Silver Is Trading Like a Shortage Story – Bitcoin Like a Macro Beta Trade

Silver and Bitcoin have spent much of the past decade being discussed in the same breath, often framed as parallel alternatives to fiat money and beneficiaries of macro stress.

That story is currently being put to the test, as the two assets are drifting in wildly different directions in late January 2026, indicating how investors are now valuing them as a vastly different trade in a tightening financial environment.

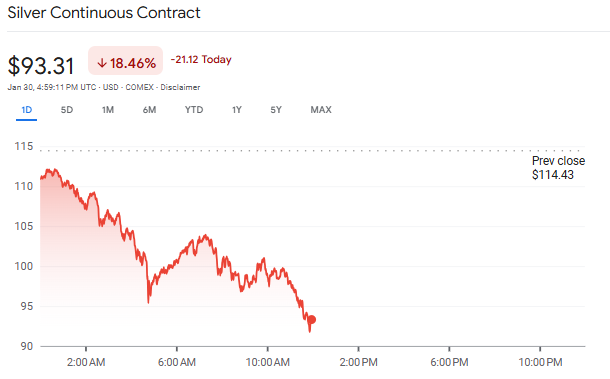

Silver shot to a fresh all-time high on Thursday and briefly hit over $121 per ounce, only to be violently pulled back, falling over 15% on Friday to about $97.

Bitcoin, on the other hand, has been on a downward trend on Friday, trading around $82,800, approximately 2.2% in 24 hours after touching an intraday low near $81,300.

There have been losses over time periods, with Bitcoin falling by almost 7% in the last week, over 13% in the last two weeks, and about 22% in comparison to a year ago.

The cryptocurrency now trades over 34% below its record in October of over $126,000, which happened amid an institutionally fueled run-up related to inflows of spot ETFs.

However, the price of silver remains approximately 25% up in the last month, nearly 150% higher in the last six months, and more than 200% up in the last year, after having shot up in a massive surge that started in 2025.

Silver Price Surge as it Breaks Higher on Industrial Demand

The divergence has become more pronounced over the past several months. In 2025, silver finished the year up more than 140%, while Bitcoin ended slightly lower.

Source: Google Finance

Source: Google Finance

During parts of late 2025, silver gained close to 190% relative to Bitcoin over a four-month window, showing how differently the two assets responded to tightening financial conditions.

Data shows that in January alone, silver surged about 39% before suffering a sharp correction. Even with the pullback, the move has been historic: silver climbed roughly 158% from an October 28 low near $45.51 to a late-January peak above $117, driven in part by concerns around China’s export licensing and global supply constraints.

Additionally, COMEX silver inventories falling from about 532 million ounces in early October to roughly 418 million ounces, a drawdown of 114 million ounces, evidenced the narrative that the rally has been supported by real supply dynamics rather than purely speculative flows.

Volatility patterns also flipped, as in December, silver’s realized volatility rose into the mid-50% range, exceeding bitcoin’s, which compressed into the mid-40s as crypto markets entered a post-leverage unwind phase.

Market participants point to fundamentally different drivers with silver’s rally, which has been anchored in physical supply tightness and industrial demand.

The metal has been operating at a structural supply deficit over the past few years, with the output of the mining sector failing to match the consumption.

Approximately half of the demand for silver is in industrial applications, such as solar panels, electric vehicles, and data centers, which keep growing at a very rapid pace.

That backdrop has turned silver into what traders increasingly describe as a shortage story.

Even this week’s sharp correction followed a parabolic advance, with profit-taking and higher margin requirements triggering abrupt sell-offs rather than a shift in longer-term demand trends.

Bitcoin Slips as Macro Fears and Tight Liquidity Hit Risk Appetite

Bitcoin’s decline, meanwhile, has been closely tied to macro and liquidity conditions.

Analysts have linked the latest leg lower to fears of a tighter U.S. policy environment, including speculation that a more hawkish Federal Reserve leadership could keep interest rates higher for longer and maintain balance sheet restraint.

Those concerns have weighed on risk assets broadly, from equities to crypto, reducing appetite for leveraged exposure.

Analysts have pointed to a tech-led selloff on Thursday, and also global markets weakened after Microsoft shares fell sharply following announcements related to artificial intelligence investment, leading to a drop in Bitcoin’s price.

Crypto markets dropped alongside equities, with total market capitalization falling by roughly $200 billion in a single session.

Liquidations exceeded $1 billion over 24 hours, with bitcoin longs accounting for a major share.

CryptoQuant analysts noted that even a relatively modest pullback in Bitcoin compared with metals was enough to trigger nearly $300 million in long liquidations within hours.

The contrast has reframed how investors are viewing the two assets, with analysts noting silver is behaving like a commodity under physical stress, amplified by speculative momentum.

Bitcoin, despite its “digital gold” narrative, is trading more like a macro beta asset, rising and falling with liquidity expectations, ETF flows, and policy signs.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt