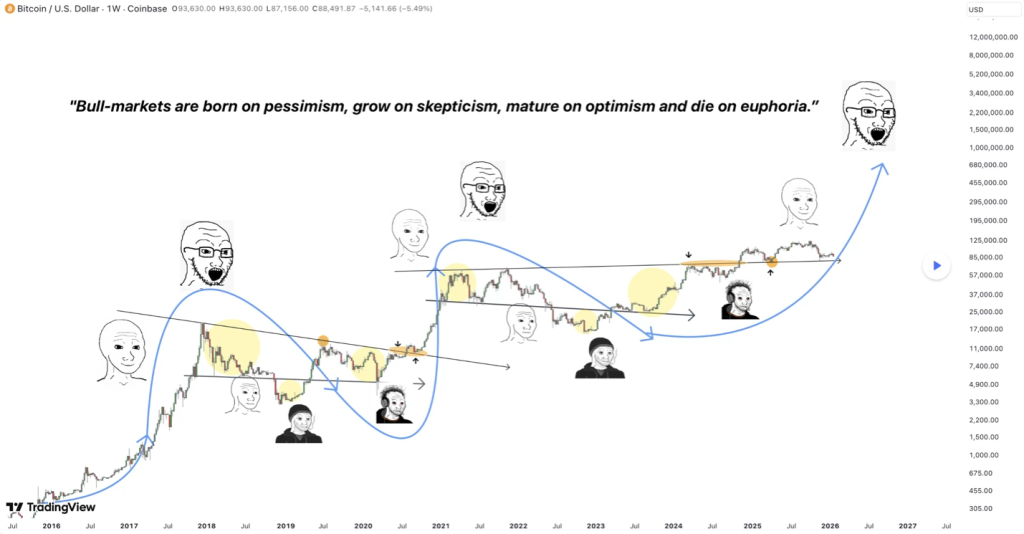

Bitcoin price prediction for 2026: $300,000 is possible if the usual cycle repeats. The chart shows the same story every time. First, Bitcoin hits a bottom when everyone says “Bitcoin is dead” (2015, 2019, 2022). Then price starts rising, but most people don’t believe it (skepticism). After that, more people accept the trend (optimism).

The final stage is euphoria, when everyone feels like a genius and the last big push happens. Right now, the chart suggests we are moving from skepticism into optimism.

That matters because big bull runs usually grow while people are still scared. Euphoria is not here yet, and that is a good sign. Also, the math is simple: from the ~$80K–$90K area, $300K is about 3x to 4x. Bitcoin has done moves like that before when the cycle is strong. And even with “smaller gains each cycle,” $300K still fits a normal late-cycle run if money and confidence come back.

Now the real question is this: even if Bitcoin reaches $300,000, is it still the best crypto investment in such a volatile market? We all know how it works in crypto: if Bitcoin does a 3x, many smaller coins can do 10x, 50x, even 100x+ during the same cycle. So the smarter focus isn’t only “Will BTC go up?” it’s “Where is the next 100x opportunity before everyone notices?

So to answer that question, we have to look at past cycles and watch what smart wallets do early.

In every big meme run, two things matter most: hype and utility.

Look at two of the biggest winners:

- SHIB became huge because it had massive hype, and it added some utility with ShibaSwap.

- PEPE exploded mainly because of hype. It had the meme power, but no real system behind it.

But here’s the key point: ShibaSwap was utility, yes, but it wasn’t truly new or game-changing.

Now Pepeto is trying to combine both in a stronger way: big hype + real utility built for traders. And what makes people pay attention is this: some of the same early wallets that made millions on SHIB and PEPE are now moving part of their money into Pepeto.

Pepeto Is the Next Big 100x Memecoin: What Makes It Stand Out?

Pepeto (PEPETO) is making waves in the cryptocurrency world. Its reputation as the potential next big memecoin is growing rapidly. Investors are drawn to its high-return potential.

What sets Pepeto apart is its unique community-driven approach. Pepeto positions itself as an evolution of the well-known memecoin PEPE, adding the missing “T” and “O” that PEPE never had: Technology and Optimization. These two elements are what many analysts say the market now demands, helping Pepeto present itself as PEPE+TO rather than just another meme token. Several factors contribute to Pepeto’s appeal:

- Innovative features: Pepeto offers more than simple utilities. It brings a full ecosystem built for the new era of meme coin trading, including a cross-chain bridge and a dedicated exchange designed to host future leading projects.

- Successful Audits: Pepeto also brings a layer of safety that many early projects lack, having already completed successful smart-contract audits with SolidProof and Coinsult,

- Vibrant community: Pepeto, known as the God of Frogs, already commands a powerful community of believers, surpassing 100,000 members across all socials and growing rapidly ahead of its official launch.

With this real utility and infrastructure, a 100x move for Pepeto feels like it’s only a matter of time. When you compare it to SHIB and PEPE, which already did 500x+ mainly on hype, Pepeto looks stronger in every way because it combines hype and real tools.

Conclusion: Pepeto stands out with real meme-utility infrastructure and early-stage

Institutions stacking Bitcoin is a loud signal, even if the chart looks quiet. It means confidence is building under the surface. Smart money tends to load up while the market is still unsure, and that’s usually how the strongest runs start.

At the same time, a growing number of early buyers are moving into Pepeto ($PEPETO) for the kind of upside you can only get before major listings and mainstream attention. Once a token goes live, the easy multiples are usually already gone.

For anyone asking what crypto to buy now, this isn’t about chasing pumps or buying tops. It’s about getting positioned early while the story is still cheap, especially when the project isn’t just hype.If you’re looking for a presale where timing still matters, Pepeto is still in that early window. Get your allocation while the presale stage is open at https://pepeto.io/.

FAQs

Why is Pepeto better than Bitcoin?

Bitcoin is safer, but it’s already big. Even if BTC hits $300K, that’s around 3–4x. Pepeto is still in presale at $0.000000180, so the upside can be much bigger if it takes off. This is the “early window” people usually miss.

What crypto to buy now for maximum upside?

If you want the biggest upside, it usually comes before big listings. Pepeto is still early, and that’s why people are rushing into it now, not later.

What are the best cryptocurrencies to buy right now?

Many investors do both: hold Bitcoin for stability, and put a smaller part into a high-upside presale like Pepeto to chase a possible 50x–100x.

What separates PEPETO from other presales?

Most presales are only hype. Pepeto is building real tools: zero-fee PepetoSwap, a cross-chain bridge, and a Pepeto Exchange planned for 2026 with 850+ projects already applying. If PEPETO becomes the token used behind all that trading, demand can explode fast.

You May Also Like

Crucial: Australia’s Digital Asset Licensing Mandate Set to Transform Crypto Landscape