Lighter Token Drops 15% as LIT Staking Goes Live

Lighter’s LIT token has dropped by almost 15% in the last 24 hours, coming after the platform announced its new staking program.

While the rollout adds new utility and ecosystem alignment, the decline is largely driven by post-launch selling and broader market forces.

LIT Staking Rollout: Everything Lighter Users Need to Know

As of this writing, Lighter DEX’s LIT token was trading for $1.85. It is down by almost 14.79% in the last 24 hours. With this drop, Lighter effectively validates the projected 15% drop for the LIT token.

Lighter (LIT) Price Performance. Source: BeInCrypto

Lighter (LIT) Price Performance. Source: BeInCrypto

It comes only hours after Lighter detailed its staking plans. The network highlighted how LIT holders can now earn rewards and access additional features across the platform. Staking LIT unlocks access to Lighter’s LLP, a key on-chain financial product.

Under the program, for every 1 LIT staked, users can immediately deposit 10 USDC into LLP. Existing LLP holders benefit from a two-week grace period ending January 28. Afterwards, staked LIT will be required to remain in the pool.

According to Lighter, this mechanism is designed to align LIT holders with LLP participants better and enhance risk-adjusted returns.

Similar structures are planned for other public pools as part of the exchange’s goal to “democratize on-chain hedge funds.”

Staking also brings fee incentives. Premium market makers and high-frequency trading (HFT) firms will see discounts on newly adjusted fee tiers, while retail trading remains free.

Lighter plans to publish full details of its premium fee tiers in the coming days, allowing professional traders to adjust their algorithms accordingly.

Additional benefits include zero-fee withdrawals and transfers for users staking 100 LIT, as well as upcoming mobile staking support. Yield will initially be generated from staking rights previously reserved for premium users.

Why LIT Dropped: Post-Launch Selling, FUD, and Staking Volatility

Despite the potential upside from staking, LIT’s price decline reflects a combination of market factors. Post-launch selling and token distribution following the public mainnet launch in October have created significant downward pressure.

Similarly, the Lighter network continues to bear the weight of FUD relating to alleged secret token sales. Its CEO, Valdimir Novakovski, had addressed the issue publicly through Discord.

Early investors and airdrop recipients sold portions of their holdings, triggering a cascade of market exits. Trading volume has also cooled since the initial launch hype, and technical support levels have been breached, fueling further selling.

The staking announcement itself likely exacerbated the drop, resulting from the ‘buy the rumor, sell the news’ situation, which worsened a period of natural volatility and profit-taking.

Lighter has previously attempted to support the token through buybacks, which began on January 5, as outlined in its tokenomics model.

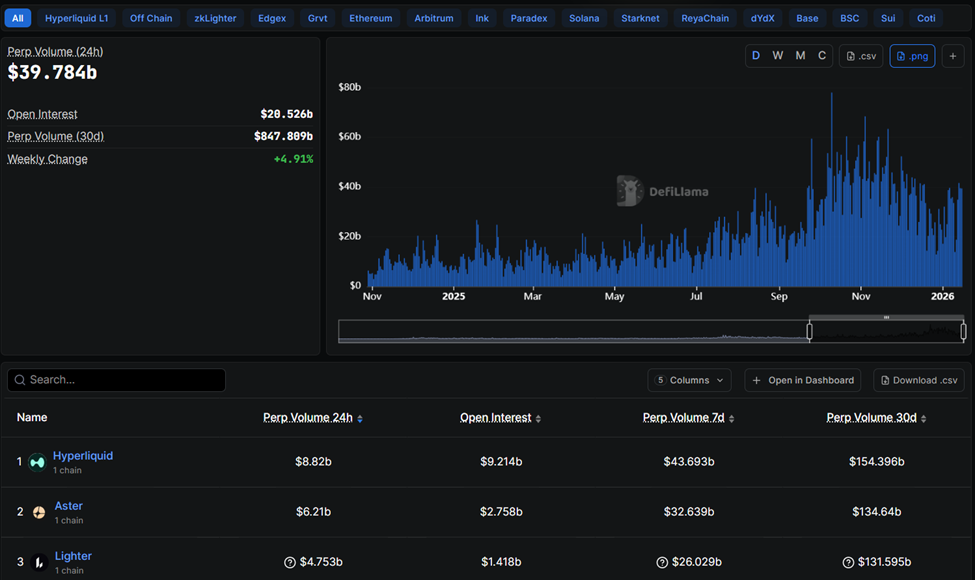

However, these efforts have so far been insufficient to offset selling pressure. The exchange remains a top contender in the perpetual swaps market, reporting nearly $5 billion in perp volume over the last 24 hours, after competitors Aster ($6.2 billion) and Hyperliquid ($8.8 billion).

Perp Volume by Protocols. Source: DefiLlama

Perp Volume by Protocols. Source: DefiLlama

In addition, Lighter recently raised $68 million at a $1.5 billion valuation in a round co-led by Founders Fund and Ribbit Capital.

As the platform further develops its LIT ecosystem, the staking rollout represents a key step in integrating token utility with access to financial products.

You May Also Like

The Channel Factories We’ve Been Waiting For

How ZKP’s Daily Presale Auction Is Creating a New Standard for 1,000x Returns