Trump's Headlines on Swiss Alps Boost Bitcoin

The US will become the "crypto capital of the world," vowed President Donald Trump at Davos on Wednesday, boosting digital asset prices.

Risk assets took off, with Bitcoin and Wall Street stocks reflecting that boost from Trump after he sought to sign the market structure law for cryptos "very soon," during his inaugural speech at the World Economic Forum (WEF) in Davos, Switzerland.

The President's comments, and his backtracking on tariff threats related to Greenland, boosted sentiment among risk assets.

Bitcoin saw a daily increase of over 2%, closing in on the $90k mark after having crashed below that level the day before, with data showing a low of $87,000.

After surging close to the $97k mark last week, the top token crashed post-Trump's remarks that the US would impose harsh tariffs on eight European countries and threats of hefty taxes on eight more sent global markets into a spiral on January 20.

Source: CoinGecko

Source: CoinGecko

Gold and silver skyrocketed to unprecedented and eyewatering levels, with gold crossing $4,800 per ounce for the first time and silver reaching an all-time high of $95 per ounce.

The ongoing classification of Bitcoin as a speculative asset, instead of the refuge its advocates assert it is, was revealed when the crypto market lost nearly $150 billion in market value due to aggressive unwinding of leveraged positions.

With a 10% duty increase on February 1 and a 25% increase by June 1 – barring a Greenland agreement – Trump said on Saturday that Germany, France, the UK, the Netherlands, Finland, Sweden, Norway, and Denmark will be subject to duties.

Additional tariffs of 25% would probably shave 0.2 percentage points off European GDP growth, ING economists said, adding to the continent's already-present worries of a recession.

Even with a brief ceasefire set in late July, the trade conflict between the EU and the US was effectively reignited by the potential imposition of tariffs, which heightened tensions and brought in a notably tougher strategy.

European nations proposed the so-called anti-coercion tool, which is the EU's trade "bazooka" that may be used to impose penalties and investment restrictions on states violating its trade rules.

The leader of the European People's Party, the biggest party in the European Parliament, Manfred Weber, said that the deal meant to be finalized in July is now "on hold," and French President Emmanuel Macron said he will ask for the mechanism to be activated.

According to the Financial Times, European capitals are mulling over whether to impose €93 billion in tariffs on the US or limit access to the bloc's market for American businesses in reaction to President Trump's threats.

Europe holds the top position as a lender to the United States, with nearly $8 trillion in US stocks and bonds.

This situation demonstrates the significant reliance that could transform this deadlock into a severe disaster.

The additional tariffs would be "complete poison" for the delicate recovery underway, according to ING analyst Carsten Brzeski, who warned that the export-reliant German economy is already facing significant pressure.

Swiss Alps Calm Trump, Reverse Cryptos' Steep Fall

But a reversal in Trump's tone at the Swiss Alps during the WEF summit stemmed the sentiment hit and crypto bleeding.

As soon as he arrived in Davos, Trump said he had enacted the "landmark Genius Act" and expressed his commitment to "maintain America's position as the leading hub for cryptocurrency globally."

During his WEF address, the president said, "Now, Congress is working very hard on crypto market structure legislation — Bitcoin, all of them — which I hope to sign very soon, unlocking new pathways for Americans to reach financial freedom.”

In addition to predicting that "the stock market is going to double," Trump assured the audience that he would not use force to conquer Greenland.

He said that "in a relatively short period of time" the Dow Jones Industrial Average will "reach 50,000."

As the Wall Street session began, Bitcoin tried to capitalize on a relief rally, with traders thoroughly analyzing his speech and their potential ramifications.

What Do Technicals Show?

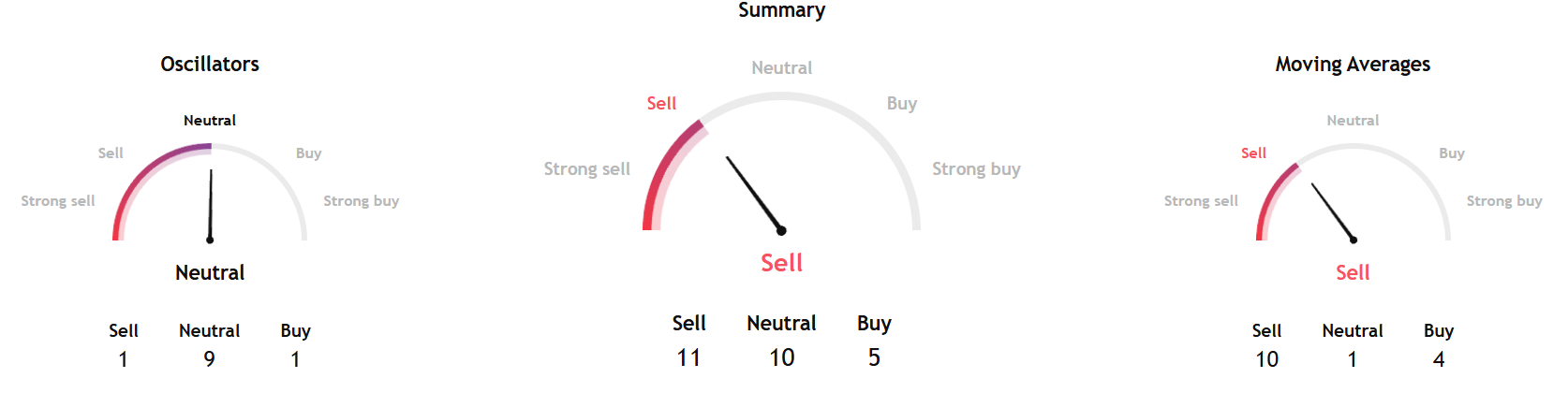

The latest readings show a sell signal for Bitcoin in the week ahead, according to TradingView's summary gauge, which includes key data from moving averages, oscillators, and pivots.

Source: TradingView

Source: TradingView

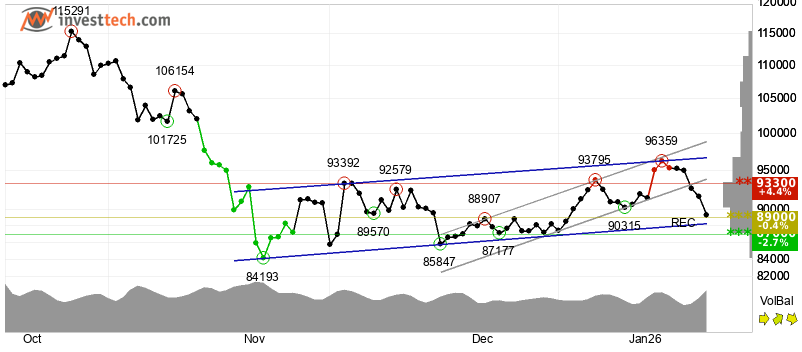

Separately, InvestTech's Algorithmic Overall Analysis gauge gave a hold signal.

According to the firm, "Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The token is moving within a rectangle formation between support at $88,328 and resistance at $96,773."

InvestTech said "A decisive break through one of these levels indicates the new direction for the currency. The token is testing support at points $89,000. This could give a positive reaction, but a downward breakthrough of points $89,000 means a negative signal."

Source: InvestTech

Source: InvestTech

Bitcoin "is overall assessed as technically positive for the short term," added the firm.

Overall, the recommendation has turned to positive after Trump's territorial "TACO."

TACO or Being Polite?

Through much of 2025, a trend referred to "Trump Always Chickens Out," or the "TACO trade" created significant excitement on Wall Street.

The outcome was favorable, as it was anticipated that the President would eventually retreat and proclaim success following his threats of tariffs against various nations and industries.

However, this sometimes resulted in an arrangement that favored the target more than the interests of the United States – especially in dealings with China.

There could be validity to the TACO trade, even with increasing doubts, as evidenced by the enthusiastic market close on Wednesday, with the S&P500 up 1.16%.

Trump stepped back from his previous threats to purchase, acquire, or take action against Greenland, causing frustration in Europe with the notion that the United States had acted unpredictably.

In light of the resistance from European nations regarding his territorial ambitions, he reconsidered the tariffs he had previously committed to. Republicans continue to express their interest in Greenland, nonetheless.

For now, a revised view for Bitcoin is up, or at worst, consolidate in a tight range again.

You May Also Like

Republic Europe Offers Indirect Kraken Stake via SPV

cpwrt Limited Positions Customer Support as a Strategic Growth Function