Hong Kong Customs Seizes 219 kg of Smuggled Silver

- Hong Kong Customs seizes silver valued at $6.1 million.

- Two individuals arrested during the operation.

- Enforcement actions continue against cross-boundary smuggling.

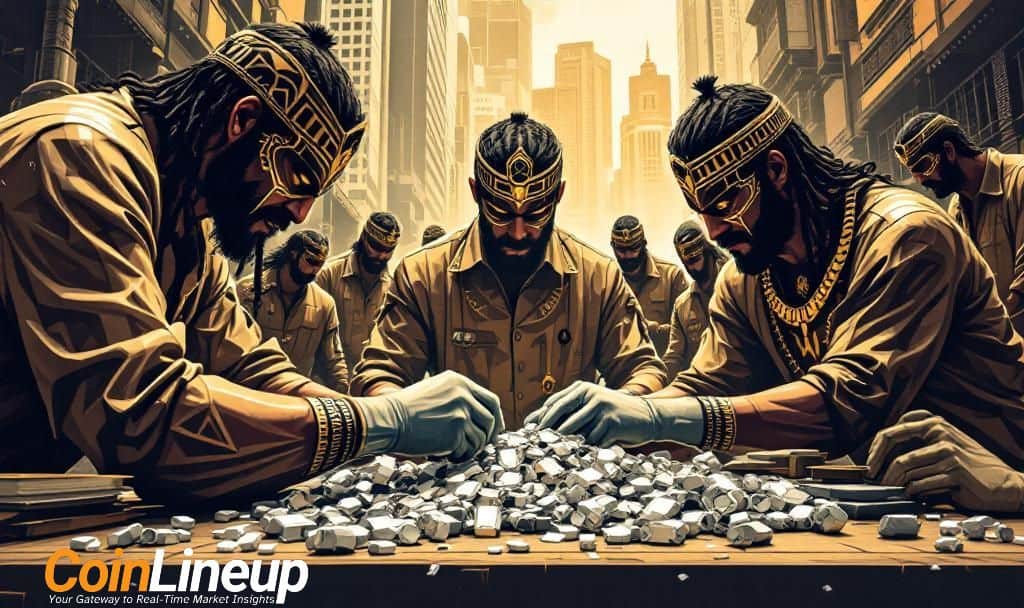

Hong Kong Customs seized 219 kg of suspected smuggled silver valued at $6.1 million. Discovered on January 27, 2026, the silver was hidden in food cans within a private car at the Heung Yuen Wai Boundary Control Point.

Hong Kong Customs successfully detected and seized 219 kg of illicit silver concealed in food cans in a car’s boot at the Heung Yuen Wai Boundary Control Point. The operation took place on January 27, 2026, with the silver valued at about $6.1 million.

Two men, aged 46 and 40, were arrested in connection with the case. They face charges of attempting to export unmanifested cargo and are scheduled for court appearance. Hong Kong Customs continues its enforcement actions based on risk assessment and intelligence. As the agency states,

The impact of this seizure is limited to physical commodities, with no immediate effect on financial markets or the cryptocurrency industry. Hong Kong Customs links their strategy to previous significant busts, showcasing a continuous effort to combat cross-boundary smuggling activities.

While there are no direct financial or technological implications within the crypto sphere, the recurrence of such cases might drive more robust regulatory measures. Historical data indicates increased vigilance and tighter border controls are becoming necessary due to smuggling incentives.

You May Also Like

Qatar pushes tokenization with launch of QCD money market fund

XAG/USD retreats toward $113.00 on profit-taking pressure